by Calculated Risk on 7/31/2007 06:27:00 PM

Tuesday, July 31, 2007

Another Bear Stearns Hedge Fund Is in Trouble

From the WSJ: Another Bear Stearns Hedge Fund Is in Trouble (hat tip ac)

Bear Stearns ... is now facing big losses in a third fund that has roughly $900 million in mortgage investments, according to people familiar with the matter.Not subprime. Not leveraged. Ouch.

The fund, known as the Bear Stearns Asset-Backed Securities Fund, ran into trouble in July and has refused to return investors' money for the moment, according to these people. One of these people said the redemption requests were postponed in hopes that the fund's assets would rebound in value. The fund contains a range of mortgages, but only a small slice of them that are considered subprime, the area that has given so many firms heartburn in recent weeks. Unlike the two other Bear funds that are being closed, this fund is not leveraged.

Also from Bloomberg: Oddo to Shut Three Funds `Caught Out' by Credit Rout

Oddo & Cie, a French stockbroker and money manager, plans to close three funds totaling 1 billion euros ($1.37 billion), citing the ``unprecedented'' crisis in the U.S. asset-backed securities market.

Oddo said it will wind down the funds within the ``shortest possible time frame'' because of a plunge in prices for collateralized debt obligations, notes backed by other bonds, loans and their derivatives.

Moody's Says Some `Alt A' Mortgages Are Like Subprime

by Calculated Risk on 7/31/2007 04:38:00 PM

From Bloomberg: Moody's Says Some `Alt A' Mortgages Are Like Subprime (hat tip Hong Kong Fuey)

Moody's Investors Service described some so-called Alt A mortgages as no better than subprime home loans, saying it will change how it rates related securities after failing to predict how far delinquencies would rise.

The ratings firm said today its expectations for losses on Alt A mortgages will rise between 10 percent and 100 percent, depending on whether a loan pool has a lot of debt extended to borrowers with low credit scores and little money for down payments. It's also raising loss expectations when borrowers don't fully document their incomes.

``Actual performance of weaker Alt-A loans has in many cases been comparable to stronger subprime performance, signaling that underwriting standards were likely closer to subprime guidelines,'' Marjan Riggi, Moody's senior credit officer, said in a statement. ``Absent strong compensating factors, we will model these loans as subprime loans.''

Moody's said in a separate statement that its expectations for losses on ``option'' adjustable-rate mortgages, part of the Alt A market, would rise even farther. Initial minimum payments on the loans fail to cover the interest borrowers owe, creating growing balances and possible payment spikes.

American Home Mortgage Provides Update

by Calculated Risk on 7/31/2007 01:26:00 PM

Press Release: American Home Mortgage Investment Corp. Provides Update on Liquidity

American Home Mortgage Investment Corp. today reported that it is working diligently to determine how best to resolve the liquidity issues that have recently developed with respect to its business. These issues are primarily the result of the unprecedented disruption now occurring generally in the secondary mortgage market.

American Home Mortgage noted that this disruption has fueled concerns in the market regarding credit risk, causing many market participants to suspend the purchase of loans from a variety of originators including American Home. Accordingly, American Home is currently experiencing a hindering of access to its traditional credit facilities. Additionally, American Home's lenders have initiated margin calls in response to the decline in the collateral value of certain of the Company's loans and securities held in its portfolio. The Company has received and paid very significant margin calls in the last three weeks and has substantial unpaid margin calls pending. Further pressure on the Company's liquidity presently exists due to its warehouse lenders effectively reducing, in this environment, their advance rate on new loans made by the Company.

Based on the foregoing, the Company at present is unable to borrow on its credit facilities and was unable to fund its lending obligations yesterday of approximately $300 million. It does not anticipate funding approximately $450 to $500 million today.

American Home Mortgage emphasized that it is seeking the course of resolution, in this environment, that is least disruptive to its business and to the many thousands of home buyers to whom it has committed to provide mortgages. The Company has retained Milestone Advisors and Lazard to assist in evaluating its strategic options and advising with respect to the sourcing of additional liquidity including the orderly liquidation of its assets.

Case-Shiller: Home prices fall further in May

by Calculated Risk on 7/31/2007 10:34:00 AM

From MarketWatch: Home prices fall further in May, Case-Shiller says

The Case-Shiller 20-city index fell 2.8% compared with a year earlier, S&P said. ... "At a national level, declines in annual home price returns are showing no signs of a slowdown or turnaround," said Robert J. Shiller, chief economist at MacroMarkets LLC., and the co-inventor of the price index.The typical pattern for a housing bust is small steady real price declines over several years, so this is probably just the beginning of the price declines.

The closely watched OFHEO House Price Index is schedule to be released August 30th for Q2.

June Construction Spending

by Calculated Risk on 7/31/2007 09:59:00 AM

From the Census Bureau: June 2007 Construction Spending at $1,175.4 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2007 was estimated at a seasonally adjusted annual rate of $1,175.4 billion, 0.3 percent below the revised May estimate of $1,178.4 billion. The June figure is 2.4 percent (±2.1%) below the June 2006 estimate of $1,204.0 billion.

During the first 6 months of this year, construction spending amounted to $550.0 billion, 3.5 percent below the $570.1 billion for the same period in 2006.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $544.3 billion in June, 0.7 percent below the revised May estimate of $548.3 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $346.6 billion in June, 0.3 percent above the revised May estimate of $345.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.Over the weekend, the Chicago Tribune reported: Subprime pain spreads into office market

"The downturn in the residential sector has spilled over into the commercial side as the mortgage lenders, title companies, real estate and mortgage brokers shut down or downsize," said Doug Shehan, a senior director at Cushman & Wakefield Illinois Inc.That story describes the normal historical pattern; nonresidential construction spending follows residential. The question is: Will we see the normal pattern?

Over the past several months the contraction of these firms has kept vacancy rates high, rents modest and building sales uncertain, he said.

"It's changed the landscape of the suburban markets dramatically," Shehan said. "Now, what will be the next industry to absorb the space?"

...

But the pain is not restricted to companies in real estate. Businesses that provide their technology, accounting and marketing also might be feeling the pinch, said Faith Ramsour, Cushman's research director.

...

"The ripple effect could be very deleterious because no other industry is growing enough to fill the space," said Geoffrey Hewings, an economics professor and regional job market expert at the University of Illinois.

I think the answer is yes.

