by Calculated Risk on 6/02/2008 11:18:00 AM

Monday, June 02, 2008

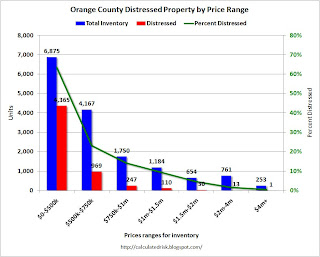

Price Distribution of Distressed Homes

Update: for Minneapolis, see Minneapolis: Price Distribution of Distressed Homes

Jon Lansner at the O.C. Register writes: Distressed homes 63% of O.C.’s cheaper supply

As a percent of all listed homes for sale, distressed properties were 38.7% of the market last week vs. 36.7% two weeks earlier ...It appears distressed inventory is continuing to increase in Orange County similar to the national trend (see the WSJ: Number of Foreclosed Homes Keeps Rising). Note: distressed sales include short sales and REOs.

What is interesting is the numbers are broken down by price range. Here is a graph showing the numbers from Lansner:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Not surprisingly, there are many more distressed homes for sale at the low end; over 70% of inventory is distressed in some of the poorer areas of Orange County (like Santa Ana). Although the lowest category for the graph is less than $500K, many of these distressed homes are probably significantly below the previous conforming limit and were probably purchased with subprime loans.

Naturally the areas with a higher percentage of distressed properties have seen faster price declines. Of course those areas also saw the most appreciation because of loose underwriting for subprime lending. Here is a graph (from a post on Saturday) showing the real Case-Shiller prices in Los Angeles for three price ranges.

This graph show the real Case-Shiller prices for homes in Los Angeles by price range.

This graph show the real Case-Shiller prices for homes in Los Angeles by price range. The low price range is less than $417,721 (current dollars). Prices in this range have fallen 34.9% from the peak in real terms.

The mid-range is $417,721 to $627,381. Prices have fallen 30.7% in real terms.

The high price range is above $627,381. Prices have fallen 22.8% in real terms.