by Calculated Risk on 11/30/2007 07:56:00 PM

Friday, November 30, 2007

Florida Schools Hit by Fund Freeze

From David Evans at Bloomberg: Florida Schools Struggle to Pay Teachers Amid Freeze (hat tip Saboor)

School districts, counties and cities across Florida sought to raise cash after being denied access to their deposits in a $15 billion state-run investment fund.This is the same school disctrict mentioned in David Evans piece on Nov 15th: Public School Funds Hit by SIV Debts Hidden in Investment Pools

The Jefferson County school district was forced to take out a short-term loan to cover payroll for the 220 teachers and other employees in the system after $2.7 million it held in the pool was frozen yesterday. At least five other districts also obtained last-minute loans, said Wayne Blanton, executive director of the Florida School Boards Association.

``The unthinkable and the unimaginable have just happened here in Florida,'' said Hal Wilson, chief financial officer of the Jefferson County school district, located 30 miles (48 kilometers) east of the state capital Tallahassee. ``What we just experienced here is a classic run-on-the bank meltdown.''

Hal Wilson smiles at the blue numbers on his desktop screen. His money is yielding 5.77 percent. For the chief financial officer of Florida's Jefferson County school board, that means the $2.7 million of taxpayer funds he's placed in the state's Local Government Investment Pool is earning more on this October day than it would get in a money market fund.From "risk free and easy" to "classic run-on-the bank meltdown" in less than two months

And Wilson says he knows the Florida officials who manage the funds of the 1,559-student district have invested them wisely.

``We're such a small school district,'' Wilson, 55, says. ``We don't have the time or staff for professional money management. They have lots of investment advisers. It's risk free and easy.''

Fed's Poole: Market Bailouts and the "Fed Put"

by Calculated Risk on 11/30/2007 04:57:00 PM

From William Poole, President, St. Louis Fed: Market Bailouts and the "Fed Put". In this speech, Poole addresses the "Bernanke Put" and the possible moral hazard created by the Fed. Poole defends the Fed and the recent rate cuts. Here is his conclusion:

Federal Reserve policy that yields greater stability has not and will not protect from loss those who invest in failed strategies, financial or otherwise. Investors and entrepreneurs have as much incentive as they ever had to manage risk appropriately. What they do not have to deal with is macroeconomic risk of the magnitude experienced all too often in the past.

In the present situation, many investors in subprime paper will take heavy losses and there is no monetary policy that could avoid those losses. Clearly, recent Fed policy actions have not protected investors in subprime paper. The policy objective is not to prevent losses but to restore normal market processes. The issue is not whether subprime paper will trade at 70 cents on the dollar, or 30 cents, but that the paper in fact can trade at some market price determined by usual market processes. Since August, such paper has traded hardly at all. An active financial market is central to the process of economic growth and it is that growth, not prices in financial markets per se, that the Fed cares about.

One of the most reliable and predictable features of the Fed’s monetary policy is action to prevent systemic financial collapse. If this regularity of policy is what is meant by the “Fed put,” then so be it, but the term seems to me to be extremely misleading. The Fed does not have the desire or tools to prevent widespread losses in a particular sector but should not sit by while a financial upset becomes a financial calamity affecting the entire economy. Whether further cuts in the fed funds rate target will alleviate financial turmoil, or risk adding to it, is always an appropriate topic for the FOMC to discuss. But one thing should be clear: The Fed does not have the power to keep the stock market at the “proper” level, both because what is proper is never clear and because the Fed does not have policy instruments it can adjust to have predictable effects on stock prices.

From time to time, to be sure, Fed action to stabilize the economy—to cushion recession or deal with a systemic financial crisis—will have the effect of pushing up stock prices. That effect is part of the transmission mechanism through which monetary policy affects the economy. However, it is a fundamental misreading of monetary policy to believe that the stock market per se is an objective of policy. It is also a mistake to believe that a policy action that is desirable to help stabilize the economy should not be taken because it will also tend to increase stock prices. It makes no sense to let the economy suffer from continuing declines in stock prices for the purpose of “teaching stock market speculators a lesson.” “Teaching a lesson” is eerily reminiscent of Mellon’s liquidationist view. Nor should the central bank attempt to protect investors from their unwise decisions. Doing so would only divert policy from its central responsibility to maintain price stability and high employment.

The Fed would create moral hazard if it were to attempt to pump up the stock market whenever it fell regardless of whether or not such policy actions served the fundamental objectives of monetary policy. I have observed no evidence to suggest that the Fed has pursued such a course. To the extent that financial markets are more stable because market participants expect the Fed to be successful in achieving its policy objectives, then that is a desirable and expected outcome of good monetary policy. There is no moral hazard when largely predictable policy responses to new information have effects on financial markets.

That the monetary policy principles I have discussed here are unclear to many in the financial markets is unfortunate. Macroeconomic stabilization does not raise moral hazard issues because a stable economy provides no guarantee that individual firms and households will be protected from failure. Improved public understanding of this point will not only help the Fed to do its job more effectively but also will help private sector firms to understand better how to manage risk.

Moody's Takes Rating Action on SIVs

by Calculated Risk on 11/30/2007 04:31:00 PM

UPDATE: Here is the Bloomberg story: Moody's Says Citigroup SIV Debt Ratings Under Threat (hat tip CBam)

From Reuters: Moody's cuts or may cut over $100 billion of SIV debt

Moody's pointed to continued decline in the value of the investments made by structured investment vehicles, or SIVs, in downgrading or issuing warnings for about $116 billion of their debt.From Moody's (no link)

"The situation has not yet stabilized and further rating actions could follow," Moody's said in a news release.

...

Given the continued decline in SIV asset values, Moody's said it is now expanding its review, which is not complete, to include the senior debt of some vehicles.

London, 30 November 2007 -- Moody's Investors Service announced today that it has completed part of its review of the SIV sector. This review was prompted by the continued market value declines of asset portfolios. Moody's confirmed, downgraded, or placed on review for possible downgrade, the ratings of 79 debt programmes (with a total nominal amount of approximately US$130 billion). This action affects 20 SIVs as described below.

Moody's has completed its review of capital notes started on November 7th. The significant additional deterioration in market value of assets across the SIV sector observed since November 7th has resulted in the expansion of Moody's original review to include the senior debt ratings of some vehicles. Moody's will continue to closely monitor SIV ratings, taking actions on individual vehicles as warranted.

In its monitoring of SIV ratings, Moody's pays particular attention to the evolving liquidity situation of each vehicle, changes in portfolio market value, and the vehicle's prospects for restructuring.

Rationale for Rating Actions

In recent weeks, Moody's has observed material declines in market value across most asset classes in SIV portfolios. These asset classes include Financial Institutions, which represent, on average, 38% of SIV portfolios, ABS 16%, CDOs 12% (including CDOs of ABS 1.4%). Financial Institutions debt suffered an average price decline of 1.6% from October 19th to November 23rd, ABS 0.7%, CDOs (excluding CDOs of ABS) 0.5%, and CDOs of ABS 22%. Furthermore, the continued inability to issue or roll Asset Backed Commercial Paper (ABCP) or Medium Term Notes (MTNs) causes mark-to-market losses to be realised when assets are liquidated to meet maturing ABCP and MTNs.

In this latest review, Moody's employed its updated methodology as announced on September 5th. The methodology update reflects the unprecedented volatility in the market value of the securities held by SIVs. For each SIV, Moody's models expected loss using a stressed volatility for the distribution of market asset prices based primarily on declines observed since July 2007. With this stress, only those tranches of the ABCP and MTNs issued that can sustain an additional price decline of two times the decline observed in this period will retain Aaa/Prime-1 ratings.

