by Calculated Risk on 2/26/2008 01:30:00 PM

Tuesday, February 26, 2008

FDIC Releases Quarterly Report

From the FDIC: Quarterly Banking Profile. A few headings:

Quarterly Net Income Declines to a 16-Year LowOn Bank Failures: "Three Failures in 2007 Is Most Since 2004"

One in Four Large Institutions Lost Money in the Fourth Quarter

Margin Erosion Persists

Full-Year Earnings Fall to Five-Year Low

Net Charge-Off Rate Rises to Five-Year High

Growth in Noncurrent Loans Accelerates

Large Boost to Loss Reserves Fails to Stem Decline in Coverage Ratio

At the end of 2007, there were 76 FDIC-insured commercial banks and savings institutions on the “Problem List,” with combined assets of $22.2 billion, up from 65 institutions with $18.5 billion at the end of the third quarter.And a graph from the FDIC:

Click on graph for larger image.

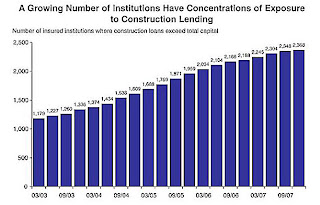

Click on graph for larger image. "A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

No wonder the FDIC is hiring.