by Calculated Risk on 8/18/2005 02:11:00 PM

Thursday, August 18, 2005

EDAB/UCLA July Report

Economic Development Alliance for Business (EDAB) presents a monthly economic report for the East Bay (Northern California). Christopher Thornberg, Senior Economist for UCLA Anderson Forecast is the author. A few excerpts:

(Hat tip to Brian Smits who sent me this report)

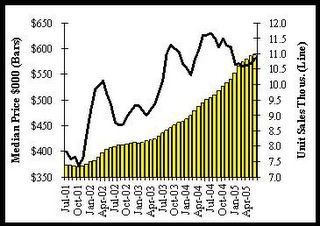

"... unfortunately there is a big problem brewing out there that is unlikely to go away quietly: the massive run-up in real estate prices across the state. Housing prices have continued to grow at a truly spectacular rate across the state and again in the Bay Area. Rampant speculation continues to fuel the fire as investors have seemingly already forgotten the lessons learned so hard in the last major asset bubble that ended not even five years ago. While there are those who try and rationalize the rapid increase in prices, we see no justification for these increases—the fundamentals that drive the price of a housing asset have been pointing to a cool market, not a hot one. Rental growth remains weak, mortgage rates have been rising slowly, and contrary to common belief the pace of home building in the area is completely in line with the growth of the workforce—the so-called housing shortage does not exist. Yes, inventory levels are low but this is due to frantic behavior of buyers."But Thornberg believes the economic problems are a year away:

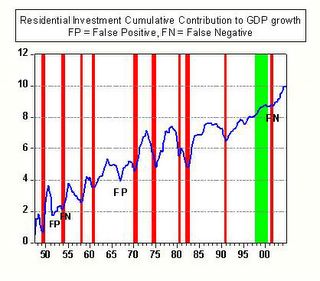

"There are some preliminary data that show what may be the beginning of the cooling of the market. But a major slowdown is at least a year away, if not more. Expect the recovery to continue well into 2006 and job growth in the East Bay to pick up speed during these 12 months. The end of 2006 or early 2007 will be the beginning of trouble, however."Thornberg presents the following graph showing that housing slowdowns have preceded eight of the 10 recessions since WWII.

Click on graph for larger image.

New Home Sales is one of my favorite leading indicators. Here are a couple of posts: New Home Sales as Leading Indicator and Update: New Home Sales as Leading Indicator.

I'm looking for a drop in housing transaction as an indicator of an economic slowdown and possible recession in '06. Thornberg also thinks its too early to predict a recession and compares the late '80s slump (leading to the early '90s recession) to today.

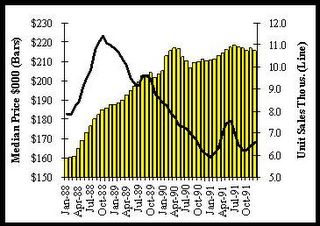

"The ... chart shows unit sales and median prices at the end of the late eighties run-up in prices. Market activity peaked in the end of 1988, and price appreciation began to slow within 6 months, and stopped within 18. So keep an eye on market activity, since this will be the first sign of impending problems. More recently unit sales have begun to fall, and you can see some slowdown in price appreciation. This may not be completely convincing evidence since you can see a similar slowdown in 2002 that quickly reversed itself. Of course this time prices are higher and more out of whack relative to income, and interest rates are rising rather than falling. This makes it considerably more likely to be the beginning of the end."

"... as of now the bubble continues to expand. And while there are certainly signs that we are past the peak in this state, activity remains at a historically high pace. There is almost no chance of a major economic slowdown in the next 12 months for the nation ..."There is much more in the report.