For example, if the net asset value of a SIV (measured as the difference between portfolio market value and the notional value of senior liabilities, expressed as a percentage of paid-in capital) was par in July and declined 30% to a current value of 70%, Moody's assumes that the probability of a deterioration in net asset value by an additional 60% of par to levels below 10% is negligible and is therefore consistent with a Aaa probability of default. Moody's analysis therefore assumes that all asset prices may move in a highly correlated manner. In addition, in Moody's stress analysis of the senior debt, Moody's reduced its estimate of current net asset value of all SIVs by 10-15 percentage points to reflect uncertainty in the ability to execute trades at current market quotes given continued NAV declines.

In modelling both senior and capital notes, Moody's extended its analysis by including the potential benefits of refinancing maturing senior debt using repurchase agreements. Moody's assumes that a vehicle that is able to replace maturing senior funding by repo funding continues to do so until an optimal level of repos is attained; the vehicle then enters into wind-down mode and, for the purpose of our analysis, liquidates its assets at distressed levels in order to satisfy noteholders.

Conclusions and Outlook

Moody's has taken rating actions as a result of deteriorating credit and other market conditions. It appears that the situation has not yet stabilised and further rating actions could follow. As with previous actions, the rating actions Moody's has taken today are not a result of any credit problems in the assets held by SIVs, but rather a reflection of the continued deterioration in market value of SIV portfolios combined with the sector's inability to refinance maturing liabilities.

Montana Fund Withdrawals

by Calculated Risk on 11/30/2007 01:40:00 PM

From MarketWatch: Florida's investment woes spark subprime fears in other states

Florida halted withdrawals from a $15 billion local-government fund on Thursday after concerns over losses related to subprime mortgages prompted investors to pull roughly $10 billion out of the fund in recent weeks.In addition to potential "bank runs" on these funds, another key concern is if other funds stop investing in asset backed CP - making the credit crunch worse.

Other states are experiencing similar problems on a smaller scale.

The Montana Board of Investments, which manages the state's money, has seen $247 million withdrawn by local governments in the past three days from a $2.5 billion money-market-like fund called the Short Term Investment Pool.

"We've had some local government withdrawals in the past few days because of reports about Florida's problems," Carroll South, executive director at the Montana Board of Investments, said in an interview on Thursday.

Rating agency Standard & Poor's warned last month that it could downgrade a $4.8 billion investment pool run by King County, Wash., because of potential subprime exposures.

Where is Moe?

by Calculated Risk on 11/30/2007 11:24:00 AM

That was my reaction to the Bernanke and Paulson show. I thought there were three stooges!

Seriously, the best take on the Paulson freeze proposal was Tanta's letter: Dear Mr. Paulson.

The industry is telling you right now that they just don't have enough people with the right skills to be able to wade through all the problem (or potential problem) loans fast enough to make the workout/foreclose decision.Since the industry lacks the infrastructure to handle the work load, it makes sense to have some sort of guideline to decide which loans to foreclose on now, and which loans to foreclose on later. Think of it as a mortgage triage protocol. And helping to craft these guidelines is a reasonable role for government. So kudos to Paulson (even if we have to put up with some silly PR).

The industry group name is hilarious too: "Hope Now Alliance". That reminds me of SEC Director Erik Sirri's comment earlier this week: "Hope is a crappy hedge".

As far as Chairman Bernanke, his concern that the stock market is off 5% or so from the recent high is touching:

The fresh wave of investor concern has contributed in recent weeks to a decline in equity values ...This comment strikes me as irresponsible given the concern over the "Bernanke Put", speculation and moral hazard. The Fed's asymmetrical response to asset bubbles is an interesting discussion, but concern over a 5% or 10% decline in the stock market? Come on.

Finally, we all know the Fed is going to cut rates in December. While the Fed was talking tough, the market was debating the size of the rate cut. And that makes it seem as if Bernanke is behind the curve.

I'm still looking for Moe.

Construction Spending Declines

by Calculated Risk on 11/30/2007 10:14:00 AM

From the Census Bureau: October 2007 Construction Spending at $1,158.3 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $863.2 billion, 1.4 percent (±1.1%) below the revised September estimate of $875.2 billion. Residential construction was at a seasonally adjusted annual rate of $503.7 billion in October, 2.0 percent (±1.3%) below the revised September estimate of $514.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $359.4 billion in October, 0.5 percent (±1.1%)* below the revised September estimate of $361.1 billion.Further declines in residential construction is widely expected, but also note the small decline in private nonresidential construction spending.

Click on graph for larger image.

Click on graph for larger image.The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. But it now appears that nonresidential construction may be slowing. This is just one month of data, and one month does not make a trend, but there is other evidence - like the Fed's Loan Officer Survey - that suggests a slowdown in nonresidential has arrived.

Thursday, November 29, 2007

The Run on Florida’s Local Government Investment Pool

by Calculated Risk on 11/29/2007 08:43:00 PM

On Nov 15th David Evans at Bloomberg wrote: Public School Funds Hit by SIV Debts Hidden in Investment Pools

What ... municipal finance managers ... across the country still haven't been told -- is that state-run pools have parked taxpayers' money in some of the most confusing, opaque and illiquid debt investments ever devised.This story led to a run on the fund, and Evans wrote today: Florida Halts Withdrawals From Local Investment Fund

These include so-called structured investment vehicles, or SIVs, which are among the subprime mortgage debt-filled contrivances that have blown up at the biggest banks in the world.

Florida officials voted to suspend withdrawals from an investment fund for schools and local governments after redemptions sparked by downgrades of debt held in the portfolio reduced assets by 44 percent.Before the run, the fund had $27 Billion in assets, and the fund was frozen today with $15 Billion remaining.

The Florida LGIP had strict investment guidelines, but unfortunately the guidelines allowed investment in asset backed commercial paper (CP) backed by prime and Alt-A mortgages.

A small percentage of the fund's investments have been downgraded and no longer meet the guidelines of the fund.

Click on chart for larger image.

Click on chart for larger image.This chart shows the investments that have been downgraded below the standards of the fund. This chart shows losses of about $45 million; not much for a $27 Billion fund (0.17%). Of course with each redemption at par (the run on the fund), the percentage losses for the remaining funds grow. $45 million for a $15 Billion fund is 0.3%. Considering the fund was paying investors 5.77%, even a 0.3% loss is not horrible.

However there are serious questions about the investment decisions of the pool. And there are other investments that could go bad. As an example the Fund invested $650 million in certificates of deposit in Countrywide Bank - with the recent redemptions that investment now amounts to over 4% of the pool's assets - and there is some risk that Countrywide could go under.

The two main concerns are: 1) Will there be a run on other investment pools? and 2) If other funds stop investing in asset backed CP, this might further the credit crunch and increase spreads for other products.

ETrade ABS Haircuts

by Calculated Risk on 11/29/2007 07:26:00 PM

Brian has dug up the value of the ETrade ABS as of Sept 30, 2007. The assets included a substantial amount of prime residential first liens.

Here is Brian's spreadsheet: Etrade Haircut Spreadsheet

He would appreciate comments on the haircuts.

The importance of these marks can't be overstated.

From Dow Jones: E*Trade's CDO Sale May Mean Lower Values For Bank Holdings (no link yet)

Hedge fund Citadel Investment Group's agreement to buy a troubled debt portfolio from E*Trade Financial Corp. ... could be bad news for banks still holding similar securities on their books.

