by Calculated Risk on 5/24/2008 10:31:00 PM

Saturday, May 24, 2008

U.S. Vehicle Miles vs. Real Gasoline Price

Yesterday the Department of Transportation reported that Americans drove 11 billion fewer miles in March '08 than in March '07. I presented a graph of the moving 12 month total miles driven here.

The following graph compares the year-over-year change in the moving 12 month total vs. the real price of gasoline (source for real prices: EIA). Note: graph uses annual data for real prices prior to 1980. Click on graph for larger image.

Click on graph for larger image.

This is only the third time since 1970 that the YoY change in total U.S. miles driven has declined. The previous two times were following the oil shocks of 1973 and 1979 - and led to the two most severe U.S. recessions since WWII.

Note that the most recent data from the DOT is for March. According to the EIA, gasoline prices have risen 13% since then! So I'd expect U.S. miles driven to have declined further in April and May.

Buffett: "longer, deeper" U.S. recession than most expect

by Calculated Risk on 5/24/2008 04:11:00 PM

From Spiegel Online: Investor-Legende Buffett attackiert gierige Banker (attacks greedy bankers)

Die Rezession werde "tiefer gehen und länger dauern, als viele denken".The recession will be deeper and last longer than most people think.

And on the bankers:

"Sie brauten ein Giftgetränk und mussten es am Ende selbst trinken", sagte Buffett. "So etwas machen die Banker normalerweise ungern, sie verkaufen es lieber an andere", fügte er sarkastisch hinzu.Loosely translated: The bankers brewed a poisoned drink, and then had to drink it themselves. Usually they prefer to sell the poison to others (said sarcastically).

Meanwhile, on Friday, Goldman Sachs forecast a "double dip" recession, with a mild pick up in the economy mid-year from the stimulus checks, followed by another slump in the economy later this year.

Update: changed headline to more accurate reflect Buffet's comments.

UPDATED: A Congressional Speculator?

by Tanta on 5/24/2008 06:37:00 AM

This is an update to post below on Rep. Laura Richardson's foreclosure woes.

Gene Maddaus of the Daily Breeze kindly forwarded today's additions to the saga. There are not two, but three homes owned by Richardson in foreclosure. And yes, she appears to have cashed out her primary residence back in 2006 to fund her campaign for State Assembly. So it looks like a pattern.

* * * * * *

I have been watching the story of Representative Linda Laura [Oops! --Ed.] Richardson and her foreclosure woes for a while now, while heretofore hesitating to post on it. For one thing, the original story--a member of Congress losing her expensive second home to foreclosure--had that kind of celebrity car-crash quality to it that I'm not especially interested in for the purposes of this blog. For another thing, posting about anything even tangentially related to politics invites the kind of comments that personally bore me to tears.

All that is still true, but the story has taken such an unfortunate turn that I feel obligated to weigh in on it. Specifically, Rep. Richardson is threatening us:

Rather than shy away from voting on mortgage-related bills, Richardson said her experiences could help her craft legislation to make sure others don't experience what she did. For example, she sees a need to add steps to inform property owners before their property can be sold.If Rep. Richardson is going to base legislative proposals on her own experience, then it matters to the rest of us what that experience was. So click the link below if you can stand to hear about it.

"We have to ensure that lenders and lendees have the tools with proper timing to resolve this," she said.

* * * * * * * * * *

The story was originally reported in the Sacramento Capitol Weekly, and picked up by the Wall Street Journal, and thence covered by a number of blogs, with the storyline being that Rep. Richardson "walked away" from her home, a second home she purchased in Sacramento after being elected to the State Assembly. The "walk away" part came from a remark made by the real estate investor who purchased the home at the foreclosure auction, not Rep. Richardson or anyone who could be expected to understand her financial situation, but that didn't stop the phrase "walk away" from headlining blog posts.

Rep. Richardson has variously claimed at different times that the house was not in foreclosure, that she had worked out a modification with the lender, and that the lender improperly foreclosed after having agreed to accept her payments. Frankly, unless and until Rep. Richardson gives her lender, Washington Mutual, permission to tell its side of the story--I'm not holding my breath on that--we're unlikely to be able to sort out this mess of claims to my satisfaction, at least. It's possible that WaMu screwed this up--that it accepted payments on a workout plan with the understanding that foreclosure was "on hold" and then sold the property at auction the next week anyway. It's possible that Richardson's version of what went on is muddled, too. Without some more hard information I'm not inclined to assume the servicer did most of the screwing up, if for no other reason that we didn't find out until late yesterday, courtesy of the L.A. Land and Foreclosure Truth blogs, that Richardson's other home--her primary residence--was also in foreclosure proceedings as recently as March of this year, a detail that as far as I can tell Richardson never disclosed in all the previous discussion of the facts surrounding the foreclosure of her second home.