Beyond the Wall of Worry: The Pier of Pain

by Tanta on 7/31/2007 09:00:00 AM

Bonds of U.S. investment banks lost about $1.5 billion of their face value this month as the risk of owning the securities increased the most since at least October 2004, according to Merrill indexes. Prices of credit-default swaps based on the debt imply that their credit ratings are below investment grade, data compiled by Moody's Investors Service show.Tanta's Muddled Metaphor Index registers in the Severe Danger Zone:

The highest level of defaults in 10 years on subprime mortgages and a $33 billion pileup of unsold bonds and loans for funding acquisitions are driving investors away from debt of the New York-based securities firms. Concerns about credit quality may get worse because banks promised to provide $300 billion in debt for leveraged buyouts announced this year.

``We have been adding, I wouldn't say we've been power- lifting,'' Kiesel said. ``You want to leave some powder dry as you've got an unprecedented amount of high-yield supply that's hitting the market. That's a train coming down the tracks. So stepping in front of that takes some guts.''

Quote of the Day

by Tanta on 7/31/2007 08:25:00 AM

To survive, American Home needs the secondary credit markets to stabilize, so the company can re-sell its loans for a profit. "They need it to happen very, very quickly," Miller says.One wonders how quickly the credit markets will stabilize when players like AHM are reneging on dividends and halting trading and failing to cough up reports. I believe our broker brethren describe this as a "viscous cycle."

Alt-A Update: IndyMac Reports

by Tanta on 7/31/2007 08:20:00 AM

What I got from IndyMac's report: things are not good in Alt-A land. Indy's Non-Performing Assets were up 342%, from 0.46% to 1.63%. Repurchases of loans are slowing down, but are still winding their way through the food chain:

A positive to note is that loan repurchases, while high at $219 million for the quarter, declined from $224 million last quarter. Importantly, repurchase demands received, which peaked at $527 million in the first quarter, fell to $221 million for all of Q207, with May and June coming in at $44 million and $43 million, respectively. This indicates that the guideline tightening we did earlier this year has had the desired impact of improving the credit quality of our loan production, which should materially improve our credit costs in this segment of our business in the second half of the year.Credit guideline tightening is slowing new production; on the other hand, slower prepayments are helping with income for servicers (like IndyMac). My own sense of this report is that if Indy weren't a thrift, it would be in the middle of a serious "liquidity crisis" like C-BASS or AHM. Certainly nothing I've seen suggests that the worst is over for anyone in the Alt-A space who hasn't already "deleveraged."

C-BASS Update: The July Margin Massacre

by Tanta on 7/31/2007 07:00:00 AM

At the beginning of 2007, we had $302 million of liquidity, representing greater than 30% of our capital of $926 million. During the first 6 months of 2007, a very tumultuous time in the subprime mortgage market, C-BASS' disciplined liquidity strategy enabled the company to meet $290 million in lender margin calls. During the first 24 days of July alone, C-BASS met an additional $260 million of margin calls, representing greater than a 20% decline in the lender's value. We believe that nothing justifies this substantial amount of margin calls received in such a short period of time, particularly as there has been no change in the underlying fundamentals of our portfolio.

Monday, July 30, 2007

Sowood hedge funds lose 50%+

by Calculated Risk on 7/30/2007 08:28:00 PM

From MarketWatch: Sowood hedge funds lose more than half their value

The Sowood Alpha Fund Ltd. and the Sowood Alpha Fund LP are down roughly 57% and 53% in July, respectively, and about 56% and 51% so far this year ...According to the letter from Sowood posted at the WSJ, Sowood has shut down both funds, sold the assets to Citadel Investment Group and will distribute the remaining assets to shareholders soon. A 50%+ haircut is better than a total loss (like for the Bear Stearns hedge funds).

UPDATE: Apparently the loss was $1.5+ Billion (from just over $3 Billion).

Cramer: Housing "Total Crisis"

by Calculated Risk on 7/30/2007 07:06:00 PM

See video at HousingDoom.

Cramer is exaggerating the problems in housing. As an example, it is extremely unlikely that 100% of 2/28s will default. But I agree with him on the Inland Empire; I've been arguing that California's Inland Empire was going to get crushed for some time.

MGIC Provides Update on C-BASS Investment

by Calculated Risk on 7/30/2007 06:21:00 PM

Press Release: MGIC Investment Provides Update on C-BASS Investment

MGIC Investment Corporation announced today that it has concluded that the value of its investment in Credit-Based Asset Servicing and Securitization LLC has been materially impaired.The investment (including $50 million within the last 10 days):

MGIC's investment in C-BASS consists of approximately $466 million of equity as of June 30, 2007 and an additional $50 million drawn on July 20 and 23, 2007 under a $50 million unsecured credit facility that MGIC provided to C-BASS.And the kicker:

MGIC has not determined the range of an impairment charge, although the upper boundary of the range could be MGIC's entire investment, less any associated tax benefit.UPDATE: Radian makes the same comments: Radian Comments on C-BASS Investment

Since February 2007, the market for subprime mortgages has experienced significant turmoil, with market dislocations accelerating to unprecedented levels beginning in mid-July 2007 and further deteriorating in the last few days.

Radian's investment in C-BASS consists of approximately $468 million of equity as of June 30, 2007 and an additional $50 million drawn on July 20 and 23, 2007 under a $50 million unsecured credit facility that Radian provided to C-BASS. On a pro forma basis reflecting the amounts drawn under this credit facility, Radian's investment in C-BASS was approximately $518 million. Radian has not determined the impairment charge, although it could be Radian's entire investment, less any associated tax benefit.

AHM: Incompetent, Dishonest, or Both?

by Tanta on 7/30/2007 01:04:00 PM

On July 19, American Home's stock slumped amid speculation that the company's credit lines were being pulled.

However, analysts dismissed the notion, saying the company told them that its credit lines were intact. . . . .

The following day, Mary Feder, vice president and investor relations director at American Home, told MarketWatch that none of the company's credit lines were being pulled.

But reassuring analysts and investors less than two weeks before warning about margin calls has undermined the credibility of American Home's management team, according to RBC's Ackor.

"Recent conversations with management reaffirmed to us that many of the factors negatively influencing the company's fundamentals were being effectively addressed, and that recent market rumors of liquidity concerns were completely unfounded," the analyst wrote.

"We certainly acknowledge that the recent and severe erosion in the global debt markets was rapid and unforeseen," Ackor added. "We are concerned, however, that management appears to have either been caught entirely off guard (implying they may not fully understand the implications of a difficult operating environment), has not accurately conveyed the potential impact of these operating challenges to the investment community, or both."

American Home announced its financing problems and the decision to halt dividends after 10 pm on Friday, a move that won't help, Ackor said. He added: "The company's dividend-delay confessional at 10:20 p.m. on a Friday night makes us think that both of these points may have merit."