Banks like Citigroup ... and Merrill Lynch ... "mark to model" approach produced some $36 billion in losses for banks in the third quarter ... The E*Trade deal, however, could show that losses have been worse. The discount broker sold Citadel its $3 billion portfolio of asset backed securities ... at a cut-rate price of around 27 cents on the dollar.

Florida REO: Priced Below 2002 New Home Price

by Calculated Risk on 11/29/2007 05:35:00 PM

The asking price for this foreclosed property in Florida is below the price the home sold for new in 2002. (hat tip John)

The asking price for this foreclosed property in Florida is below the price the home sold for new in 2002. (hat tip John)

Here are the details:

Feb 15, 2002: $122,300 (New)

Mar 15, 2006: $259,600

Oct 23, 2007: Foreclosed.

Current Asking Price: $99,900

There are probably some special circumstances with this house, but ... yikes! According to the public tax records, the larger house on the 2nd lot away sold for $185,300 new in 2004, and for $370,000 in 2006.

According to the public tax records, the larger house on the 2nd lot away sold for $185,300 new in 2004, and for $370,000 in 2006.

This raises some interesting questions: How far have prices really fallen?

How will the neighbors react when they discover their homes are worth far less than they paid in recent years?

As OFHEO noted today:

Declines in home prices will increase the frequency with which homeowners find themselves with no equity and thus may be motivated to “walk away” from the property and the mortgage.No kidding - this has to be depressing for the neighbors. Note: I rarely mention Florida, but this is worth noting.

Florida Freezes Fund Withdrawals

by Calculated Risk on 11/29/2007 04:16:00 PM

UPDATE: This Bloomberg Special Report has more info: Florida Suspends Withdrawals From Investment Pool (hat tip Andrew)

The pool had $3 billion of withdrawals today alone, putting assets at $15 billion, said Coleman Stipanovich, executive director of the State Board of Administration. The board manages the pool along with other short-term investments and the state's $137 billion pension fund.Original post from the WSJ: Florida Moves to Halt Run on Fund

``If we don't do something quickly, we're not going to have an investment pool,'' said Stipanovich at the meeting in the state capitol in Tallahassee. The fund was the largest of its kind, managing $27 billion before this month's withdrawals.

Local governments including Orange County and Pompano Beach that use the pool like a money-market fund asked for their money back after the State Board of Administration disclosed in a report earlier this month that holdings in the fund were lowered to below investment grade.

...

The pool has invested $2 billion in structured investment vehicles and other subprime-tainted debt, state records show. About 20 percent of the pool is in asset-backed commercial paper, Stipanovich said at the meeting today.

``There is no liquidity out there, there are no bids'' for those securities, he said.

Florida halted withdrawals from a $15 billion local-government fund Thursday after concerns over losses ... prompted investors to pull roughly $10 billion out of the fund in recent weeks.

The State Board of Administration met Thursday and voted to immediately freeze withdrawals ...

The decision shows how far this year's ... credit crisis has spread. Florida's Local Government Investment Pool, which had more than $27 billion in assets at the end of September, is a money-market fund that's supposed to invest in ultrasafe assets to provide participants with a secure place to stash spare cash. But even these types of funds have been hit by the widening crunch.

House Prices and Foreclosures

by Calculated Risk on 11/29/2007 02:34:00 PM

OFHEO provides a discussion of foreclosures and house prices in the Q3 House Price Index report.

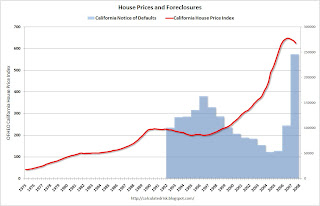

The causal relationship between home prices and foreclosures is two-directional: high foreclosure activity can both cause and be caused by home price declines. Home price declines can cause foreclosures by decreasing the equity homeowners have in their properties. Mortgagors are much more likely to default on their loans if the current value of their property falls below the outstanding loan balance (i.e., their equity is zero or less). Declines in home prices will increase the frequency with which homeowners find themselves with no equity and thus may be motivated to “walk away” from the property and the mortgage.Historically foreclosure activity peaks when prices bottom. The following graph shows this relationship for California.

Home foreclosures contribute to weakening prices by introducing additional supply to the inventory of unsold homes. Compounding this influence is the fact that the sellers of foreclosed homes, frequently creditors, may be strongly averse to holding onto the property for an extended period of time. As a result, they may be willing to sell for lower prices than resident homeowners.

Click on graph for larger image.

Click on graph for larger image.In the '90s, as prices fell in California, foreclosure activity (using Notice of Defaults NODs) increased. Prices bottomed in 1996, as foreclosure activity peaked.

Now imagine what will happen over the next few years as house prices fall. Foreclosure activity is already at record levels (2007 estimated on graph). Yet, as prices fall, foreclosure activity will probably continue to increase - the activity will be literally off the chart!

Back to OFHEO:

The upshot of the interrelatedness of foreclosures and house price changes is that the empirical evidence should reveal sharp differences in measured appreciation for states and cities with higher foreclosure rates. ...

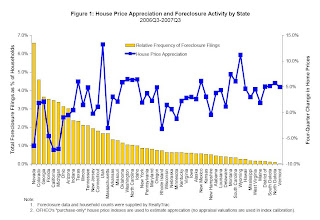

Figure 1 plots recent appreciation rates and foreclosure filings by state since the third quarter of 2006. The bars reflect the relative intensity of foreclosure activity for states, where intensity is defined as the ratio of statewide foreclosure filings to the number of households. The blue squares show house price appreciation between the third quarters of 2006 and 2007. OFHEO’s “purchase-only” price index, which is constructed exclusively with sales price data, is used to estimate price changes.OFEHO's conclusion on house prices and foreclosure:

The graph clearly depicts the negative correlation over the latest year. With few exceptions, states with the lowest appreciation (i.e., greatest depreciation) tended to have the most foreclosure filings. For instance, Nevada had by far the greatest relative foreclosure activity and, at the same time, showed the third largest price decline. By contrast, states with relatively few foreclosure filings, including the Dakotas and Vermont, had relatively strong price growth of between 5 and 6 percent.

In conclusion, it should be recognized that house prices are very hard to track in housing market downturns. Empirical evidence has consistently shown that homeowners are hesitant to sell their homes for losses, often leaving their homes on the market for long periods awaiting the “right” price. Price declines may appear muted, as inventories of for-sale properties grow sharply and the properties that do sell may not fully reflect price declines that have occurred. In this environment, if the inventory of unsold properties is relatively large in high-foreclosure areas, then it may take some time for the association between foreclosures and price trends to reveal itself within cities. The best empirical estimates will only become available after the market normalizes and excess inventory has been sold.Translation: There are large price declines coming.

MGIC Tightens Alt-A

by Tanta on 11/29/2007 12:45:00 PM

AP, via our Clyde:

MILWAUKEE (AP) -- The nation's leading mortgage insurer, MGIC Investment Corp., says it will raise prices and limit its coverage of loans made without proof of income to try to rein in growing losses. . . .You know, I actually believe that MGIC always thought stated income for wage earners was silly.

One of the bigger changes proposed announced Wednesday will limit the insurance MGIC offers people who have Alt-A loans, which generally require only limited verification of income.

MGIC will insure these loans only for people who are self-employed, the original market for them, Culver said. They have been used more recently by people who wanted to borrow more than they could really afford, resulting in losses for MGIC and other mortgage insurers, he said.

