by Calculated Risk on 7/31/2008 10:09:00 AM

Thursday, July 31, 2008

GDP and Investment

The BEA reported that GDP increased 1.9% in Q2 2008 at a seasonally adjusted annual rate (SAAR). But the underlying details - especially for investment - are weak.

Residential investment (RI) declined at a 15.6% (SAAR).

Investment in equipment and software declined 3.4% (SAAR).

The lone bright spot for investment was non-residential investment in structures. Non-RI structure investment increased at a 14.4% SAAR. But all evidence suggests this investment is about to slow sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

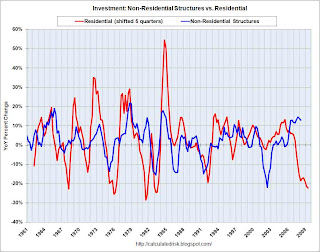

This first graph shows the typical relationship between residential investment and non-residential investment in structures. Note that residential investment is shifted 5 quarters into the future on the graph (non-residential investment usually follows residential by about 4 to 7 quarters).

The current non-residential boom has gone on a little longer than normal, probably for two reasons: 1) there was a slump in investment following the bursting of the tech bubble, and 2) loose lending standards kept non-residential investment lending strong until mid-year 2007, and it takes time to build non-residential structures.

All signs suggest that the bust is now here, and non-residential investment will probably be a drag on GDP for the next year or more. The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

Some of the current investment boom is energy related, and I'll break out the three key areas that will soon go bust - office buildings, multimerchandise shopping, and lodging - as soon as the underlying detail tables are available. The third graph shows residential investment (RI) as a percent of GDP.

The third graph shows residential investment (RI) as a percent of GDP.

RI as a percent of GDP is at 3.5%, just above the cycle lows in 1982 and 1991. It is possible that RI, as a percent of GDP, will bottom later this year (or possibly in early 2009) since inventory is finally declining (housing starts are now below housing sales).

When RI finally bottoms, the good news is RI will no longer be a drag on GDP, but the bad news is RI will probably not recovery quickly because of the huge overhang of inventory. Unfortunately, by the time RI bottoms, non-residential investment will probably have taken over as a significant drag on GDP - suggesting the recession will linger.

Investment is usually the key to the economy, and investment remains weak.