Metaphor Watch: Bloomberg Takes the Lead

by Tanta on 7/30/2007 12:24:00 PM

Headline is "Five Signs That Subprime Infection Is Worsening." Then:

The tremors from the subprime debacle are vibrating throughout the interconnected web of modern global financial markets.Yep. You know your infection is worsening when your debacle starts vibrating through your web.

Free subscription to Calculated Risk for anybody who finds one with "tentacles" in it.

AHM Halted Pending Announcement

by Calculated Risk on 7/30/2007 10:39:00 AM

From AP: NYSE Halts Trading in AHM Shares Pending Announcement After Suspended Dividend

The New York Stock Exchange halted trading in shares of American Home Mortgage Investment Corp. Monday morning pending an announcement from the struggling mortgage lender, which on Friday froze its dividend.

An NYSE spokesman said the exchange expects ... an announcement during trading hours Monday.

Perhaps We Should Contain Our Metaphors

by Tanta on 7/30/2007 08:29:00 AM

This lede is from the bleedin' Economist, no less:

If you got the part about how the bond insurer is the "victim" of "subprime" but is being "stalked" by a hedge fund, you probably got that part of The Queen where it turns out that Diana was a buck.A hedge fund stalks subprime's next potential victim

I'm surprised and stunned.

Marginal Credit Tightening

by Tanta on 7/30/2007 08:07:00 AM

From Financial Times:

Investment banks are responding to rising credit concerns by imposing tougher lending terms on hedge funds, in a move that threatens to exacerbate investor unease in the financial markets.Now, if they just get rid of that "stated returns" product. . . .

Prime brokerage departments at several investment banks have raised their margin requirements for certain hedge fund clients as they seek to insure themselves against the possibility of new hedge fund collapses as a result of the recent market turmoil.

“Financing terms for hedge funds are being tightened and this is forcing a further deleveraging of risk across global markets,” said Gerald Lucas, senior investment adviser at Deutsche Bank.

One prime broker said his bank had started examining its lending criteria in the wake of the much publicised problems at two hedge funds run by Bear Stearns.

“Recently we have broadened our stricter standards to funds beyond those with exposure to US mortgage market. I’d say this is now a pretty broad-based retreat from leverage.”

Sunday, July 29, 2007

Financial Times: US subprime crisis shows signs of spreading

by Calculated Risk on 7/29/2007 07:03:00 PM

From the Financial Times: US subprime crisis shows signs of spreading

AHM said it is delaying paying dividends ..."First indications"? Are they joking?

The move represents one of the first indications that the crisis facing sub-prime mortgage lenders in the US is expanding to affect lenders like American Home Mortgage whose borrowers tend to have higher 'prime' ore 'near prime' credit ratings.

Housing: Mid-Year Forecast Update

by Calculated Risk on 7/29/2007 05:35:00 PM

This is an update to my 2007 housing forecast.

Probably the most important housing numbers are sales (new and existing homes), prices, and housing starts.

Starting with Existing Homes, my original forecast was for sales of 5.6 to 5.8 million units in 2007. To date, through June, the NAR has reported sales of 2.929 million units.

Lending standards are being tightened again, and this will most likely impact sales in the 2nd half of 2007. Since existing home sales are reported at the close of escrow, many of the July and August sales were in process before the most recent round of tightening - so I've assumed only a minor impact on reported sales for July and August (as compared to 2005 and 2006). I've assumed a greater impact on sales for the last four months of the year. Click on graph for larger image.

Click on graph for larger image.

This graph shows my current month by month forecast for existing home sales this year (red is actual for 2007). It is possible that sales will fall off a cliff later this year, but that kind of decline is extremely difficult to predict, and I think a more gradual decline is likely.

My current forecast is for 5.6 million units; at the bottom end of my original forecast range.

For anyone interested, you can enter our contest: Forecast 2007 Existing Home Sales. PLEASE enter your forecast in the comments to the contest thread (not in the comments here) so I know where to look in January. Thank you!

For New Home sales, my original forecast was that sales would "surprise to the downside" compared to Fannie Mae's forecast of 975 thousand units. Through June, the Census Bureau has reported sales of 458 thousand units.

Sales are reported for New Homes when the contract is signed, so the recent tightening of lending standards will probably impact reported New Home activity sooner than reported existing home activity. My current forecast for New Home sales is for a total of 830 to 850 thousand units.

For existing home prices, my forecast was for prices to decline "nominally by 1% to 3% nationwide by all measures (OFHEO, NAR)." So far prices are up slightly according to the NAR:

The national median existing-home price for all housing types was $230,100 in June, up 0.3 percent from June 2006 when the median was $229,300.Down slightly according to the FHFB.

The FHFB reported the decline in the average price was $501, or 0.16 percent, from $306,759 in October 2005 to $306,258 in October 2006. This is the first decline in the MIRS since 1992-93.And up in the first quarter according to the OFHEO (the second quarter OFHEO House Price Index is scheduled to be released on August 30).

The OFHEO House Price Index (HPI), which is based on data from sales and refinance transactions, was 0.5 percent higher in the first quarter than in the fourth quarter of 2006.All of these methods have flaws and are based on nationwide price changes. I'll stick with my forecast of a 1% to 3% price decline nationwide in 2007.

Housing Starts. In my 2007 housing forecast, I didn't forecast starts. However, last year I calculated that completions might fall to 1.2 million units per year, and starts might fall even further to 1.1 million units per year. It now appears starts will be in the 1.4+ million range for 2007. What I overlooked was that the builders would get caught in a self destructive Nash equilibrium: the homebuilders have to keep building, because they can't sell the land. And they builders can't gain by changing their own behavior, because the industry is very fragmented and the other builders will keep on building. In the aggregate, this behavior is self destructive, but it makes sense for each individual builder.

I still think starts will decline significantly from the current level to work off the record levels of inventory. And it's the total inventory (new and existing homes) that matters: as an example, see this story from the WaPo yesterday: Glut of Condos Pits Private Sellers Against Developers.

I'll have more on starts, inventory levels, and the excess housing stock in the near future.

Saturday, July 28, 2007

Saturday Rock Blogging: Speechless

by Tanta on 7/28/2007 10:10:00 AM

American Home Mortgage Edition.