"We always thought it was silly, a wage earner who could show you a paycheck would pay a higher interest rate not to show you their paycheck," he said.

The company will raise prices on Alt-A loans, other loans worth 95 percent of a home's value and certain loans for people with low credit scores or small down payments. More specifics will be announced next week, Culver said.

What is missing here is the explanation for why they went ahead and insured something this "silly."

ETrade Sells Portfolio for 27 cents on the Dollar

by Calculated Risk on 11/29/2007 12:43:00 PM

From MarketWatch: CEO leaves as E-Trade gets $2.55 billion from Citadel

The subprime crisis claimed a new scalp Thursday, as E-Trade's CEO Mitch Caplan said he was stepping down as part of a deal that has private equity firm Citadel injecting $2.55 billion into the troubled firm.That is about 27 cents on the dollar for the ABS portfolio.

Under the deal, Citadel will end up with about a 20% stake in E-Trade after acquiring its $3 billion asset backed securities portfolio for $800 million and making other investments.

More on New Home Sales

by Calculated Risk on 11/29/2007 11:45:00 AM

First, three key points to consider on housing.

Note: For more graphs, please see my earlier post: October New Home Sales

Let's start with revisions. In August, I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August have been revised down to 717 thousand! The same is true for September (initially reported at 770 thousand, now revised down to 716 thousand).

The same will probably be true for the just reported October sales number of 728 thousand. It is likely the final number will be below 700K.

I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau initially overestimates sales).

For an analysis on Census Bureau revisions, see the bottom of this post.

Next up, inventory. The Census Bureau reported that inventory was 516 thousand units. But this excludes the impact of cancellations. Currently the inventory of new homes is understated by about 100K (See this post for an analysis of the impact of cancellations on inventory).

This also means that the months of supply is understated. The Census Bureau reported the months of supply as 8.5 months. Assuming a typical downward revision, and adjusting for the impact of cancellations, the actual months of supply is probably closer to 10.5 months.

The impact of OFHEO reported falling prices on household assets. Also this morning, OFHEO reported that house prices fell in Q3. This will impact the Fed's calculation of household real estate assets. I expect household real estate assets to decline around $60 Billion in Q3. (0.3% price decline times $21 Trillion in assets).

Since Mortgage Equity Withdrawal appears to have still been strong in Q3, the percent equity will decline sharply! I believe this will start to impact the ability of homeowners to use the Home ATM in the near future.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

This is what we call Cliff Diving!

And this shows why so many economists are concerned about a possible consumer led recession - possibly starting right now!

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through October.

Typically, for an average year, about 86% of all new home sales happen before the end of October. Therefore the scale on the right is set to 86% of the left scale.

It now looks like New Home sales will be around 800 thousand - the lowest level since 1996 (758K in '96). My forecast was for 830 to 850 thousand units in 2007 and that now appears a little too high.

OFHEO: House Prices Fall in Q3

by Calculated Risk on 11/29/2007 10:38:00 AM

From OFHEO: House Prices Weaken Further in Most Recent Quarter

For the first time in nearly thirteen years, U.S. home prices experienced a quarterly decline. The OFHEO House Price Index (HPI), which is based on data from sales and refinance transactions, was 0.4 percent lower in the third quarter than in the second quarter of 2007. This is similar to the quarterly decline of 0.3 percent (seasonally-adjusted) shown in the purchase-only index. The annual price change, comparing the third quarter of 2007 to the same period last year showed an increase of 1.8 percent , the lowest four-quarter increase since 1995. OFHEO’s purchase-only index, which is based solely on purchase price data, indicates the same rate of appreciation over the last year.Finally OFHEO shows prices falling.

October New Home Sales

by Calculated Risk on 11/29/2007 10:10:00 AM

According to the Census Bureau report, New Home Sales in October were at a seasonally adjusted annual rate of 728 thousand. Sales for September were revised down substantially to 716 thousand, from 770 thousand. Numbers for July and August were also revised down.

This is another VERY weak report for New Home sales. The stunning - but not surprising - downward revision to the August and September sales numbers was extremely ugly. This is the third report after the start of the credit turmoil, and, as expected, the sales numbers are very poor.

I expect these numbers to be revised down too - perhaps below 700K. More later today on New Home Sales.

Fitch Opens Loan Files: Results Not Pretty

by Tanta on 11/29/2007 09:53:00 AM

Regular readers of this site will remember more or less constant outbursts of complaining about the lack of full-file due diligence in the securitization process. People look at data tapes and write contract warranties; people don't actually open up loan files and assess the accuracy of those data tapes, let alone go beyond the tape elements (quantifiable information like LTV and DTI and FICO) to qualitative aspects and conformity with "soft guidelines" (the rules of processing or evaluating documents or information that generates the quantities).

Well, glory be. Some analysts at Fitch rolled up their sleeves and sat down with a pile of loan files (45 of them, to be precise). What they discovered are the parameters of the the most innovative product the industry has ever offered, the NUNA (No Underwriting, No Accountability).

While we realize this was a very limited sample, Fitch believes that the findings are indicative of the types and magnitude of issues, such as poor underwriting and fraud, which are prevalent in the high delinquencies of recent subprime vintages. In addition, although the sample was adversely selected based on payment patterns and high risk factors, the files indicated that fraud was not only present, but, in most cases, could have been identified with adequate underwriting, quality control and fraud prevention tools prior to the loan funding.I suggest reading the whole thing, if you've got a few minutes to blow on mortgage credit risk assessment arcana. What is happening here, although Fitch doesn't state it in these terms, is that someone went through a pile of loan files that were originally processed and underwritten in the "innovative" (cheap) way, and subjected them to processing and underwriting in the traditional (less cheap) way. As far as I can tell, the results here did not come from "extraordinary" levels of investigation or even much in the way of hindsight data (that is, by working back from events that took place after the loan was closed).

What this little exercise of Fitch's shows is that doing things like working through a credit report, looking carefully at the ownership of accounts (sole, joint, authorized user) and the relationship of tradelines to the information listed on the application (matching mortgage tradelines to real estate owned and matching general debt usage and spending patterns to income claimed) provides you with vital information that leads you to reject a mere FICO score as either a sole determinant of credit quality or as a "magic offset" that can let you ignore other weaknesses in the deal. No, really. All that is what we used to do before we started relying on FICOs and AUS.

But don't think this is just an anti-technology rant: 22% of the files Fitch looked at had a "HAWK Alert" right there on the original credit report, visible to anyone who reads English. What's that? It's a warning message that the credit repositories print on a report when some combination of facts or transactions trigger one of its potential fraud algorithms. It does not prove fraud, but it is designed to make your average human underwriter sit up straight and start poring over documents at a much greater level of detail and skepticism than might be usual.

Computers are great for this kind of thing: they help you put your work into "buckets" right off the bat. Any loan with a HAWK Alert should be immediately routed out of the "automation" pipeline and onto the desk of a senior underwriter. The technology helps you direct your human expertise where it really pays off.

Yeah, right, except that as Fitch notes, there is no indication in any of these files that anyone even noticed the HAWK Alert. And the problems that caused that Alert were, apparently, quite visible in the original file documents, if you looked past the FICO score to the details of the tradelines or the relationship of the tradelines to the loan application. (Loan app says borrower is a first-time homebuyer, credit report says there are existing mortgage tradelines. Duh.)