What part of this I am most interested in, right now, is the question of what in the hell exactly Richardson was thinking when she bought the Sacramento home in the first place. Since the story is quite complex, let's get straight on a few details. Richardson was a Long Beach City Council member who was elected to the state legislature in November of 2006. In January of 2007 she purchased a second home in Sacramento, presumably to live in during the Assembly session. In April 2007, the U.S. Congressional Representative from Richardson's district died, and Richardson entered an expensive race for that seat, winning in a special election in August of 2007. By December 2007 the Sacramento home was in default, and it was foreclosed in early May of 2008. The consensus in the published reports seems to be that Richardson spent what money she had on her campaign, not her bills. According to the AP:

Richardson, 46, makes nearly $170,000 as a member of Congress and was paid $113,000 during the eight months she served in the state Assembly in 2007 before her election to Congress. She also received a per diem total of $20,000 from California, according to a financial disclosure form she filed with the House of Representatives clerk.It seems to me that all this focus on what happened after she bought the Sacramento home--running for the suddenly-available Congressional seat, changing jobs, etc.--is obscuring the issue of the original transaction.

In November of 2006, Richardson already owned a home in Long Beach. As a newly-elected state representative, she would have been required to maintain her principal residence in her district, but she would also have had to make some arrangements for staying in Sacramento during Assembly sessions, given the length of the commute from L.A. County to the state capitol. She seems to have told the AP reporter that "Lawmakers are required to maintain two residences while other people don't have to," which is not exactly the way I'd have put it. Lawmakers are required to maintain one primary residence (which need not be owned) in their district. They are not required to buy a home at the capitol (of California or the U.S.); many legislators do rent. Richardson is a single woman with no children, yet she felt "required" to purchase a 3-bedroom, 1 1/2 bathroom home in what sounds like one of Sacramento's pricier neighborhoods for $535,500, with no downpayment and with $15,000 in closing cost contributions from the property seller. (The NAR median price in Sacramento in the first quarter of 2007 was $365,300.)

I have no idea what loan terms Richardson got for a 100% LTV second home purchase in January 2007, but I'm going to guess that if she got something like a 7.00% interest only loan (without additional mortgage insurance), she got a pretty darn good deal. If she got that good a deal, her monthly interest payment would have been $3123.75. Assuming taxes and insurance of 1.50% of the property value, her total payment would have been $3793.13.

The AP reports that Richardson's salary as a state representative was $113,000 in 2007, and she received $20,000 in per diem payments (which are, of course, intended to offset the additional expense of traveling to and staying in the Capitol during sessions). I assume the per diem is non-taxable, so I'll gross it up to $25,000. That gives me an annual income of $138,000 or a gross monthly income of $11,500.

The total payment on the second home, then, with my sunny assumptions about loan terms, comes to 33% of Richardson's gross income. I have no idea what the payment is for her principal residence in Long Beach. I have no idea what other debt she might have. I am ignoring her congressional race and job changes and all that because at the point she took out this mortgage, that was all in the future and Richardson didn't know that the incumbent would die suddenly and all that. I'm just trying to figure out what went through this woman's mind when she decided it was a wise financial move to spend one-third of her pre-tax income on a second home. (There's no point trying to figure out what went through the lender's mind at the time. There just isn't.)

Now, Richardson has this to say about herself:

"I'm Laura Richardson. I'm an American, I'm a single woman who had four employment changes in less than four months," Richardson told the AP. "I had to figure out just like every other American how I could restructure the obligations that I had with the income I had."Yeah, well, I'm Tanta, I'm an American, I'm a single woman, and I say you're full of it. You need to show us what your plan for affording this home was before the job changes, girlfriend. You might also tell me why you felt you needed such an expensive second home when you had no money to put down on it or even to pay your own closing costs. As it happens, the Mercury News/AP reported that by June of 2007--five months after purchase--you had a lien filed for unpaid utility bills. You didn't budget for the lights?

But what are we going to get? We're going to get Richardson all fired up in Congress about tinkering with foreclosure notice timing, which is last I knew a question of state, not federal, law, and which has as far as I can see squat to do with why this loan failed.

Quite honestly, if WaMu did give Richardson some loan modification deal, I'd really like to know what went through the Loss Mit Department's collective and individual minds when they signed off on that. Sure, Richardson's salary went up to $170,000 when she became a member of the U.S. Congress, but what does she need a home in Sacramento for after that? Where's she going to live in Washington, DC? And, well, her principal residence was also in the process of foreclosure at the same time. I suppose I might have offered a short sale or deed-in-lieu here, but a modification? Why would anybody do that? Because she's a Congresswoman?

I'm quite sure Richardson wants to be treated like just a plain old American and not get special treatment. Well, I was kind of hard on a plain old American the other day who wrote a "hardship letter" that didn't pass muster with me. I feel obligated to tell Richardson that she sounds like a real estate speculator who bought a home she obviously couldn't afford, defaulted on it, and now wants WaMu to basically subsidize her Congressional campaign by lowering her mortgage payment or forgiving debt. And that's . . . disgusting. At the risk of sounding like Angelo.

I know some of you are thinking that maybe poor Ms. Richardson got taken advantage of by some fast-talking REALTOR who encouraged her to buy more house than she could afford. According to Pete Viles at L.A. Land,

She likes the Realtors, and they like her. She filed financial disclosure forms with the House Ethics Committee reporting the National Assn. of Realtors flew her to Las Vegas in November to help swear in the new president of the association, Realtor Dick Gaylord of Long Beach.No wonder she's blaming the lender.

