by Calculated Risk on 3/10/2006 09:18:00 PM

Friday, March 10, 2006

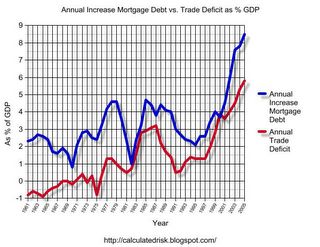

Mortgage Debt and the Trade Deficit

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Current account, Feb 4, 2005 Click on graph for larger image.

Click on graph for larger image.

With the release of the Fed's Flow of Funds report, we can look at the relationship between the annual increase in household mortgage debt and the trade deficit.

Note: I'm using the trade deficit instead of the current account deficit, since the current account for '05 has not been released yet.

I expect the annual increase in mortgage debt to decline in 2006. This is because I expect new and existing home purchases to decline, and homeowners to extract less equity from their homes in 2006.

The drop in mortgage activity is is one of the reasons I expect the trade deficit to stabilize in 2006. From my 2006 predictions:

Trade Deficit / Current Account Deficit: I could be wildly wrong here too, but I think the trade deficit will stabilize or even decline slightly next year. As the economy slows, I think imports will slow.I should have been more clear. There is no way the trade deficit will decline on an annual basis in 2006, but I was expecting the deficit to stabilize or decline from the September to December level of $66 Billion per month.

The record January deficit of $68.5 Billion was a little disheartening, but mortgage extraction has just begun to slow. So far I've been wrong - but its early.

Drs. Brad Setser and Menzie Chinn are more pessimistic ...

Brad Setser: January trade data

Menzie Chinn: The downward march of the trade balance