And of course the ridiculousness of the whole stated income thing is here on display, but Fitch never quite gets to asking the question raised by it all: if stated income is such high risk that you need to develop all sorts of processes and practices for testing it, contextualizing it, and subjecting the rest of the file to a fine-toothed review to compensate for it, what, exactly, is the benefit, in cost and speed, of doing it in the first place? At some level Fitch's analysis reads like a medical school textbook on using expensive fifth-generation antibiotics to treat staph infections caused by failure of doctors and nurses to wash their hands between patients. It's nice to know that can be treated, but it would be even nicer--not to mention cheaper--if hand-washing became more popular in the first place.

The fact is that many mortgage shops did, actually, put all kinds of practices and processes and "risk management control points" in place over the last several years to compensate for the risk created by their reliance on AUS, stated income, FICO scores, AVMs, and so on. For a lot of these shops, all that compensating was at least as expensive as just doing it the old way from the beginning. Certainly it remains to be demonstrated what kind of originator the files Fitch found came from: newbies who never learned the old ways and hence never saw the risk? Thinly-capitalized budget operations who just couldn't afford to produce anything except NUNA loans? Cynical players who knew the stuff was junk but who also knew that neither the security issuers nor the rating agencies would notice, and who also knew that the game of representations and warranties, properly played, would insulate them from having to take it back?

The whole thing really begins to take on an amazing Rube Goldberg quality once you refuse to accept the beginning premise--that these "innovative" ways of underwriting loans are a given, it's the compensation mechanisms that are the question. You do not have to believe that traditional human underwriting is perfect to wonder whether the cure is worse than the disease when it comes to compensating for automation.

(Hat tip to some awesomely cool dood)

Wednesday, November 28, 2007

SEC: Wall Street Sold "Too many Lottery Tickets"

by Calculated Risk on 11/28/2007 10:19:00 PM

From Bloomberg: Wall Street Failed in CDO `Lottery,' SEC's Sirri Says

Securities firms and banks sold ``too many lottery tickets'' tied to U.S. mortgages and failed to look closely enough at their growing risks, the head of the Securities and Exchange Commission's market regulation division said today.Here is Sirri's speech:

Financial companies had ``a significant risk management failure'' on so-called super senior classes of collateralized debt obligations made up of asset-backed bonds, Erik R. Sirri said at a conference in New York ...

``There is a spectrum of lottery tickets that can be written,'' offering little upside for the seller and potentially large, sudden losses in a worst-case scenario, Sirri said.

If a firm were to have a concentrated position in a risk that suddenly became illiquid, that would clearly be bad. However, much worse would be a concentrated position with negative convexity that suddenly became illiquid. That trifecta is a risk manager's nightmare, as there is little to do once the markets start moving adversely and liquidity goes away, other than to hope. And as one head trader wisely said recently, "Hope is a crappy hedge." Combine this unhappy situation with risk that has begun to morph into less obvious forms and one starts to understand what occurred with super senior ABS CDO over the past nine months.

WSJ: Incorrect Home Price Graph

by Calculated Risk on 11/28/2007 05:39:00 PM

The WSJ included this graph in a story on consumers: Consumer Gloom Adds to Recession Risk

The WSJ included this graph in a story on consumers: Consumer Gloom Adds to Recession Risk

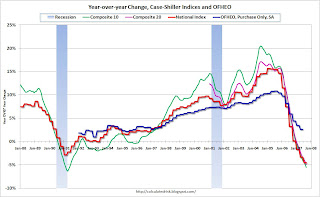

The problem with this graph is that this isn't the Case-Shiller U.S. Home price index; this is the year over year graph for the Case-Shiller Composite 10 price index.

This minor mistake does help understand the differences between the various price indices. Case-Shiller has indices for 20 cities, plus two composites: one for 10 cities, one for all 20 cities. They also offer a quarterly U.S. National home price index.

The following cities are included in the Composite 10 and includes many of the more bubbly areas: Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco, Washington DC. This is what the WSJ presented. Click on graph for larger image.

Click on graph for larger image.

This graph compares the Composite 10 index to the Case-Shiller U.S. home price index. Note that the National price index is stair stepped because it is only available quarterly (and plotted monthly).

That extra few percent per year in the Composite 10 doesn't look like much, but it definitely added up!

Now to complicate the graph, lets add the Composite 20 (started in 2000) and the OFHEO Purchase Only home price indices. The larger the geographical coverage, the less the appreciation.

The larger the geographical coverage, the less the appreciation.

The OFHEO index lags the Case-Shiller index because it covers the entire nation (Case-Shiller is not really national), and OFHEO is probably also impacted by the use of conforming loans only.

The Q3 OFHEO index will be released tomorrow.

More on October Existing Home Sales

by Calculated Risk on 11/28/2007 12:28:00 PM

For more existing home sales graphs, please see the earlier post: October Existing Home Sales

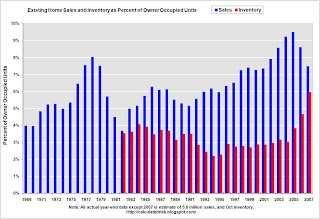

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the October inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.453 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.8 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, and closing in on the worst levels of the housing bust in the early '80s (inventory was 11.5 months at the end of 1982).

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units. For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - October sales were at a 4.97 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

The third graph is an update to my mid-year forecast adding the actual results for July, August, September and October in 2007. Update: Labels fixed.

Update: Labels fixed.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through October there have been 4.9 million units sold, and it looks like the total for 2007 will be just over 5.6 million units.

Bloomberg: Derivatives Indicate Commercial Property "Meltdown"

by Calculated Risk on 11/28/2007 11:05:00 AM

From Bloomberg: Deadbeat Developers Signaled by Property Derivatives (hat tips Brian & FormerlyknownasJS)

The cost of derivatives protecting investors from defaults on the highest-rated bonds backed by properties more than doubled in the past month, according to Markit Group Ltd. Prices suggest traders anticipate defaults rising to the highest level since the Great Depression, according to analysts at RBS Greenwich Capital in Greenwich, Connecticut.The fundamentals for CRE appear to be at a turning point: vacancy rates are rising, more inventory is coming online, prices for commercial property are now falling, and lending standards (as loose as subprime lending) are being tightened. That sounds like the ingredients for a "significant correction".

The seven-year rally in offices and retail properties ended in September when prices fell an average of 1.2 percent, according to Moody's Investors Service. More losses are likely because banks are holding $54 billion of commercial mortgages they can't sell, data compiled by New York-based Citigroup Inc. show.

...

Real estate deals are coming apart at the fastest pace since September 2001, when the U.S. economy was shrinking, because banks are tightening standards for loans, said Robert White, president of Real Capital Analytics, a New York-based research firm.

...

``The commercial real estate market is imploding,'' said James Ortega, who manages $150 million at Saenz Hofmann Fund Advisory in Sao Paulo. Ortega has set trades to profit from a decline in property companies' shares. ``We're about to experience a very significant correction.''

October Existing Home Sales

by Calculated Risk on 11/28/2007 10:00:00 AM

The NAR reports that Existing Home sales fell below 5 million (SAAR) in October, the lowest level since 2000.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased by 1.2 percent to a seasonally adjusted annual rate1 of 4.97 million units in October from a downwardly revised level of 5.03 million in September, and are 20.7 percent below the 6.27 million-unit pace in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, October sales were slightly above September.

The impact of the credit crunch is obvious as sales in September and October declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So October sales were for contracts signed in August and September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October. Total housing inventory rose 1.9 percent at the end of October to 4.45 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, up from a downwardly revised 10.4-month supply in September.This is basically the same inventory level as the last few months, although the months of supply increased to 10.8 months as SA sales fell, and inventory increased slightly.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the 'months of supply' metric for the last six years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of December 2000.