Wounded Innocence 1, Seasoned Vigilance 0

by Tanta on 7/28/2007 09:12:00 AM

Mr. Ubiquitous, Joshua Rosner, got some op-ed space in the New York Times the other day. (Perhaps he's gotten a bit impatient with merely being Gretchen Morgenson's go-to guy on this topic and wants the byline.) So open up the paper with me, and read:

FOR five months, it has been clear thatAck! Ack! Ack! (Sorry, friends, but that coffee that just came out of my nose was hot).

rising delinquencies and foreclosures, coupled with higher interest rates on adjustable mortgages and declining home price appreciation, would undermine the market for mortgage securities. Yet it took Moody’s Investors Service, Fitch Ratings and Standard & Poor’s, the three leading agencies that rate long-term debt, until this month to react to this looming financial crisis, which involves more than $1.2 trillion of subprime mortgages originated in 2005 and 2006 alone. As one investor asked during a recent S.&P. conference call, “What is it that you know today that the markets didn’t know three months ago?”The S&P analyst in my dreams replied: "Well, Bob, we knew you knew this three months ago but you bloody weren't going to sell any of it until we downgraded it, so we had a pool going in the office to see how long we could play chicken with you. Sorry you're so upset, but I won $100 off you just this morning, so this wasn't an entire waste of time. If Mr. Market is so damned much smarter than we are, why weren't you happily playing ratings arbitrage? Don't tell me you're still long? Ha ha ha ha ha--excuse me. Next question?"

The two largest credit rating agencies, Moody’s and S.&P., announced two weeks ago that they are reviewing and lowering ratings on many of the $17.2 billion in residential mortgage-backed securities. They are doing the same for the pools of these loans known as collateralized debt obligations. The effort is, to use a well-worn but apt phrase, too little, too late. But it is not too late for regulators and legislators to take steps to restore investor confidence and to ensure the future of these markets.I assume all readers of this blog understand what "restoring investor confidence" means. If you don't, would you like to buy some cheap mortgage-backed securities?

The subprime crisis has not been averted. In fact, it is still largely ahead of us. The downgrades represent only a small fraction — about 2 percent of the mortgage-backed securities rated for the year between the fourth quarters of 2005 and 2006 — of what the rating agencies suggest could be a mountain of bad debt held by investors, including pension plans, banks and insurance companies. The agencies are primarily downgrading assets with expected losses that are already working their way through the pipeline. They are not projecting future losses.Of course they're projecting future losses. That's why so many of them went on that "Watch Negative" thingie. Tanta begins to think there might be something tendentious going on here.

Nor do the downgrades apply only to lower-rated securities. Some even relate to the performance of debts that are rated AAA, meaning the agencies judged them to be of the best quality — bulletproof."Bulletproof"? The regulatory distinction is between "speculative grade" and "risk free"? Those banks and others are holding reserves and risk-based capital against their "investment grade" assets because S&P promised that the money was both "invested" and "sewn into the mattress" at the same time? I must have been watching Star Trek reruns when that news got posted on Yahoo! Finance.

The credit ratings agencies play a more important role in debt markets than stock analysts do with regard to equities. No one was told they could buy a certain stock only if, for example, an unscrupulous stock analyst said it was a “buy.” But regulators require banks, insurance companies and pension managers to purchase only high-quality debts — and the quality is judged by ratings agencies.

Fitch, Moody’s and S.&P. actively advise issuers of these securities on how to achieve their desired ratings. They appear to be helping investment banks, hedge funds and fund companies, all of which have a fiduciary obligation to investors, to develop the worst possible product that would still achieve a certain rating.Really? Tell it to the people who got an IO 2/28 with a 6.50% margin and a prepayment penalty, brother. There's a big, competitive contest for "worst possible product."

S.&P. has stated that it now has reason to “call into question the accuracy of some of the initial data provided to us.” This suggests that S.&P. may have chosen either to merely accept the data offered it by issuers without doing its own due diligence. Or worse, S.&P. could have ignored other information because it might have hurt revenues by reducing the number of assets it could have rated.Those data tapes had doc type codes on them, dude, which did appear in your prospectus. Which part of "stated income" has you confused? What exact kind of "due diligence" did you think was going to help with that problem? ("Let's see . . . originator claims the borrower's income is unverified and unverifiable. Hmmm . . . well, that looks right to me. Next file!")

The Securities and Exchange Commission, working with Congress if necessary, should require the credit rating agencies to regularly review and re-rate debt securities. Rating agencies are typically paid by issuers and only for initial ratings, which leads to much of the shoddy analysis and questionable timing in the re-rating of securities.Don't get me wrong. I'm all in favor of investors having to shell out money for due diligence. I have this idea that increasing the up-front cost of risk-taking (rather than leaving it all "back-loaded") might introduce a tad bit of market discipline. I could also work up some enthusiasm for stock analysts who stop punishing mortgage originators for having too much of that "operational expense" like Quality Control analysts who haven't been laid off yet. And simply licensing mortgage brokers and forcing them to have basic fiduciary requirements would warm the cockles of my disgusted little heart.

Training and qualification standards for ratings analysts should also be required to help create consistent, objective, transparent and replicable methods. Moreover, rating agencies should put in place automated and objective systems, based on the changing value of underlying assets, to continuously re-rate debt structures.

Lastly, many accountants and government officials endure a “cooling off” period before they can work for a client. A similar delay for ratings analysts would greatly enhance the integrity and independence of the rating process. Right now, nothing stops a ratings analyst from taking a lucrative job at a bank whose deal he has just rated.

Each of these actions would serve the interest of investors large and small, public and private. Unless the government acts, the credit ratings agencies will stand on the sidelines of the coming crisis, doing nothing until it’s already happened.

It is possible that after all that, I could get talked into shedding a few precious, glistening tears for hedge fund investors who do not themselves wish to be regulated, but who wish the rating agencies to be regulated, so that they can chase yield with no risk. But, you know, before I get behind any regulatory policy that "protects" these guys from the for-profit rating agencies onto which they happily off-load the unglamorous parts of being a Big Money Investor, I want to know what they're holding, and how those hedges are doin'. Open kimono for me, open kimono for you.

Ed. Note: I wrote this the other day* but forgot to publish it. As Mad-Eye Moody** would say, "Constant vigilance!"

*Hat tip, AS!

**No relation to the rating agency

Commercial Real Estate Delinquencies Rise

by Calculated Risk on 7/28/2007 02:31:00 AM

From the WSJ: Hints of Broader Problems Arise in Real-Estate Loans

Delinquencies on loans that back commercial mortgage-backed securities rose for the first time since 2003 in the second quarter, potentially a sign that real-estate problems are broadening to the commercial sector.The AHM story will get the buzz (previous post), but this actually might be more important for the overall economy.

CMBS delinquencies rose 13% in the second quarter to $1.65 billion from $1.46 billion in the first quarter, according to a new report by Standard & Poor's, which attributes the rise to overaggressive loans made in 2006, as well as increased problems in the retail sector.