In suggested remarks* at the NAR gathering, also filed with the House, Richardson's script read: "I might be one of the newest members of Congress but I am not a new member of the REALTOR Party. When I needed help to win a tough primary, REALTORS stood up and backed me even though I was the underdog."

--Real estate industry professionals have given her $39,500 in campaign contributions in the current election cycle, according to Open Secrets.

Friday, May 23, 2008

MarketWatch: Bank failures to surge in coming years

by Calculated Risk on 5/23/2008 08:08:00 PM

Alistair Barr at MarketWatch provides an analysis of the coming surge in bank failures.

Only three banks have failed so far in 2008. But that number is set to surge as the credit crunch slows economic growth and hammers some lenders that grew too fast during the recent real-estate boom, experts say.And on C&D loans:

The roots of today's banking crisis grew out of the boom and bust in the real estate market. Lenders originated more and more mortgages, while other banks, particularly smaller and medium-sized institutions, ploughed money into construction and development loans.

...

At this point in the crisis, you can't stop bank failures," said Joseph Mason, associate professor of finance at Drexel University's LeBow College of Business, who has studied past financial crises.

Small and medium-sized banks found it difficult to compete with large lenders in the national markets for mortgages and other consumer loans. So many focused on C&D loans because this type of financing relies more on local, personal connections, said Zach Gast, financial sector analyst at RiskMetrics.Barr names several banks that might fail, including IndyMac and Corus. The bank failures are coming.

As the real estate market boomed, C&D loans did too. A decade ago, bank holding companies had $60 billion of these loans. That number is now $480 billion, according to Gast, who also notes that C&D loans are almost never securitized, so they're held on banks' balance sheets.

Such rapid loan growth usually creates trouble later. Indeed, delinquencies represented 7.1% of total C&D loans at the end of the first quarter, up from 0.9% at the end of 2005, Gast said.

DOT: Vehicle Miles Fell 4.3% in March

by Calculated Risk on 5/23/2008 04:31:00 PM

Graph of 12 month rolling total U.S. vehicle miles added: Click on graph for larger image.

Click on graph for larger image.

From the Department of Transportation: Eleven Billion Fewer Vehicle Miles Traveled in March 2008 Over Previous March

Americans drove less in March 2008, continuing a trend that began last November, according to estimates released today from the Federal Highway Administration.It appears that prices are finally impacting demand in the U.S.

...

The FHWA’s “Traffic Volume Trends” report, produced monthly since 1942, shows that estimated vehicle miles traveled (VMT) on all U.S. public roads for March 2008 fell 4.3 percent as compared with March 2007 travel. This is the first time estimated March travel on public roads fell since 1979. At 11 billion miles less in March 2008 than in the previous March, this is the sharpest yearly drop for any month in FHWA history.

Vallejo files for bankruptcy

by Calculated Risk on 5/23/2008 02:21:00 PM

From the AP: Vallejo files for bankruptcy to deal with budget shortfall

This was expected. The question is: Is Vallejo unique, or will a number of other cities file bankruptcy?

Historical Housing Graphs: Months of Supply, Sales and Inventory

by Calculated Risk on 5/23/2008 01:31:00 PM

The first graph shows the year end months of supply since 1982 (and April 2008). Click on graph for larger image.

Click on graph for larger image.

The months of supply has risen to 11.2 months, and will probably be over 12 months sometime this summer. I don't have monthly data back to the early '80s, but the months of supply will probably be close to an all time record by July.

The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record. Note: for 2008 I used the April sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

Note: for 2008 I used the April sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

If the red columns (inventory) rises above the blue column (sales) - something that will probably happen this summer - then the "months of supply" number will be over 12.

The third graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that inventory is at an all time record level by this key measure.  This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - April sales were at a 4.89 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - April sales were at a 4.89 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests that sales of existing homes could fall further in 2008.

More on April Existing Home Sales and Inventory

by Calculated Risk on 5/23/2008 11:39:00 AM

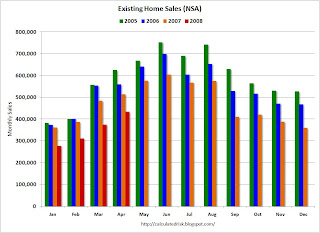

For more, see my earlier post: April Existing Home Sales Click on graph for larger image.

Click on graph for larger image.

The first graph is Not Seasonally Adjusted sales by month for the last few years. This shows that sales have plunged in April 2008 compared to the previous three years.

April is an important month for existing home sales, and is part of the spring selling season. The next four months - May through August - are typically the strongest selling months of the year. Existing home sales are recorded at the close of escrow, and most homebuyers want to move during the summer months.

For forecasting, probably the most important number in the existing home sales report is inventory; houses listed for sale. For April, the NAR reported inventory at 4.552 million units, an all time record high for April.

This tells us nothing about the number of distressed homes for sale (REOs, short sales). It also says nothing about homeowners waiting for a 'better market'. But the NAR inventory report does provide a general idea of the supply side of the 'supply and demand' equation.