This shows sales have now fallen to the level of December 2000. More later today on existing home sales.

CFC BK Investigation: It's About Costs, Again

by Tanta on 11/28/2007 09:38:00 AM

Given the tizzy certain segments of the press and internet commentariat went through over a handful of Federal District Court Judges sending foreclosing lenders back to the office to dig up the correct paperwork, I anticipate similar tizzy over this, from Gretchen Morgenson:

The federal agency monitoring the bankruptcy courts has subpoenaed Countrywide Financial, the nation’s largest mortgage lender and loan servicer, to determine whether the company’s conduct in two foreclosures in southern Florida represented abuses of the bankruptcy system. . . .So what does this mean?

In court documents, the trustee said that it intended to examine the procedures Countrywide used to determine that it had a valid claim to the properties and that it had correctly calculated the amounts it said the borrowers owed. The trustee’s office asked Countrywide to produce a copy of the notes and mortgages, a payment history on both loans and the correspondence it had with the borrowers.

First, it is perfectly possible that the charges to the borrowers were intentionally inflated. If so, this action by the trustee will remove a major incentive for lenders to do that, and is therefore to be applauded.

Second, it is perfectly possible that the charges to the borrowers were wholly and completely effed up beyond all recognition by a servicing operation that doesn't bother to assemble all the right documents, review each item for accuracy, and cross-check with the payment history (the printout of all transactions on the account since inception). PJ at Housing Wire makes a good case that the foreclosure filing dustups in Ohio have a lot to do with the way the operations are structured and a "timeline" built into them that encourages attornies to file first, review the case later.

Item the second here is not, by the way, a "defense" of Countrywide or anyone else. Frankly, it'd be better news for all of us if this turned out to be a case of intentional misconduct. I'm betting, frankly, that it's probably a case of operational slovenliness, undertrained staff, bad "timeline" policies, and low-bid contract legal work on the ground being unmanaged by a huge national servicer headquartered a continent away. This is the worst case because, well, that's how the business model of the 800-pound gorilla mortgage servicer works.

Force the giant, "efficient" servicers to do their homework--which is what both the bankruptcy trustees and the foreclosure judges are doing--and you just "added back" the costs of doing business that the consolidation and automation and outsourced-legal work processes were supposed to subtract out of the whole thing. Do enough of that, and all of a sudden it's as expensive for a Countrywide to service a $1.5 trillion mortgage portfolio as it is for ten small regional servicers to handle $150 billion a pop.

Now is that bad news? It depends on your point of view. If you think deconsolidation would manage risk better, improve customer service, and slow down the magic refi machine by sending mortgage transaction costs back to their appropriate levels, then you probably don't think this is bad news at all. If you have a financial or political interest in keeping the punch bowl out, you will find this a distressing idea.

Please, let's be clear here. This kind of thing is going to do a real number on mortgage lending, servicing, and securitization profitability not, in my view, because that profitability has been exclusively due to inflated BK bills. That profitability has been due to "efficiencies" that result, among other things, in inflated BK bills (and insufficiently documented foreclosure filings). In other words, this is going to end up like Sarbanes-Oxley, I suspect: it'll hurt not because it will flush out a bunch of Enrons, but because it will force everyone to pay their risk management and operational control costs.

So let's please skip the uproar over "Countrywide has to prove it owns the loans!" That's not the point here with requiring copies of the notes and mortgages and payment histories and correspondence files. The point of all that is making Countrywide--and everyone else, eventually--"show its work" in its filings. If you present a bill to the trustee, you back it up with documentation of the charge. That's a perfectly unexceptional requirement. That the industry will spin as "red-tape paperwork burdens" is inevitable and should be dismissed as the usual defensive piffle.

What we are seeing here on both the foreclosure and the bankruptcy front is a movement toward having to deal with the true costs of secured lending: the costs involved in maintaining one's security and liquidating it in the event of default. That is going to change the math of securitization economics as well as the profitability of mortgage servicing operations, and that is going to directly impact the consumer in terms of curtailing easy credit and increasing the cost of mortgage financing. Not all of us think that's a bad outcome. If it means servicers hiring specialists with deep skill sets instead of paper-pushing temps, then I for one have no problems with it. I'd like to see the costs of that come out of executive bonuses and dividends rather than new fees to consumers, of course, but no bankruptcy trustee or foreclosure judge is going to make that happen. That'll take a shareholder revolt. Good luck.

Fed's Kohn: Policy to be "Nimble"

by Calculated Risk on 11/28/2007 09:24:00 AM

From Fed Vice Chairman Donald L. Kohn: Financial Markets and Central Banking

... uncertainties about the economic outlook are unusually high right now. In my view, these uncertainties require flexible and pragmatic policymaking--nimble is the adjective I used a few weeks ago.That sounds like Kohn supports a rate cut in December.

Tuesday, November 27, 2007

Freddie Cuts Dividend

by Calculated Risk on 11/27/2007 06:54:00 PM

From Reuters: Freddie Mac cuts dividend, slates $6 billion preferreds

Freddie Mac ... said it halved its quarterly dividend and will sell $6 billion in preferred stock to bolster capital in anticipation of mortgage-related losses.No surprise.

Wells Fargo Visits the Confessional

by Calculated Risk on 11/27/2007 06:50:00 PM

From MarketWatch: Wells sets aside $1.4 bln to cover home loan losses (hat tip crispy&cole)

Wells Fargo & Co., the second-largest U.S. mortgage lender, said late Tuesday that it will set aside $1.4 billion during the fourth quarter to cover higher losses on home-equity loans caused by deterioration in the real estate market.

...

The special reserve covers an $11.9 billion portfolio of loans that the bank originated or acquired through indirect sources such as mortgage brokers, Wells explained. That portfolio will be sold off under the guidance of a dedicated management team, the bank added.

Goldman Sachs on Housing

by Calculated Risk on 11/27/2007 05:34:00 PM

Goldman Sachs Chief Economist Jan Hatzius released a new report on housing today: Housing (Still) Holds the Key to Fed Policy

There is no link available.

Note: The following excerpts are used with permission.

In this new report, Goldman revised down their housing outlook significantly (here is their August forecast). Goldman now sees housing starts falling to 750K (their earlier forecast was for starts to fall to 1.1 million units).

On housing prices:

Home prices are also likely to decline substantially. If the economy narrowly escapes a full-blown recession—as we continue to expect in our baseline forecast—a peak-to-trough decline of 15% in house prices is the most likely outcome. This would imply price declines in states such as Florida of up to 30%. If the economy does enter a recession, prices could decline as much as 30% nationwide.On the impact of less Mortgage Equity Withdrawal (MEW) on consumer spending:

Consumer spending growth has remained stable over the last 1-2 years as rising equity prices and sturdy income growth have offset the drag from falling mortgage equity withdrawal (MEW) and slowing home prices. Nevertheless, consumption has underperformed income growth, as predicted by our MEW-augmented consumption model. Going forward, our model points to a more substantial drag of housing on real consumer spending growth, with a slowdown from the recent 3% pace to a 1% annualized rate in early 2008.

Click on graph for larger image.