American Home Mortgage Delays Dividend

by Calculated Risk on 7/28/2007 02:06:00 AM

Press Release: American Home Mortgage Investment Corp. Delays Payment Dividends (hat tip barely)

American Home Mortgage Investment Corp. announced today that its Board of Directors has decided to delay payment of its quarterly cash dividend ... in order to preserve liquidity until it obtains a better understanding of the impact that current market conditions in the mortgage industry and the broader credit market will have on the Company's balance sheet and overall liquidity. The disruption in the credit markets in the past few weeks has been unprecedented in the Company's experience and has caused major write-downs of its loan and security portfolios and consequently has caused significant margin calls with respect to its credit facilities.I can't recall a declared dividend being "delayed". This can't be good.

The quarterly cash dividend of $0.70 per share on the Company's common stock had been declared on June 15, 2007 and was to be paid on July 27, 2007 to all shareholders of record as of July 9, 2007. The Series A Preferred Stock dividend and Series B Preferred Stock dividend had been declared on June 15, 2007 and are payable on July 31, 2007, to shareholders of record as of July 9, 2007.

emphasis added

Friday, July 27, 2007

Census Bureau: Vacancy Rates Decline Slightly in Q2

by Calculated Risk on 7/27/2007 10:20:00 PM

From the Census Bureau on Residential Vacancies and Homeownership

National vacancy rates in the second quarter 2007 were 9.5 (+/- 0.4) percent for rental housing and 2.6 (+/- 0.1) percent for homeowner housing, the Department of Commerce’s Census Bureau announced today. The Census Bureau said the rental vacancy rate was not statistically different from the second quarter rate last year (9.6 percent), but was lower than the rate last quarter (10.1 percent). For homeowner vacancies, the current rate was higher than a year ago (2.2 percent), and lower than the rate last quarter (2.8 percent). The homeownership rate at 68.2 (+ 0.5) percent for the current quarter was lower than the second quarter 2006 rate (68.7 percent), but was not statistically different from the rate last quarter (68.4 percent).

Click on graph for larger image.

Click on graph for larger image.The first graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the decline in Q2 was statistically significant.

This small decline in Q2 leaves the homeowner vacancy rate almost 1% above normal, or about 750 thousand excess homes.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. This would suggest there are about 600 thousand excess rental units in the U.S. that need to be absorbed.

More on this when I finish my mid-year housing update.

BEA: Q2 Mortgage Debt Increase

by Calculated Risk on 7/27/2007 06:46:00 PM

Note: This is an estimate of the total increase in household mortgage debt, not to be confused with MEW (Mortgage Equity Withdrawal or extraction). MEW is a subset of this amount. The gold standard for net equity extraction is the Kennedy-Greenspan data usually available, courtesy of Dr. Kennedy, a few days after the Fed's Flow of Funds report is released. For Q2 2007, the Flow of Funds report is scheduled to be released on September 17, 2007.

As a supplement to the advance GDP report (released today), the BEA provides an estimate of mortgage interest paid for the quarter, and the effective mortgage interest rate. With a little work, an estimate of the total increase in mortgage debt for the quarter can be derived. Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly increase in household mortgage debt based on the Fed's Flow of Funds report compared to the BEA derived increase in mortgage debt. Note that the BEA data is Seasonally Adjusted (SA) and the Flow of Funds data is Not Seasonally Adjusted (NSA).

NOTE: It is difficult to compare NSA vs. SA data. In this case, the current quarter (Q2) appears to have the least seasonal adjustment. Use with caution: my confidence in this analysis for any single quarter is not high.

The BEA data suggests that total household mortgage debt increased by $188 Billion in Q2. If this estimate is close, this suggests that MEW increased in Q2 - possibly boosting consumer spending. If this advance estimate is correct, this will be a surprise - an understatement - and raise even more concerns about consumer spending later this year.

GDP and Fixed Investment

by Calculated Risk on 7/27/2007 09:49:00 AM

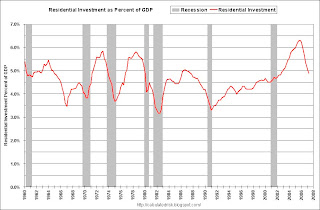

The first graph shows Residential Investment (RI) as a percent of GDP since 1960. Click on graph for larger image

Click on graph for larger image

Residential investment, as a percent of GDP, has fallen to 4.88% in Q2 2007. The median for the last 50 years is 4.58%.

Although RI has fallen significantly from the cycle peak in 2005 (6.3% of GDP in Q3 2005), RI as a percent of GDP is still well above all the significant troughs of the last 50 year (all below 4% of GDP). Based on these past declines, RI as a percent of GDP could still decline significantly over the next year or so.

The fundamentals of supply and demand also suggest further significant declines in RI.

Non Residential Structures Investment in non-residential structures continues to be very strong, increasing at a 22% annualized rate in Q2 2007.

Investment in non-residential structures continues to be very strong, increasing at a 22% annualized rate in Q2 2007.

The second graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In a typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for five straight quarters. So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

Right now it appears the lag between RI and non-RI will be longer than 5 quarters in this cycle. Although the typical lag is about 5 quarters, the lag can range from 3 to about 8 quarters. The third graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey. Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

The third graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey. Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

This data suggests that nonresidential structure investment is likely to follow the decline in residential investment later this year.

Equipment and Software The final graph shows the typical relationship between residential investment (shifted 3 quarters) and fixed investment in equipment and software. Usually investment in equipment and software follows residential investment by about 3 quarters.

The final graph shows the typical relationship between residential investment (shifted 3 quarters) and fixed investment in equipment and software. Usually investment in equipment and software follows residential investment by about 3 quarters.

Although the YoY change in real investment in equipment and software is weak, investment picked up in Q2 at a 2.3% annual rate.

Q2 GDP: 3.4%

by Calculated Risk on 7/27/2007 08:45:00 AM

From the BEA: Gross Domestic Product

As expected, PCE (personal consumption expenditures) growth slowed sharply to 1.3% in the second quarter.

The bright spots in the report: Net exports of goods and services contributed 1.18%, and government spending contributed 0.82%, and non-residential fixed investment 0.83%.

Investment in non-residential structures increased at a 22% annualized rate!

I'll post on fixed investments later today.

