by Calculated Risk on 9/04/2008 11:36:00 AM

Thursday, September 04, 2008

Price to Rent Ratio

Peter Viles at the LA Times (L.A. Land blog) has some excerpts from a Credit Suisse report projecting that house prices might bottom in late 2009. See: Credit Suisse: Home price declines likely until late '09

The report, using two separate methods of predicting home price trends, says both methods "point to home prices moving back in line with past historical 'equilibrium' levels in 12 to 18 months..." The report notes that housing prices could "overshoot" their equilibrium levels, and fall for even longer than 12 to 18 months, in which case, "'cheap' housing is still about two years away."I think price to rent ratios are helpful, but have flaws. I wouldn't use median house prices because the mix of homes impacts the median price.

Also the Credit Suisse projection of prices declining for another 12 to 18 months is based on prices continuing to fall at the current rate. Historically, during a housing bust, price fall slowly at first, then decline more rapidly for a couple of years, and then slowly for several more years until the eventual bottom. Right now we are in the rapid price decline phase. So I'm still expecting prices to fall for some time (although I expect price declines to start to slow), with a price bottom in the 2010 to 2012 period in the bubble areas, and perhaps sooner in other areas (less bubbly areas and certain low end areas).

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now the inventory of existing homes (especially distressed properties) is at an all time high.

On price to rent ratios, back in October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter: House Prices and Fundamental Value.

Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

I've posted on this before, and here is an update to their graph through Q2 2008:

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

The Fed letter used the OFHEO index (Blue), but this index includes refinances and has other problems. The OFHEO index shows that prices have barely fallen from the recent peak, and therefore the price-to-rent ratio has barely declined.

Data is available quarterly for the Case-Shiller National Index starting in 1987. For this graph, the price-to-rent ratio for Case-Shiller in Q1 1987 was set to the OFHEO price-to-rent for Q1 1987.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% complete as of Q2 2008 on a national basis. This ratio will probably continue to decline with some combination of falling prices, and perhaps, rising rents. And, as Credit Suisse analysts noted, the ratio may overshoot too.

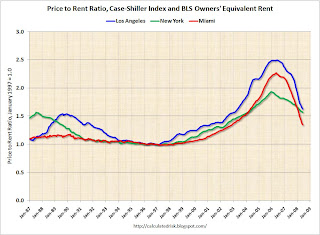

The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1987 = 1.0. The OER from the BLS for each individual city is used.

The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1987 = 1.0. The OER from the BLS for each individual city is used.Some combination of falling prices, and perhaps rising rents, will probably push the ratio back towards 1.0. By this measure of housing fundamentals, it appears that Miami has corrected about 75% of the way to the eventual bottom, Los Angeles about 60%, and New York about 40%.

Some people are seeing the start of a price bottom in Florida, from Bloomberg: Florida Real Estate Bottom Signaled by Sale of Distressed Condo

Sales of distressed Miami properties have begun, signaling a bottom for south Florida's real estate market and the end of waiting for vulture funds armed with about $30 billion to spend.The price-to-rent ratio would suggest that parts of Florida are indeed "almost there". But with the high level of inventory, prices will probably decline further, and the bottom in real terms is probably still a few years away.

...

``There's a purging going on,'' [Jack McCabe, McCabe Research & Consulting LLC] said. ``It's my belief that the vulture buyers would form the bottom of the real estate market, and we're almost there. That bottom may last for three years as foreclosure sales go on.''

Price-to-rent ratios are useful, but somewhat flawed. They give a general idea about house prices, but there are other important factors (like inventory levels, price to income and credit issues). We are getting closer on prices, but I think we still have a ways to go.