by Calculated Risk on 5/28/2008 10:47:00 AM

Wednesday, May 28, 2008

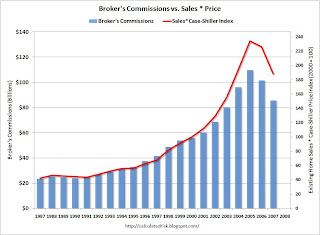

Broker's Commissions: Riding the Double Bubble

First, the NY Times reports on the Realtors antitrust settlement: Realtors Agree to Stop Blocking Web Listings

The Justice Department and the National Association of Realtors reached a major antitrust settlement Tuesday that government officials said should spur competition among brokers and ultimately bring down hefty sales commissions.Innovation will probably put pressure on commissions. This gives us an excuse to look at a long term graph of Broker's Commissions:

The deal frees Internet brokers and other real-estate agents offering heavily discounted commissions to operate on a level playing field with traditional brokers by using the multiple listing services that are the lifeblood of the industry, government officials said.

...

Norman Hawker, a business professor at Western Michigan University who ... predicted that the settlement would ultimately mean a drop in sales commissions of 25 percent to 50 percent as a result of increased competition.

Click on graph for larger image.

Click on graph for larger image. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005 (see 2nd graph for commissions in dollars). Commissions have declined to an annual rate of $72 billion in Q1 2008. (All data from the BEA).

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Only the percent commission held down total commissions a little. This might surprise some readers, but at the peak of the bubble, many agents were discounting commissions below 6%. Listings were like printing money, and it was common for agents in California (and probably elsewhere) to offer to list a property for 4 1/2% or 5%, with the selling agents receiving 3%, and the listing agent taking less.

The following graph compares broker's commissions with an index created by multiplying sales transactions times the Case-Shiller National Home Price Index:

UPDATE: Reader 'get sum' notes in the comments that per his discussions with the BEA, their estimate of commissions assumes a 6% rate.

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).Now, with prices falling, transactions falling, and more competition, it is likely that total commissions will fall further over the next few years. Tough times for many real estate agents.