See the earlier post for a graph of inventory. The second graph shows the seasonal pattern for inventory for the last few years (based on year end inventory from the previous year).

The second graph shows the seasonal pattern for inventory for the last few years (based on year end inventory from the previous year).

Note: the NAR doesn't seasonally adjust inventory.

This suggests that the inventory build so far this year has been about normal, and it is reasonable to expect inventory levels to continue to increase into the summer.

My guess is existing home inventory will peak in mid-summer at around 5 million units. This will probably put the months of supply over 12 months.

BTW, the all time record high for inventory, for any month, was July 2007 at 4.561 million units. That will probably be broken in May.

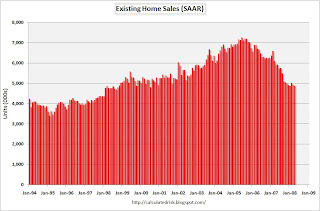

April Existing Home Sales

by Calculated Risk on 5/23/2008 10:07:00 AM

Update: Graphs added.

Update2: Here is the NAR press release.

From MarketWatch: Unsold houses rise to 23-year high in April

The U.S. housing market weakened further in April, with a flood of homes coming on the market even as sales and prices declined, the National Association of Realtors reported Friday.

Resales of U.S. houses and condos dropped 1% to a seasonally adjusted annualized rate of 4.89 million from 4.94 million in March.

...

Resales have sunk 17.5% in the past year and are down 33% from the peak in 2005.

...

The inventory of unsold homes jumped 10.5% to 4.55 million, an "uncomfortably high" level, said Lawrence Yun, chief economist for the real estate trade group.

Inventories represented an 11.2 month supply at the April sales pace ...

Click on graph for larger image.

Click on graph for larger image. The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April 2008 (4.89 million SAAR) were the weakest April since 1998 (4.77 million SAAR).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.55 million homes for sale in April.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.55 million homes for sale in April. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase in the Spring.

I'll have more on inventory later today.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply increased sharply to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Inventory is the story in this report.

More later (the NAR website has problems this morning).

Thursday, May 22, 2008

Comptroller Dugan on "Unprecedented Home Equity Loan Losses"

by Calculated Risk on 5/22/2008 05:21:00 PM

From the Comptroller of the Currency: Comptroller Dugan Tells Lenders that Unprecedented Home Equity Loan Losses Show Need for Higher Reserves and Return to Stronger Underwriting Practices (hat tip Steven)

Comptroller of the Currency John C. Dugan said today that accelerating losses in the home equity business show the need to build reserves and to return to the stronger underwriting standards of past years.It appears HELOC losses are accelerating rapidly in Q2, and will definitely impact earnings. Dugan's comment that HELOC losses are "not likely large enough to impair capital" might be a tad optimistic.

Home equity loans and lines of credit grew dramatically in recent years, more than doubling, to $1.1 trillion, since 2002. In part, that’s because of the rapid appreciation in house prices, the tax deductibility feature of home equity loans, and low interest rates.

“But another contributing factor was perhaps not so obvious: liberalized underwriting standards,” Mr. Dugan said, in a speech to the Financial Services Roundtable’s Housing Policy Council. “These relaxed standards helped more people to qualify for loans, and more people to qualify for significantly larger loans.”

These relaxed standards included limited verification of a borrower’s assets, employment, or income; higher debt to equity ratios; and the use of home equity loans as “piggyback” loans that helped borrowers qualify for first mortgages with low down payments and without mortgage insurance, resulting in ever-higher cumulative loan-to-value ratios.

Consequently, once house prices began to decline in 2007, home equity lenders began to experience unprecedented losses. While losses have traditionally run at about 20 basis points, or two tenths of a percent of loans, they shot up to nearly 1 percent in the fourth quarter of 2007 and to 1.73 percent in the first three months of 2008.

Looked at in dollar terms, losses on all home equity loans, including HELOCs and junior home equity liens, rose from $273 million in the first quarter of 2007 to almost $2.4 billion in the first three months of 2008 – a nine-fold increase. And the largest home equity lenders are now saying that they expect losses to continue to escalate in 2008 and beyond, Mr. Dugan said.

The Comptroller said these loss numbers need to be viewed in perspective. Though accelerating quickly, they are still much lower than the loss rates for other types of retail credit, such as credit card loans.

“It’s true that home equity credit was priced with lower margins than these other types of credit, and it’s true that the product has become a significant on-balance sheet asset for a number of our largest banks,” he said. “Nevertheless, the higher level of losses and projected losses – even under stress scenarios – are what we at the OCC would describe generally as an earnings issue, not a capital issue. That is, while these elevated losses, depending on their magnitude, could have a significant effect on earnings over time, with few exceptions they are not in and of themselves likely to be large enough to impair capital.”

For the near term, Mr. Dugan said, the OCC expects national banks to continue to build reserves.

emphasis added

S&P Cuts Ratings of Prime-Jumbo Mortgage Bonds

by Calculated Risk on 5/22/2008 04:48:00 PM

From Bloomberg: S&P Cuts, Reviews $6 Billion of Prime-Jumbo Mortgage Bonds (no link yet)

Standard & Poor's cut or threatened to cut the ratings on almost $6 billion of securities backed by prime ``jumbo'' mortgages ...This is more evidence that the credit problems have moved up the chain. See: Fed: Delinquency Rates Rose Sharply in Q1. Also the Q1 Mortgage Bankers Association (MBA) delinquency report will be released soon - and I expect that report to show accelerating delinquencies in Alt-A and prime loans.