Thursday, July 26, 2007

Markets Looking for a Rate Cut

by Calculated Risk on 7/26/2007 08:26:00 PM

The futures market is now pricing in a rate cut in December with some chance of a rate cut by October. From the WSJ: Futures Markets Bet Fed Will Cut Rates This Year

Trading in December fed funds contracts translates into the market giving 100% certainty that the Fed will cut rates to 5% by the Dec. 11 Fed meeting from the current 5.25% rate. That is up from about a 44% chance at Wednesday’s close. The market is pricing in roughly 50% odds that the FOMC could cut the rate as early as the September or October meetings.That doesn't quite fit with the data from the Cleveland Fed, but clearly market participants see the odds of a rate cut increasing. And yes, that is a 20% implied probability of a 50 bps rate cut by the October meeting:

There is no question what the impacted CEOs want: AutoNation CEO Urges Rate Cut To Prop Up Sagging Vehicle Sales

The chief executive of the nation's largest publicly traded auto-dealership chain is disputing suggestions that the housing slowdown is contained, attempting to drum up support for interest-rate cuts that would help sagging vehicle sales.

Mike Jackson, head of AutoNation Inc., ... took issue with Federal Reserve Chairman Ben Bernanke's recent suggestions that the housing slump won't significantly crimp economic growth over time. "Absent a rate cut, which will both have a financial impact and a psychological impact, I think it's going to take a long time to work through -- a long time," Mr. Jackson said of the housing correction. "The stress in housing is significant, the stress in automotive retail is significant."

Bear Stearns Seizes Hedge Fund Assets

by Calculated Risk on 7/26/2007 05:41:00 PM

From the WSJ: Bear Stearns Seizes Hedge Fund Assets

The parent company has assumed ownership of the remaining assets ... in the High-Grade Structured Credit Strategies Fund. Those assets will now be hedged by Bear's trading team and likely sold when their values seem more attractive, says a person close to the situation.The High-Grade fund was the less levered fund, so I suppose this means both funds are (or will be) shut-down.

Predict Existing Home Sales Contest

by Calculated Risk on 7/26/2007 02:06:00 PM

If anyone missed the post yesterday, we are having a contest to predict Existing Home sales for 2007 (to be announced in January '08). Please post your predictions in the comments to the contest post: Contest: Forecast 2007 Existing Home Sales

As food for thought, here is an excerpt from a Goldman Sachs piece yesterday: How Much More Downside for Housing Activity?

Today’s comment assesses how far the US housing downturn has progressed, relative to historically “typical” trough levels for both housing starts and existing home sales. If we are on our way to such a “typical” trough, both indicators would have significantly further to fall, from a current 1.47 million to 1.1 million in the case of housing starts and—more dramatically—from 5.75 million to 3.6 million in the case of existing home sales.

Even though our housing views have long been on the bearish side, these figures are well below our baseline forecasts, especially in the case of existing home sales. We do believe these “typical trough” results are probably too pessimistic, mainly because of structural improvements in the workings of the housing and mortgage markets compared with the 1970s and 1980s. However, the recent upheavals in the mortgage finance industry have made us less confident on this score.

Excerpted with permission.

Wells Fargo to Close Non-Prime Wholesale Lending Business

by Calculated Risk on 7/26/2007 12:40:00 PM

Click on photo for larger image.

Wells Fargo Closes Nonprime Wholesale Lending Business

Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A., said today that it will close its nonprime wholesale lending business, which processes and funds nonprime loans for third-party mortgage brokers. In 2006, this business represented 1.6 percent of Wells Fargo's total residential mortgage loan volume of $397.6 billionJPMorgan also tightened mortgage lending standards today too. From JPMorgan:

Will require an initial fixed rate for at least five years on adjustable-rate mortgages for non-prime borrowers to reduce payment shock risk

Will employ underwriting guidelines that require borrowers to demonstrate their ability to handle increases in interest rates on non-traditional mortgages

Has tightened credit standards, including making adjustments to acknowledge declining home values in certain markets and reducing the use of high loan-to-value ratios and stated-income products

Will continue to consider borrowers’ required property tax and homeowners’ insurance payments in determining affordability. Chase offers all its borrowers an option to escrow those payments with Chase

Will continue its practice of not offering option ARMs, which can expose borrowers to negative amortization when their monthly payment does not cover interest costs

More on June New Home Sales

by Calculated Risk on 7/26/2007 11:07:00 AM

For more graphs, please see my earlier post: June New Home Sales Click on graph for larger image.

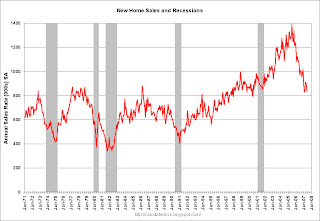

Click on graph for larger image.

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through June.

Typically, for an average year, about 52% of all new home sales happen before the end of June. Therefore the scale on the right is set to 52% of the left scale.

At the current pace, new home sales for 2007 will probably be in the high 800 thousands - about the same level as in 1998 through 2000. This is significantly below the forecasts of even many bearish forecasters.

If sales slow in the 2nd half of 2007 - as I expect - New Home sales might be in the low 800s - the lowest level since 1997.

June New Home Sales

by Calculated Risk on 7/26/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 834 thousand. Sales for May were revised down significantly to 893 thousand, from 930 thousand. Numbers for April were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in June 2007 were at a seasonally adjusted annual rate of 834,000 ... This is 6.6 percent below the revised May rate of 893,000 and is 22.3 percent below the June 2006 estimate of 1,073,000..

The Not Seasonally Adjusted monthly rate was 77,000 New Homes sold. There were 98,000 New Homes sold in June 2006.

June '07 sales were the lowest June since 2000 (71,000).

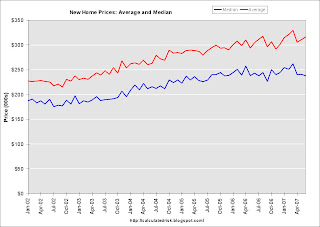

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in June 2007 was $237,900; the average sales price was $316,200.

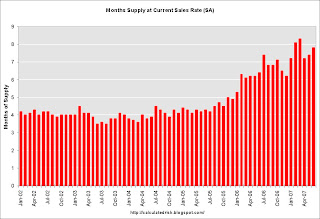

The seasonally adjusted estimate of new houses for sale at the end of June was 537,000.

The 537,000 units of inventory is slightly below the levels of the last year. Inventory for the previous months were revised up slightly.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 7.8 months at the current sales rate.

It appears we are back to were sales are being revised down every month. As I noted last month, this probably indicates another downturn in the market. More later today on New Home Sales.

Wednesday, July 25, 2007

Citigroup Loves Piers

by Calculated Risk on 7/25/2007 08:17:00 PM

NOTE: Haloscan comments are acting up again. Please try refreshing the page if the posts do not display completely. Please accept my apologies for the poor performance of Haloscan.