Click on graph for larger image. On negative equity:

The basic problem is that house price declines create large amounts of negative equity. Homeowners with negative equity lose their ability to respond to adverse financial events such as job loss or mortgage reset by refinancing or selling their home, and they therefore become much more likely to default. The importance of this problem is illustrated in Exhibit 16, which shows the distribution of home equity among US mortgage holders at the end of 2006 according to an analysis by First American CoreLogic, Inc. About 7% of US mortgage holders had negative equity at that point, and another 14% had equity of less than 15%. Thus, 21% of all mortgage holders—holding about $3 trillion in aggregate mortgage debt given the average mortgage debt held by the vulnerable borrowers—would be put into a negative-equity position if home prices fell by 15%.There is much more in the report. Goldman now puts the odds of a recession in 2008 at around 40%, and they see the unemployment rate rising to 5.5% by the end of 2008.

In the past, such a rise in the unemployment rate has invariably come in the context of an overall recession ... The risk that it would do so again is high ... however, our analysis does not imply a recession when taken at face value. Instead, it points to a long period of below-trend growth.I'll post more on the details of their analysis - and offer my view - later this week. Goldman has definitely turned significantly more bearish on housing and the economy.

House Prices: Real vs. Nominal

by Calculated Risk on 11/27/2007 02:59:00 PM

The S&P Case-Shiller National home price index was released this morning. (See note at bottom).

The reported Case-Shiller numbers are nominal; not adjusted for inflation. Most people think in nominal terms, but it's also important to look at real house prices.

| Click on graph for larger image. The first graph shows the nominal Case-Shiller index. The index peaked in Q2 2006, and nominal prices have declined about 5% from the peak. |

The second graphs shows real prices according to the Case-Shiller index (adjusted using CPI less Shelter). Real Prices peaked in Q1 2006, and are off about 8% from the peak.

The second graphs shows real prices according to the Case-Shiller index (adjusted using CPI less Shelter). Real Prices peaked in Q1 2006, and are off about 8% from the peak.The second graph probably provides a better first estimate of how far prices still need to fall (for the Case-Shiller universe). If prices fall to 120 (in real terms) that is about another 25% from the current level.

This could happen with falling nominal prices, or from several years of inflation, or a combination of both. Say nominal prices fall 15% over the next three years, with a 2% per year inflation rate, then real prices would fall to about 130 on the Case-Shiller index.

This suggests to me that price declines have just started, and that the process will last several years. It's important to remember that different areas will see different percentage price declines - the bubble areas will see the largest declines - and the time frames for each location will be different.

NOTE: There are significant differences between the OFHEO HPI and the Case-Shiller National index. This is an excellent summary by OFHEO economist Andrew Leventis: A Note on the Differences between the OFHEO and S&P/Case-Shiller House Price Indexes. The OFHEO note suggests that the primary reason for the difference between Case-Shiller and OFHEO price indices is geographical coverage (not the loan limitations for OFHEO).

LA Times: How Far Will House Prices Fall?

by Calculated Risk on 11/27/2007 01:35:00 PM

Peter Y. Hong at the LA Times writes: Homeowners' big question: How low will prices go?  Click on graph for larger image.

Click on graph for larger image.

The LA Times article focuses on California. This graph shows the Case-Shiller home price index for several selected cities. If SoCal prices fall 25%, then prices in other areas - like Miami and Las Vegas - will probably decline a similar amount. These are nominal prices, I'll have more on Real vs. Nominal prices later today.

From the LA Times:

No one knows how severe the slump will be, but economists and real estate experts interviewed by The Times, and who were willing to make predictions, said prices could fall 15% to 25% before turning back up.

Most said values would continue falling through at least next year, and some thought the market wouldn't reverse course until 2010.

That could translate to big declines for home buyers who bought at the peak of the market, which various measures place in late 2006 or early 2007.

...

Some analysts, including UC Berkeley professor Kenneth Rosen, believe the severity of the downturn will vary by region.

Areas such as the Central Valley and the Inland Empire will be the hardest hit, he said, because these attracted a higher percentage of new buyers with shaky credit, and many of them are now defaulting on their loans. He believes values in these communities could fall by 15%.

But "in areas where there is very little new housing, where it's hard to build and a lot of wealthy people live, there will be little decline or maybe none at all."

...

But others call this wishful thinking, saying low prices eventually work their way to even the most affluent areas.

"Every place takes the hit in the long run," said Christopher Thornberg of Beacon Economics, a consulting firm in L.A.

...

[Edward E. Leamer of UCLA's Anderson Forecast] and Thornberg are among the most bearish of analysts, saying the recently ended housing boom pushed prices out of sync with incomes.

Los Angeles County median home prices are about 40% to 50% higher than the median income justifies, Thornberg said. He said the market would settle when prices and incomes became more closely aligned.

"Southern California prices will fall 25% from their peak and won't find their bottom until the end of 2009," Thornberg said.

Leamer also sees a drop-off at the high end of the range -- 20% to 25% -- and sees the downturn lasting into 2010.

OFHEO: House Prices Fall, Conforming Limit Unchanged

by Calculated Risk on 11/27/2007 11:08:00 AM

From OFHEO: 2008 Conforming Loan Limit $417,000

Office of Federal Housing Enterprise Oversight Director James B. Lockhart today announced the maximum 2008 conforming loan limit for single-family mortgages purchased by Fannie Mae and Freddie Mac (the Enterprises) will remain at the 2007 level of $417,000 for one-unit properties for most of the U.S. Higher limits apply to Alaska, Hawaii, Guam and the U.S. Virgin Islands as well as to properties with more than one unit.The FHFB is reporting the year over year national price decline was 3.49%.

The conforming loan limit determines the maximum size of a mortgage that an Enterprise can buy or guarantee. By law the maximum conforming loan limit is based on the October-to-October change in the average house price in the Monthly Interest Rate Survey (MIRS) of the Federal Housing Finance Board (FHFB). The FHFB reported the decline in the average price was $10,685 or 3.49 percent, from $306,258 in October 2006 to $295,573 in October 2007. The combined two-year decline is now 3.65 percent.

“While the house price survey data used in determining the conforming loan limit show a decline over the past year, as previously announced and consistent with the proposed new conforming loan limit guidance, the level will remain at $417,000 for the third straight year,” said Lockhart.

S&P: Record Home Price Declines

by Calculated Risk on 11/27/2007 09:58:00 AM

From MarketWatch: Home prices falling everywhere: S&P

U.S. home prices were falling in every region of the country in September, according to a closely watched index of home prices released Tuesday.

Home prices fell in September in all 20 major cities covered by the Case-Shiller price index, even in cities that had been holding up before the August freeze in mortgage markets, Standard & Poor's reported.

"There is no real positive news in today's data," said Robert Shiller, chief economist at MacroMarkets LLC, and the co-developer of the index.

For the national Case-Shiller home price index, prices fell 1.7% in the third quarter compared with the second quarter, and were down a record 4.5% in the past year. It was the largest quarter-to-quarter price decline in the 20 years covered by the index.

Citigroup Receives $7.5 Billion Capital Infusion

by Calculated Risk on 11/27/2007 12:35:00 AM

From the WSJ: Abu Dhabi to Bolster Citigroup With $7.5 Billion Capital Infusion

Citigroup Inc. ... is receiving a $7.5 billion capital infusion from the investment arm of the Abu Dhabi government.

...

As a result of the deal, the investment authority known as ADIA will become one of Citigroup's largest shareholders, with a stake of no more than 4.9%.

...

In exchange for its investment, ADIA will receive convertible stock in Citigroup yielding 11% annually. The shares are required to be converted into common stock at a conversion price of between $31.83 and $37.24 a share over a period of time between March 2010 and September 2011.

Monday, November 26, 2007

Market Expects December Fed Rate Cut

by Calculated Risk on 11/26/2007 08:52:00 PM

From the Cleveland Fed: Fed Funds Rate Predictions Click on graph for larger image.

