by Calculated Risk on 10/08/2008 12:14:00 PM

Wednesday, October 08, 2008

The Adjustment Process

When I started this blog (Jan 2005), I was concerned about excessive speculation in housing and extremely loose lending practices. It appeared that housing starts and new home sales would fall significantly. I forecast record foreclosures and significant declines in home prices. Many of us wondered who the eventual bagholders would be for all the bad loans. I was also concerned about the extent of equity extraction from homes (the home ATM), and I believed that the coming housing bust would lead the economy into a recession.

This blog was a daily dose of doom and gloom!

Here was how former Fed Chairman Paul Volcker described the situation in Feb 2005:

"Under the placid surface, at least the way I see it, there are really disturbing trends: huge imbalances, disequilibria, risks – call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot.I'm frequently asked if I'm more concerned today than I was in 2005. There are reasons for concern: the credit markets have seized up, many financial institutions are insolvent, consumer spending and investment in commercial real estate is starting to decline, export growth appears to be slowing, the unemployment rate is rising ... and the economy is clearly in a recession.

...

We are buying a lot of housing at rising prices, but home ownership has become a vehicle for borrowing as much as a source of financial security."

There are huge and scary downside risks today, but I'm actually more sanguine now than I was in 2005. If you think back to 2005, we were standing at the precipice, and there was no where to go but over the cliff.

Here is a look at some of the data. Where would you rather be?

Click on graph for larger image in new window.

Click on graph for larger image in new window.Housing starts have collapsed by more than half since 2005. This decline seemed obvious and inevitable in 2005, and now most of the adjustment has already happened.

Which was better for the economy looking forward? To be standing at the edge (in 2005) or to be much nearer the bottom in 2008?

Here is a similar graph for new home sales. Just like for housing starts, new home sales have collapsed by more than half since 2005.

Here is a similar graph for new home sales. Just like for housing starts, new home sales have collapsed by more than half since 2005.The good news is starts of single family homes built for sale have fallen below new home sales, and new home inventory is declining (although existing home inventory is still near record levels). Once again the bulk of the adjustment is now behind us.

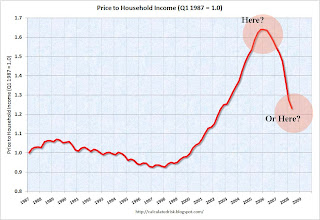

The third graph shows price-to-income using the Case-Shiller national index through Q2 2008.

The third graph shows price-to-income using the Case-Shiller national index through Q2 2008. Although I believe there are more price declines ahead (and therefore more homeowners with negative equity and more foreclosures), prices are much more reasonable today than in 2005.

The price adjustments were inevitable, and progress is being made.

The fourth graph shows Mortgage Equity Withdrawal (MEW) or the Home ATM. It was scary in 2004, 2005 and even in 2006 as homeowners supplemented their income by using the equity in their homes. This amounted to around 9% of disposable personal income in some quarters.

The fourth graph shows Mortgage Equity Withdrawal (MEW) or the Home ATM. It was scary in 2004, 2005 and even in 2006 as homeowners supplemented their income by using the equity in their homes. This amounted to around 9% of disposable personal income in some quarters.It was obvious this had to stop and now it has. The decline in MEW will impact consumer spending, but this was a necessary step towards fixing household balance sheets.

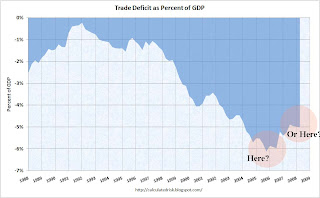

And the final graph shows the trade deficit as a percent of GDP. The trade deficit peaked in 2005 too, and would have fallen even faster except for the huge increase in oil prices.

And the final graph shows the trade deficit as a percent of GDP. The trade deficit peaked in 2005 too, and would have fallen even faster except for the huge increase in oil prices.Now that oil prices are falling, this adjustment in the trade deficit will probably accelerate. The trade deficit doesn't need to fall to zero, but 5% or 6% of GDP was unsustainable.

It's easy to get caught up in the day to day financial crisis and recession news - and this blog will continue to bring you the doom and gloom of the worsening recession. But it's important to remember that even though the adjustment process is painful, progress is being made.

Here is something to ponder from the Seattle Times in 1990: Experts: Bank Crisis Risks Turning Recession Into Depression (hat tip John)

People are starting to make nervous jokes about pulling their money out of shaky U.S. banks and stashing it under their mattresses instead.The financial crisis is worse today than in 1990, and there are many problems ahead (like less consumer spending and business investment), but I believe progress is being made.

But the banking crisis is no joke.

It is real - so real it risks turning the emerging recession into the biggest economic nightmare since the Great Depression of the 1930s.

``My own view of this tends to be apocalyptic - that we are on the threshold of a '30s-like experience,'' said David Cates, chairman of Ferguson & Co., bank consultants based in Dallas.

``The banking system is under tremendous strain. Should it begin to unravel, recession could easily become an economic disaster,'' said a recent editorial in Business Week magazine.