by Calculated Risk on 2/12/2006 03:15:00 PM

Sunday, February 12, 2006

Housing Slowdown Threatens Inland Empire's Economy

UPDATE: Please see my Angry Bear post: Krugman: Debt and Denial

The Press Enterprise reports: A drop in real estate prices could have far-reaching effects, economists warn.

Inland Southern California's surging real estate prices have done more than create hefty equities for hundreds of thousands of homeowners.

They've also kept thousands of people working.

But if prices start to drop in Riverside and San Bernardino counties, and homes stay on the market for five months instead of five days, it hurts more than just sellers. It also leads to less work for the people who build new homes and to those who help sell, finance and insure them.

If those jobs slow, economists question which, if any, industries of the region's economy have enough strength to pick up the slack.

Several economists who watch the two counties did not hesitate when asked to name a potential landmine for the economy in 2006.

"Real estate is a big concern, and we're going to have to watch it carefully," said Chapman University economist Esmael Adibi.

...

"The markets are starting to cool, and everyone says we may be sliding down the backside of a hill," said UCLA economist Christopher Thornberg.

He said there's a "substantial risk" in the second half of the year when he expects home prices to drop. He was one of the first economists to suggest that a slowdown in the market could bring on conditions seen in a recession.

The Inland area relied heavily on housing-related jobs in 2005.

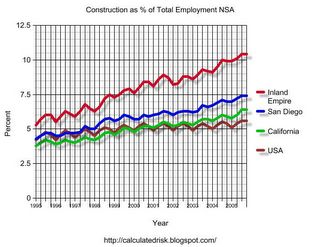

Click on graph for larger image.

This graph is from my Angry Bear post last November: Construction Employment in the Inland Empire

As the housing market slows areas like California's Inland Empire that have been heavily dependent on Real Estate related employment will suffer the most.