Ratings on 125 classes of [prime-jumbo] bonds created in the first half of 2007 ... were downgraded ... Ratings on 156 classes were put under review. ... Ninety percent of the securities put under review are AAA rated ...

Late payments of at least 90 days and defaults among prime-jumbo loans underlying bonds issued last year rose to 1.16 percent as of April bond reports, up 180 percent since December, S&P said.

National House Price Indices: OFHEO vs. Case-Shiller Graphs

by Calculated Risk on 5/22/2008 01:23:00 PM

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the OFHEO Purchase Only Index (through Q1 2008) vs. the Case-Shiller National Index (through Q4 2007). (Q1 2000 = 100 for both indices).

Note that the Case-Shiller National Index showed a larger price increase during the boom, and is now showing a faster price decline. The second graph shows the year-over-year change in the price indices. The Case-Shiller index showed larger annual percentage increases than OFHEO during the boom, and is now showing larger annual percentage declines.

The second graph shows the year-over-year change in the price indices. The Case-Shiller index showed larger annual percentage increases than OFHEO during the boom, and is now showing larger annual percentage declines.

The Case-Shiller index for Q1 2008 will be released next Tuesday at 9 AM ET, and the index will probably be at about the same level as the OFHEO index on the first graph, and will probably show a year-over-year price decline close to 15%.

S&P: Subprime and Alt-A Delinquencies Rising

by Calculated Risk on 5/22/2008 11:50:00 AM

From Reuters: Subprime, Alt-A mortgage delinquencies rising: S&P

Delinquencies for Alt-A mortgages rated between 2005 and 2007 are climbing, with total delinquencies rising as high as 17 percent in some cases, more than 6 percentage points higher than previous estimates, the ratings agency said in a report.Yesterday, the Fed released the commercial bank delinquency report and it appears that prime delinquencies are rising rapidly too.

Lower-quality subprime mortgage delinquencies soared as high as 37 percent for mortgages originated in 2006, 4 percentage points higher than previous estimates, S&P said.

Subprime mortgages originated in 2007 saw delinquencies climb to almost 26 percent, 6 percentage points higher.

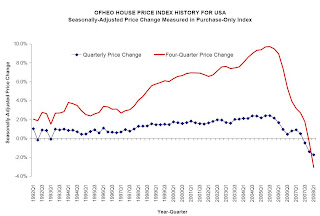

OFHEO: Decline in House Prices Accelerates

by Calculated Risk on 5/22/2008 10:34:00 AM

From OFHEO: Decline in House Prices Accelerates in First Quarter

U.S. home prices fell in the first quarter of 2008 according to OFHEO’s seasonally-adjusted purchase-only house price index. The index, which is based on data from home sales, was 1.7 percent lower on a seasonally-adjusted basis in the first quarter than in the fourth quarter of 2007. This decline exceeded the 1.4 percent price decline between the third and fourth quarters of 2007 and is the largest quarterly price decline on record. Over the past year, prices fell 3.1 percent between the first quarter of 2007 and the first quarter of 2008. This is the largest decline in the purchase only index’s 17-year history.

Click on graph for larger image.

Click on graph for larger image.This graph, from OFHEO, shows the four quarter and quarterly price changes for the Purchase Only Index.

There are significant differences between the OFHEO index and the Case-Shiller index (see House Prices: Comparing OFHEO vs. Case-Shiller), but it's important to note that the Fed uses the OFHEO index to calculate changes in household assets - and this means the Flow of Funds report in Q1 will show a significant decline in the value of household real estate (no surprise, but the number will be large).

Ford Warns, Cuts Production

by Calculated Risk on 5/22/2008 09:18:00 AM

Ford Motor Company today said it is making adjustments to its production plan and revising downward its near-term North American Automotive profit outlook ...It just keeps getting worse for the auto industry.

Ford is reducing 2008 production of large trucks and SUVs, as gas prices soar and customers move more quickly to smaller and more fuel-efficient cars and crossovers.

Ford said it now plans to produce 690,000 vehicles in North America during the second quarter, a further reduction of 20,000 units from previously announced planned production levels and a decline of 15 percent from the second quarter of 2007. The company plans to produce between 510,000 and 540,000 units in the third quarter, down 15 to 20 percent from the same period last year.

How Not to Write a Hardship Letter

by Tanta on 5/22/2008 08:26:00 AM

It is inevitable that we would join the mirth all over the rest of the toobz regarding The Tanned One's unfortunate use of the "reply" rather than "forward" button in the process of registering his "disgust" with a borrower who emailed some 20 Countrywide executives (including the press office) with a request for a mortgage modification based on a form letter he found on the net. Moe Bedard, whose advice on approaching his servicer this borrower faithfully followed, wasted not a moment in "reaching out to the media" with this story, managing to land it in the LAT yesterday.