Click on graph for larger image.

A number of Fed presidents will be speaking this week, including Cramer's favorite Fed President William Poole on Friday.

The Fed has been saying don't expect a rate cut in December; meanwhile the market is debating the size of the cut: 25bps or 50bps.

Since the credit crunch is worsening again, I've linked to Cramer's August meltdown at the bottom of the posts.

Upside Down in America

by Calculated Risk on 11/26/2007 04:07:00 PM

The Irvine Housing blog brings us these details (hat tip Atrios):

| Asking Price: $1,249,000 Purchase Price: $1,157,000 Purchase Date: 1/6/2005 |

The property was purchased in January 2005 for $1,157,000. The combined first and second mortgages totalled $1,156,730 leaving a downpayment of $270. Let’s just call it 100% financing.This story has been repeated all across America (usually on a smaller scale). This was not a subprime loan when the home was first purchased, but the collateral is now less than the total loan amount. The house hasn't sold yet, so perhaps the $999,999 Option ARM first is also impaired.

By April, they owners were able to find refinancing through Countrywide with a $999,999 first mortgage. This mortgage was an Option ARM with a 1% teaser rate. The minimum payment would be $3,216 per month.

Also in April of 2005, they took out a simultaneous second mortgage for $215,000 pulling out their first $58,000.

So look at their situation: They are living in a million dollar plus home in Turtle Ridge making payments less than those renting, and they “made” $58,000 in their first 4 months of ownership.

Apparently, these owners liked how hard their house was working for them, so they opened a revolving line of credit (HELOC) in August 2005 for $293,000. Did they spend it all? I can’t be sure, but the following certainly suggests they did.

In December of 2005, they extended their HELOC to $397,990.

In June of 2006, they extended their HELOC to $485,000.

In April of 2007, the well ran dry as they did their final HELOC of $491,000. I bet they were pissed when they couldn’t get more money.

So by April 2007, they have a first mortgage (Option ARM with a 1% teaser rate) for $999,999, and a HELOC for $491,000. These owners pulled $333,000 in HELOC money to fuel consumer spending.

Assuming they spent the entire HELOC (does anyone think they didn’t?), and assuming the negative amortization on the first mortgage has increased the loan balance, the total debt on the property exceeds $1,500,000. The asking price of $1,249,000 does not look like a rollback, but if the property actually sells at this price, the lender on the HELOC (Washington Mutual) will lose over $300,000.

These owners will probably just walk away. I doubt they have any assets. They never put any money into the deal, they pulled out $333,000 in cash, and they got to live in Turtle Ridge for 3 years. Not a bad deal — for them.

And look at the Mortgage Equity Withdrawal (MEW). One third of a million dollars, or over $100K per year. Perhaps the money was invested. Perhaps it was spent on new cars, flat screen TVs, vacations, or more - but this Home ATM appears out of money, and I suspect that will impact the homeowners' lifestyle.

This illustrates two important points: We are all subprime now, and, with falling house prices, the Home ATM is running dry.

Report: 'Massive' Layoffs at Citigroup

by Calculated Risk on 11/26/2007 02:02:00 PM

From MarketWatch: Citigroup leads slide on report of 'massive' layoffs

Citigroup shares fell Monday after CNBC reported the firm could lay off up to 45,000 staffers ...UPDATE: a comment from Citi via the WSJ :

CNBC reported early Monday that the bank is planning a large number of layoffs as part of a response to recent huge write-offs for bad mortgage investments.

CNBC described the layoffs as "massive" and said they would not be restricted to the fixed income and mortgage divisions.

In April, Citi set layoffs of 17,000 people, or about 5% of its more than 300,000 employees.

"We are engaged in a planning process in anticipation of our new CEO, and our business heads are planning ways in which we can be more efficient and cost effective to position our businesses in line with economic realities," [Citi] spokeswoman Christina Pretto said in a statement ... "any reports on specific numbers (of layoffs) are not factual."

SIV Accounting

by Calculated Risk on 11/26/2007 12:10:00 PM

What does it mean that HSBC is moving their SIVs to their balance sheet?

Let's start with the structure of an SIV (Structured Investment Vehicle). First an SIV has investors - like hedge funds or wealthy individuals - who invest say $1 Billion in the SIV (the equity). Then the SIV issues commercial paper (CP) and medium-term notes (MTN) that pay slightly higher rates than similar duration paper. The typical SIV, according to Fitch, uses 14 times leverage, so in our example the SIV would sell CP and MTN for $14 Billion.

Now the SIV invests this $15 Billion ($1 Billion equity and $14 Billion borrowed) in longer term notes. The idea is simple: borrow short, lend long, hedge the interest rate and credit risks - and the profits flow to the investors in the SIV.

So what does a bank like HSBC have to do with this? Usually the bank sets up the SIV, attracts the investors, manages the SIV for a fee - and there was always the appearance that the SIV CP was backed by the bank - perhaps allowing the CP and MTN to pay lower interest rates.

So what is the problem? Some SIVs invested in asset backed paper, backed by home mortgages. Even though the SIVs almost always invested in the highest tranches (with no losses to date), the market value of these assets has fallen recently (not a news flash). This means that the investors in the SIV (the equity) have taken paper losses on their $1 Billion investment.

UPDATE: Note the following NAVs are for the equity portion. A NAV of 71% means the $1 Billion equity in the example is now worth $710 million.

In fact many of the SIV NAVs have fallen substantially. From Moody's: Moody's says some SIV NAVs have fallen below 50%

Moody's [on Nov 8th] said that the average NAV across the SIV sector has fallen from 101% at the beginning of July to 71% at the beginning of November, and the shut-down of the CP market has led to realised losses in some cases.Once the value of the equity falls enough (usually 50%) there is usually a trigger event forcing the SIV to liquidate the longer term investments. A forced liquidation might not only wipe out all the remaining SIV equity, but the holders of the CP and MTN might take some losses too.

However, the rating agency pointed out that there was significant variation between the NAVs of different SIVs, with some declining only to 90% and others falling below 50%.

This has made potential investors in CP and MTN (not to be confused with the investors in the equity of the SIV) to refuse to buy any more CP. Since there is a duration mismatch - the investments are in longer term notes, CP is less than 9 months - the SIV is stuck with a liquidity problem when the CP comes due.

To solve this problem, a bank like HSBC could explicity guarantee the CP and MTN, and this would attract investors in CP and MTN again. But under accounting rules, this guarantee means the SIV belongs on the bank's balance sheet. The structure stays the same - the SIV equity investors still take the losses - but there is no liquidation event. If the losses exceed the equity investment ($1 Billion in our example), then the bank would start taking losses.

From the HSBC article this morning:

[HSBC] insists earnings won't be materially impacted, because existing investors will continue to bear all economic risk from actual losses.Clearly HSBC think these is adequate equity in these SIVs to cushion the bank from any losses.

Finally, to the balance sheet!

The balance sheet lists the assets and liabilities of the company. Moving the SIV to the balance sheet simply means adding the $15 Billion in assets (those longer term notes) to the Asset portion of the balance sheet, and moving the $15 Billion in CP, MTN and SIV equity to Liabilities. The new assets balance with the new liabilities, and there is no income or loss for the bank. Since the equity will take the losses first, any mark down in the $15 Billion in assets will be matched by a mark down in the liabilities - up to $1 Billion.

So what is the problem if there are no losses for the bank? There is an impact on the ratios of the bank - the reason the SIVs were off the balance sheet in the first place - and this limits other lending activities of the bank, contributing to the credit contraction.