by Calculated Risk on 11/09/2008 04:42:00 PM

Sunday, November 09, 2008

The Commercial Real Estate Bust

Since investment in non-residential structures is slowing (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble? And how did the CRE boom compare to previous CRE booms?

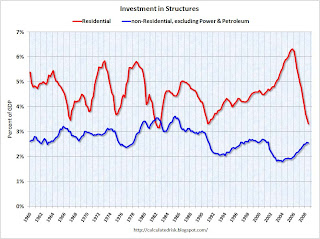

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The current non-residential boom was greater than the late '90s boom, but much less than the non-residential boom in the '80s.

However much of the recent boom in non-residential investment is energy related. The second graph compares residential investment to non-residential investment in structures excluding Power and Petroleum exploration as a percent of GDP since 1960. With this comparison, the recent boom is less than the late '90s boom, and far less than the S&L related '80s boom. This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Residential investment has declined by 3% of GDP so far from the peak. Non-residential investment would have to decline to about 1% of GDP (see first graph) to match the impact of GDP from the residential bust so far. And excluding power and petroleum, non-residential investment would have to be below zero to match the impact on GDP from the residential bust!

In percentage terms, residential has collapsed by about 50% (compared to GDP). Non-residential would have to decline to less than 2.0% of GDP (1.3% of GDP ex-power and petroleum) - the lowest level in history by far - to match the residential collapse in percentage terms.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s CRE boom.

Some areas of non-residential investment have been overbuilt, and I've forecast significant declines for investment in offices, malls, and lodging. But those looking for a collapse in CRE investment comparable to the current residential investment bust are wrong.