by Calculated Risk on 11/03/2008 02:34:00 PM

Monday, November 03, 2008

Fed: Lending Standards Tighten, Loan Demand Weakens in October

Note: some readers are being swamped with political ads - especially in California. I'm trying to block the ads ... please accept my apology.

From the Fed: The October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans. Considerable net fractions of foreign institutions also tightened credit standards and terms on loans to businesses over the past three months. Large fractions of domestic banks reported tightening standards on loans to households over the same period. Demand for loans from both businesses and households at domestic institutions continued to weaken, on net, over the past three months.

Click on graph for larger image in new window.

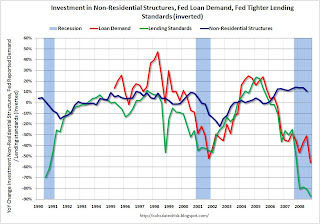

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.