by Calculated Risk on 11/21/2008 12:14:00 PM

Friday, November 21, 2008

Kedrosky: The Option ARM Non-Bomb?

Paul Kedrosky writes: The Option ARM Non-Bomb? (hat tip Brett)

I just had someone email me something interesting today about their adjustable-rate mortgage resetting –- but to considerably lower levels. How widespread is this phenomenon? Or, asked differently, what percentage of ARMs are tied to Treasuries, as opposed to Libor, etc.?The answer from American CoreLogic, via Sue McAllister at the Mercury News, is 60% of ARMs are tied to a LIBOR index, about 25% to various treasuries, and the remaining 15% to the 11th District Cost of Funds Index (COFI -popular in California).

Click on graph for larger image.

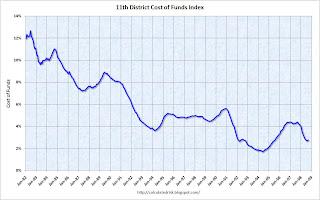

Click on graph for larger image.This graph shows the 11th District Cost of Funds Index.

It appears ARMs tied to the COFI and treasuries will be non-bombs. The other 60% of loans tied to LIBOR might reset at a higher rate, although with the 3-month LIBOR down to 2.16% (it was 5.02% one year ago), even these 60% aren't bombs.

But we have to remember a higher interest rate is only one problem. Many of these borrowers had Option ARMs and were choosing the negatively amortizing or interest only options. When these loans recast, the borrowers will be required to pay the amortizing payment - and that could have a much larger impact on the monthly payment than the change in interest rates.

Remember "Reset" refers to a rate change. "Recast" refers to a payment change. See Tanta's Reset Vs. Recast, Or Why Charts Don't Match