As a PR stunt, there's not much you can criticize here about Mr. Bailey's letter or Moe's media-savvy frothing in response. Angelo just handed these folks a dose of self-righteousness that will keep them stoned for weeks. The problem here, of course, is that if you are a borrower in distress trying to work something out with your servicer--Countrywide or anyone else--your primary need is not sympathy from the senior execs or attention from the press office or a flap in the newspaper. Your primary need is to reach a person in default servicing who can do something about your problem. This person needs to understand very clearly what your problem is and what can, practically, be done about it. At the risk, therefore, of sounding like a shill for Countrywide (this is a blog in-joke; every time I write something insufficiently hostile to CFC I get accused of being an "industry shill"), I offer to use what insight I have into the minds of loss mitigation specialists who deal with these things to offer some advice on how to write a letter that runs much less of a risk of being dismissed as just another sympathy-seeking form-letter.

* * * * * * * * * *

First of all, your goal is not to convince the servicer that you deserve a loan modification. Some people can't quite get a handle on this point, but you need to. Your goal is to convince the servicer that what you are asking for--in this case, a modification, although it could be a deed-in-lieu or a short sale or just a temporary repayment plan--is 1) necessary given your financial situation and 2) going to work. The biggest problem I have with Mr. Bailey's letter is that it does not ask for anything specific and it does not help me see why a modification would actually work in his case. In fact, it makes the mistake of suggesting that a modification would only allow Mr. Bailey's shaky income situation to continue or get worse. That being the case, it doesn't really matter if the person reading your letter feels sympathy for you or believes that the situation was truly beyond your control.

Let's start at the beginning:To Whom It May Concern:

The first sentence of this letter encapsulates what's wrong with it: it is going to be about "explaining" "unfortunate circumstances." The fact is that every letter every Loss Mit specialist in the universe gets from borrowers is about "unfortunate circumstances." It is quite rare to get a letter from someone that says "Look, I'm a selfish irresponsible pig, but I want more from you than I already have." Trust me on this. Everyone who talks to the Loss Mit department has "unfortunate circumstances." That is what the Loss Mit department is designed to deal with.

I am writing this letter to explain my unfortunate set of circumstances that have caused me to become delinquent on my mortgage. I have done everything in my power to make ends meet but unfortunately I have fallen short and would like you to consider working with me to modify my loan. My number one goal is to keep my home that I have lived in for sixteen years, remodeled with my own sweat equity and I would really appreciate the opportunity to do that. My home is not large or in an upscale neighborhood, it is a “shotgun” bungalow style of only 900 sq. ft. built in 1921. I moved into this home in May of 1992…this was the same year I got clean and sober from drugs and alcohol, and have been ever since, this home means the world to me.

It is very hard for people in financial distress not to focus on their own misery, or to imagine that the "uniqueness" of their misery is not really the point. You need to get beyond that. You may think it is "unfair" that your story sounds more or less like everyone else's. Life is unfair. Servicers do not modify loans because they feel sorry for you. They modify loans because you have convinced them that you will be able to make payments that way.

A much better first paragraph would be: "I am writing to request that you consider a modification of my delinquent mortgage loan so that I can continue to make payments. I have tried to analyze my own situation objectively, and I believe that a monthly mortgage payment of no more than $xxx would allow to me to keep current on my mortgage and my other necessary obligations. I am a long-time homeowner and am committed to staying in my home if we can work out terms that are practical for both of us."

Starting out by addressing head-on what payment you need in order for this to work accomplishes a couple of things: it shows that you are, indeed, thinking practically about your situation. It gives the Loss Mit people a clearer idea of what you want. And it (hopefully) sets a tone that keeps you from degenerating into irrelevancy or sympathy ploys. No one needs to know that you had a booze or drug problem prior to 1992. Certainly no one needs this hint that your property is old, obsolete, and probably filled with DIY "remodeling." Not given what we see in the rest of the letter.The main reason that caused me to have a hardship and to be late is my misunderstanding of the original loan. I was told that after the first year of payments, I would be able to refinance to a better fixed rate- then the bottom fell out of the industry. My payments for that first year were on time. I also lost my second income due to physical conditions in a very physically demanding industry.

Where to start with this? It simply sounds too vague to be believable, even if you think a Loss Mit specialist will be moved to modify your loan because you were told you could refinance. If you feel you need to include such information, I'd try this: "I refinanced my home in [month of year], and I made the mistake of relying on the broker's oral assurance that I could refinance it in a year to lower the payments. After making the first year's payments on time, I contacted my original broker again to apply for a refinance. I was told that I did not qualify because [specific reason given by broker]. I inquired about refinance opportunities with two other companies, both of whom told me [the truth goes here]. It appears that the only way I can lower my payments to a tolerable level is to request a modification."

This would show that you did indeed attempt to refinance, that you paid attention to what you were told the second time, and that you have some understanding of what your options are. The original letter simply blames everything on the loan officer who wrote the original loan and sounds a little too pat--"the bottom fell out of the industry" does indeed sound like something you read on the Internet. Once again, this writer is asking for sympathy, not presenting himself as someone who has made a good-faith effort to rectify the problem himself.

