by Calculated Risk on 3/06/2008 12:27:00 PM

Thursday, March 06, 2008

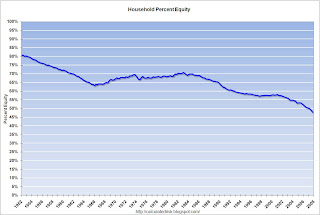

Fed: Household Percent Equity Plummets in Q4

The Fed released the Q4 Flow of Funds report today: Flow of Funds.

The Fed report shows that household real estate assets decreased from $20.325 Trillion in Q3 to $20.155 Trillion in Q4. That is a decline of $170.2 billion.

When we subtract out new single family structure investment and residential improvement, the value of existing household real estate assets declined by $282 Billion.

The simple math: Decrease in household assets: $20,154.7 billion minus $20,324.9 billion equals minus $170.2 billion. Now subtract investment in new single family structures ($259.7 Billion Seasonally Adjusted Annual Rate) and improvements ($187.2 Billion SAAR). Note: to make it simple, divide the SAAR by 4.

Finally negative $170.2B minus $259.7/4 minus $187.2B/4 equals a decline in existing assets of $282 Billion.

Household percent equity was at an all time low of 47.8%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1952. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

Note: approximately 31% of household have no mortgage. So the 50+ milllion households with mortgage have far less equity than 47.8%. The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

This is just the beginning. If house prices fall 20%, households will lose $4 trillion in equity. If they fall 30%, households will lose $6 trillion in equity.