We've been joking about short term bridge loans turning into "pier loans", and it appears Citigroup is the proud owner of many of these shiny new piers.

From the WSJ: Chrysler Throws Salt in Citigroup’s Wounds (hat tip Brian)

Citigroup is one of the banks that will ... be left holding the bag after investors took a pass on the sale of $10 billion of loans at Chrysler’s auto unit for the company’s leveraged buyout. ... It isn’t good news for either the banks or the buyout firms. There will come a point, if we aren’t there already, when banks refuse to make new loan commitments.That is a lot of piers.

...

Chatter among investment bankers lately has focused on Citigroup, which is said to be clamping down especially hard on making new loans. ... Citi has the misfortune of having been involved in a lot of the buyout loans that have soured lately, including Allison Transmission, U.S. Foodservice, Dollar General and ServiceMaster. It also has a role in three of the coming megadeals that still need to be financed: First Data, TXU and Clear Channel Communications.

NAHB Economist Cuts Forecast

by Calculated Risk on 7/25/2007 05:43:00 PM

John Spence as MarketWatch reports: Economist cuts housing forecasts

The chief economist for the National Association of Home Builders on Wednesday ... lowered his forecasts for new construction as the market has weakened further ...This means Seiders expects starts to average about 1.38 million per month, at a seasonally adjusted annual rate, for the 2nd half of '07. That is too much production, and I expect starts to fall even further.

"It's fair to say the performance of the housing market during the first half [of 2007] and the outlook for the second half and next year are a lot weaker than six months ago," said David Seiders ...

His outlook for 2007 single-family housing starts is now 9% lower than it was at the beginning of the year, while his 2008 forecast has been slashed by 15%, Seiders said on a conference call. His forecast is for housing starts of 1.42 million this year and 1.45 million in 2008.

Contest: Forecast 2007 Existing Home Sales

by Calculated Risk on 7/25/2007 01:33:00 PM

Existing home sales through June were 2.929 million units. In a typical year, sales through June are about half the sales for the year. So at the current pace, sales will be around 5.86 million.

Here are a few forecasts (made at the end of '06):

David Lereah (as NAR economist): 6.34 million

Fannie Mae Chief Economist David Berson: 5.925 million

Calculated Risk (me): 5.7 million (center of range, 5.6 to 5.8 million).

And a few more forecasts from the comments:

Banker: 5.5 million

Barely: 5.35 million

central_scrutinizer: 5.9 million

Please feel free to add your prediction to the comments section of this post. We will announce a winner in January - and the prize will be ... uh, your name announced as the winner and the admiration of others.

More on June Existing Home Sales

by Calculated Risk on 7/25/2007 12:05:00 PM

For more existing home sales graphs, please see the previous post: June Existing Home Sales

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the June inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.196 million is below the all time record 4.431 million units set last month. However, since sales have continued to fall, the "months of supply" metric remained at the same level: 8.8 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

The "months of supply" is calculated by dividing the total inventory by the seasonally adjusted annual rate (SAAR) of sales, and multiplying by 12. Currently inventory is 4.196 million, SAAR sales are 5.75 million giving 8.8 months of supply.

Both the numerator and the denominator are generally moving in the wrong direction (although inventory declined in June). Not only is inventory near record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units.

Forecasts

The followings shows the actual cumulative existing home sales (through June) vs. three annual forecasts for 2007 (NAR's Lereah, Fannie Mae's Berson, and me). Note: Several people have asked me to add their forecasts to this graph, instead I think I'll have a contest to predict the total existing home sales for 2007. My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

NSA sales are 2.929 million units through June. In a typical year, sales through June are about half the sales for the year. So at the current pace, sales will be around 5.86 million. It appears that sales will slow, perhaps significantly, in the second half of 2007, so the risk to my forecast is most likely on the downside.

To reach the NAR forecast, revised downward on July 11 to 6.11 million units, sales would have to be above the 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say the July NAR forecast was too optimistic.

KKR Debt Deal Fails For Alliance Boots

by Calculated Risk on 7/25/2007 11:36:00 AM

From Bloomberg: KKR's Banks Fail to Sell $10 Billion of Alliance Boots LBO Debt

Kohlberg Kravis Roberts & Co.'s banks, led by Deutsche Bank AG, failed to sell 5 billion pounds ($10 billion) of senior loans to fund the leveraged buyout of Alliance Boots Plc, two people with direct knowledge of the deal said.And from the WSJ: Bankers Postpone Chrysler Debt Sale

Bankers raising $20 billion in loans for Chrysler Group have postponed a sale of $12 billion in debt for the auto company and are planning to fund the bulk of that debt from their own pockets for the time being, according to a person familiar with the matter.

June Existing Home Sales

by Calculated Risk on 7/25/2007 09:56:00 AM

The National Association of Realtors (NAR) reports Prices Rise, Existing-Home Sales Decline in June

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 3.8 percent to a seasonally adjusted annual rate1 of 5.75 million units in June from a downwardly revised level of 5.98 million in May, and are 11.4 percent below the 6.49 million-unit pace in June 2006.

...

The national median existing-home price2 for all housing types was $230,100 in June, up 0.3 percent from June 2006 when the median was $229,300. The median is a typical market price where half of the homes sold for more and half sold for less.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now over 8 months, we should expect falling prices nationwide.

However, the NAR reports that YoY prices were up slightly in June.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory declined from the record in May to a 4.196 million units in June.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory declined from the record in May to a 4.196 million units in June.Total housing inventory fell 4.2 percent at the end of June to 4.20 million existing homes available for sale, which represents an 8.8-month supply at the current sales pace, the same as a downwardly revised 8.8-month supply in MayOther sources have reported that inventory levels have increased, and I expect inventories to continue to rise through the summer. More on existing home sales later today.

Alt-A Update: CDR Goes Mainstream

by Tanta on 7/25/2007 09:05:00 AM

I would have posted this yesterday, but I got caught up in reading the actual Citi report on which it is based (and that's 58 pages of hard-core Nerdalytics). I am going to try to have something more to say about this today. Until then, Bloomberg:

July 24 (Bloomberg) -- Defaults on some so-called Alt A mortgages packaged into bonds last year are now outpacing those from subprime loans, according to Citigroup Inc.

The three-month constant default rate for 2006 Alt A hybrid adjustable-rate mortgages is 2.3 percent, compared with 2.2 percent for subprime ARMs, New York-based Citigroup analysts led by Rahul Parulekar wrote in a July 20 report. The figures represent the percentage of balances in a mortgage-bond pool expected to default in the next year based on 90-day trends.