As far as "I also lost my second income due to physical conditions in a very physically demanding industry," you're much better off being factual and specific there--especially since, if you do get a Loss Mit specialist assigned to your case, you might be asked for documentation of income in the last two years. A much better approach (assuming, of course, it's true) would be: "I took a second job as a part-time bricklayer in [month and year] to help make ends meet, but I suffered a back injury in [month and year] that meant I could no longer do physically-demanding work. There are no second jobs available to me now that pay more than minimum wage, which is not enough for me to meet all my current obligations." If you got fired, you should either admit it frankly or leave the whole detail out. If you were laid off, say so. "Lost my second income" quite honestly suggests the worst to those of us who read letters like this all the time.As my ARM payments increased, I have had less money to put towards making my business (income) work. I had been unable to generate business because all of my funds were going towards attempting to make my loan payments. This, coupled with major repairs to my vehicle (93 jeep) and paying out of pocket for medical and dental issues (I have no ins.) caused me to fall further and further behind, destroying my credit rating.

Here's where the wheels really fall off this letter. I need to know what kind of business you are in, and why it requires you to spend money on it, and what kind of money we're talking about. As written, this letter suggests that you need your mortgage payment reduced so that the monthly cash-flow can be "invested" in a business that doesn't seem very successful. Why does Mr. Bailey think that the lender would conclude, in this case, that a modification would work? And this is, actually, the point at which one wonders what happened to the proceeds of Mr. Bailey's latest refinance. Apparently it didn't go into home improvements; did it go into a failing business? That does happen a lot. Will it help to, in essence, do it again by means of a modification?

Now, it’s to the point where I cannot afford to pay what is owed to Countrywide. It is my full intention to pay what I owe. But at this time I have exhausted all of my income and resources so I am turning to you for help.

I feel that a loan modification would benefit us both. With that, and knowing my home will not be foreclosed, I would be able to obtain a roommate in order to generate more income, have the funds to generate more business and have a good working relationship with Countrywide. I would appreciate if you can work with me to lower my delinquent amount owed and payment so I can keep my home and also afford to make amends with your firm.

It is certainly OK to mention unexpected expenses that have arisen lately--like the car repair and the medical bills--but I would caution anyone about claiming that that "destroyed your credit rating." The first thing a servicer is going to do is pull your credit report. If you can supply the car repair invoice and medical bills (or cancelled checks), showing that these expenses were incurred just before delinquencies began appearing on your credit report, you may indeed help the servicer see that the issue here is unforeseen expenses. But you need to be honest with yourself: if your credit history was a mess before those expenses popped up--which is likely the case for Mr. Bailey, I fear--then you don't help your case by writing something like this. The person reading your letter can see your credit report.

Finally, suggesting that you would take in a boarder if you got the modification won't help you much if you need boarder income to qualify for the modified payment. And how much would a boarder pay? How much of a difference would it make?

The big problem with this letter is that Mr. Bailey doesn't simply present a budget and a proposal. The letter needs to say something like this: "My current income is $xxx per month. My monthly expenses [itemized] are $xxx per month. I believe I can add $xxx per month to income by taking in a boarder. That means that I can continue to pay my mortgage if we can reduce the monthly payment to $xxx." The bottom line is, if you cannot write something like that because you cannot come up with a set of numbers that work (and can be verified), you really have no business asking for a modification. If you can come up with reasonable numbers that work, it only helps your case with the servicer to come across as someone who has taken a clear view of the monthly budget and can suggest a concrete plan.

Finally, if you are going to email or fax a letter like this, you need to offer to provide whatever documentation the servicer needs in a follow-up letter. A simple way to do this: "Please let me know what financial documents you will need from me, and where to address them so that they come to the attention of the right person." Quite honestly, the offer to work cooperatively and promptly with the servicer in a specific way is worth any number of rhetorical flourishes borrowed from some Internet form letter.

There are some unfortunate comments over on Moe's site about this letter, the burden of wisdom of which is "not everyone is a college grad or trained writer, you know, so people use form letters and shouldn't be criticized for it." Let me tell you that the biggest problem Loss Mit folks tend to have with borrower letters is not that they don't have the old college polish. The biggest problem is that "explanations" for delinquencies are not actually the same thing as proposals for a successful workout. Nobody cares about rhetorical flourishes; Mr. Bailey's modification will stand or fall on the question of whether it is likely to keep him out of foreclosure, and that stands or falls on whether he can afford the modified payments out of his current income.

To be just as honest as I can, I don't think I would have used the term "disgusting" for Mr. Bailey's letter, as Angelo did. However, the term "bullshit" did pop into my underwriter's mind as I read it. That was in part because of the "form letter" quality of some of it; it was also because Mr. Bailey's discussion of his income situation is so muddled. I write this to suggest to Mr. Bailey, and anyone else contemplating sending such a letter, that this is a likely response from servicing people. I am not particularly defending it, you know. I was in fact trained as an underwriter years ago and we were in fact trained to not leap to conclusions and use the term "bullshit" loosely. (And to "forward," not "reply," but that's another matter.) So it's possibly quite "unfair" that I think Mr. Bailey's letter is unlikely to cut any mustard on its own (although now that it got Angelo in the papers again, he might get a more thorough hearing than his letter alone would have gotten).

But most people can't count on the CEO screwing up and winning the battle in the pages of the LAT; most people really really need to get somewhere with the actual servicing employees we have, not the ideal ones who never react badly to borrower pleas for sympathy. We are what we are. I suggest writing in your own voice, about the details of your monthly budget, sticking to the relevant facts, and trying as hard as you can to stifle the impulse to blame your problems on everyone but yourself. That doesn't mean you have to blame yourself; it means we're past "blame" at this point. You're in trouble; you need to work something out; you need to get on with a practical request. You are a flawed person writing to an undoubtedly flawed person. If you don't want the Loss Mit specialist to "fill in the blanks" in your letter from his or her own possibly cynical experience with other letters of this type, don't leave those blanks in it. That's the best advice I can give you.

Wednesday, May 21, 2008

Fed: Delinquency Rates Rose Sharply in Q1

by Calculated Risk on 5/21/2008 06:41:00 PM

Added: quote from Goldman Sachs at bottom.

The Federal Reserve reports that delinquency rates rose sharply in Q1 in all categories - except agricultural loans (higher food prices helps). Click on graph for larger image.

Click on graph for larger image.

This graph shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.

Credit card delinquency rates are at 4.86%, about the same level as the peak of '01 recession. Credit card delinquencies peaked at 5.45% in the '91 recession.

Commercial real estate delinquencies are rising rapidly, and are at the highest rate since '95 (as delinquency rates declined following the S&L crisis). From the Fed: "Commercial real estate loans include construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate."

Residential real estate delinquencies are at the highest level since the Fed started tracking the data (since Q1 '91).

Update: From Goldman Sachs chief economist Jan Hatzius: Mortgage Credit Deterioration: Broadening and Picking Up Speed (excerpted with premission):

"The Fed’s first-quarter report on loan performance at commercial banks shows mortgage credit quality deteriorating at an accelerating pace. ...

The rapid pace of deterioration is particularly significant because the mortgage holdings of commercial banks appear to be tilted toward higher-quality loans, with more prime and less subprime. ...

The Fed data suggest that mortgage credit performance outside the subprime sector is deteriorating rapidly. This reinforces our long-standing view that the surge in mortgage defaults is much broader than simply a reflection of poor underwriting standards in specific subprime vintages. We don’t doubt that lax underwriting standards were an important issue. But the main driver of the defaults is the decline in home prices, the increase in negative equity positions, and the resulting inability of borrowers who encounter financial stress to sell or refinance their way out of trouble. Although subprime borrowers are more likely to encounter financial stress than prime borrowers—and the share of negative-equity borrowers who will end up defaulting is therefore much higher in the subprime sector—the qualitative outlook for the trajectory of credit losses in the much larger prime market is not all that different."

Congresswoman "Walks Away"

by Calculated Risk on 5/21/2008 06:09:00 PM

From Capitol Weekly: Foreclosure tale shows that nobody is immune from crisis (hat tip too many to mention - thanks all!)

Is the MBA Purchase Index Useful Again?

by Calculated Risk on 5/21/2008 05:36:00 PM

The Mortgage Bankers Association releases a Weekly Mortgage Application Survey. I used to follow the MBA index closely, because the index was a reasonable early indicator of house sales.

All that changed in early 2007 as the MBA index and house sales diverged. There were two reasons for this change: 1) many homebuyers were applying multiple times for loans (the MBA just counts applications), and 2) many lenders were going out of business - and most of these smaller lenders were not in the MBA sample. For more, see this post from May 2007: Is the MBA Index Currently Useless?  Click on graph for larger image.

Click on graph for larger image.

This graph shows the MBA index since January 2002.

We still can't compare to earlier periods because of the changes in the industry. As an example, existing home sales were at the 6 million annual rate in Jan 2002 and the MBA purchase index averaged 356. Over the last 4 weeks, the MBA index has average 363, but existing home sales are below the 5 million annual rate.

And it's still too early to tell if the index is useful again. But perhaps we can start looking at the index for clues as to the direction of home sales again - and check back later to see if the index was correct. Right now the MBA index is suggesting sales will fall over the next couple of months. We will see.

Fed Minutes Suggest Rate Cuts Are Done

by Calculated Risk on 5/21/2008 02:29:00 PM

From the WSJ: Fed Signals Rate Cuts Are Done, Lowers Growth Forecast for 2008

The Federal Reserve on Wednesday appeared to shut the door to the possibility of further interest rate cuts, saying in April meeting minutes that the last rate cut was a "close call," and that many officials think future reductions are unlikely even if the economy contracts.Here are the minutes.

...

The Fed also released updated quarterly economic forecasts with the April minutes. The central tendency of officials' forecasts is for gross domestic product to rise between just 0.3% and 1.2% this year, down from the last forecast of growth between 1.3% to 2%. Officials also raised their forecasts for the unemployment rate and both headline and core inflation as measured by the price index for personal consumption expenditures.

Slower growth, more inflation, no rate cuts ...