The speed at which Alt A hybrid ARMs are being paid off due to home sales or refinancing has also fallen to about the same level as for subprime ARMs, which typically prepay more slowly, the analysts said. Slower prepayments can make the same rates of defaults more damaging by leaving more of the initial balances outstanding to eat into bond-investor protections.

The combination of challenges mean 2006 bonds backed by Alt A mortgages, a credit grade above subprime loans, may need ``lower loss severities to still come out with lower cumulative losses than subprimes,'' the Citigroup analysts wrote.

Life Is Like A Box of Subprime Loans

by Tanta on 7/25/2007 08:01:00 AM

Some of you may have noticed that LEND took quite a beating yesterday. Apparently there is some question of the viability of the Lone Star deal:

On June 29, Jean Wan filed an amended stockholder class action lawsuit against Accredited, Lone Star and several executives and directors involved in the deal.Stupid is as stupid does.

Wan claimed Accredited would be better off remaining independent because many of the company's subprime mortgage rivals had already gone bankrupt. Once the market recovers, Accredited could thrive as one of the few remaining subprime specialists and shareholders shouldn't miss out on this opportunity, the suit argued.

The complaint is being called the "Forrest Gump" suit because it compares Accredited's situation with that of the two main characters in the 1994 film.

Forrest and Lieutenant Dan buy a shrimp boat and start the Bubba Gump shrimp company. But they struggle early on because there are so many other boats catching all the shrimp. Then a hurricane hits, destroying many boats and leaving Bubba Gump owning the last shrimp boat in the area. From then on, Forrest and Dan become rich, the suit explained.

Accredited, like Forrest and Dan, was able to weather the subprime mortgage storm that destroyed rivals like New Century Financial.

"Effectively, Accredited is now the 'Bubba Gump' of the subprime lending market," the suit said. "Currently, Accredited stands in the enviable position of being able to grab up the market share left by New Century and the other subprime lenders that have declared bankruptcy or left the market."

"This position will allow the holders of Accredited's equity to reap the lion's share of profits available in the subprime lending market," the complaint added. "The Individual Defendants, however, wish to keep these profits for themselves and freeze out Accredited's current shareholders."

Chrysler's Bankers: Long Walk, Short Pier?

by Calculated Risk on 7/25/2007 01:50:00 AM

From the WSJ: Chrysler's Bankers May Take On Debt

Chrysler's attempt to tap debt markets for $20 billion hit a critical juncture as bankers began discussing the likelihood that they will have to step up with a large part of the money because investor demand hasn't been strong enough.

...

The struggle to raise money from investors was the latest sign of how inhospitable debt markets have become recently. ... Chrysler's bankers -- including J.P. Morgan Chase & Co., Goldman Sachs Group Inc., Citigroup Inc., Bear Stearns Cos. and Morgan Stanley ... were yesterday discussing plans to take a half or more of a $10 billion piece of the Chrysler auto loan, people familiar with the matter said.

The debt to be held by the banks would bear the first losses if Chrysler has problems repaying. ... The $8 billion loan sale for Chrysler Financial, meanwhile, is still on track to be completed this week, though the company has had to increase the amount of interest it would pay on the debt.

It also needs to raise $42 billion, much of it to compensate Daimler for existing Chrysler debt it still holds. That sale isn't expected to be as difficult, because much of it will be backed by healthy Chrysler auto loans.

Tuesday, July 24, 2007

Fed's Plosser: No Signs Of Subprime Woes Spreading

by Calculated Risk on 7/24/2007 07:41:00 PM

From the WSJ: Fed Official Sees No Signs Of Subprime Woes Spreading

A Fed policy maker said rising delinquencies on prime mortgages would be one reason to worry that problems in subprime mortgages are affecting the broader economy, but there's no sign of that yet.I guess Plosser will be "more nervous" tonight when he reads the CFC press release and the summary of their conference call.

"If I started to see some of the spillovers occur in some of the prime mortgages, I'd get more nervous," Federal Reserve Bank of Philadelphia president Charles Plosser said in an interview with The Wall Street Journal Tuesday. Worrisome signals, he said, would be "things like serious, substantial falls in consumer spending, or employment really begin to tail off" or signs that the negative impact on consumer wealth of falling housing prices is "showing up in consumption in one form or another, or employment. And we don't see that much."

Housing: Demand Shifts

by Calculated Risk on 7/24/2007 05:03:00 PM

Later this week I'll post an update on my 2007 housing forecast. I've been waiting for the foreclosure data for Q2, and the existing and new home sales data for June, scheduled to be released tomorrow and Thursday respectively.

On Friday I pulled out the old Supply and Demand drawings to compare the housing market to an efficient market. In this post I'd like to discuss two recent shifts in demand for housing, and how I expect them to unwind.

First, here are the new and existing home sales, since 1969, normalized by the number of owner occupied units (OOU). Click on graph for larger image.

Click on graph for larger image.

For the recent housing boom (in sales, not price), I marked three periods on the graph. There may be some disagreement on the dates and the causes of the boom for each period, but a simply explanation is:

Period 1: This was mostly due to fundamentals of real wage growth, employment growth and demographics.

Period 2: This was primarily due to an interest rate shock (lower rates) that moved renters to home ownership.

Period 3: This was primarily due to speculation, especially home buyers using excessive leverage for speculation.

NOTE: The following models of demand shifts assume an efficient market and no shifts in supply.

Period 2: Interest Rate Shock This diagram depicts how I'd expect an interest rate shock to impact housing demand. After interest rates decrease sharply, there would be a temporary increase in demand - perhaps for a couple of years - as renters migrate to home ownership.

This diagram depicts how I'd expect an interest rate shock to impact housing demand. After interest rates decrease sharply, there would be a temporary increase in demand - perhaps for a couple of years - as renters migrate to home ownership.

According to the Census Bureau, the number of American households renting decreased by 1.4 million from 2001 to early 2004. These households probably migrated to home ownership because the "rent or buy" decision favored buying due to lower interest rates.

This increase in demand was temporary, and according to the Census Bureau, the migration from renting to buying ended by early 2004. Looking at a Supply and Demand diagram, the interest rate shock temporarily shifted demand from D0 to D1.

Looking at a Supply and Demand diagram, the interest rate shock temporarily shifted demand from D0 to D1.

This moved the quantity demanded from Q0 to Q1, and the price from P0 to P1.

When the demand shifts back (above model of temporary demand shift), the quantity demanded falls back to Q0 - but housing suffers from sticky prices, so price only declines slowly to P0.

However, we can look at the graph of actual sales (first graph), and we can see that sales didn't decline in 2004 and 2005; instead sales increased.

Period 3: Excessive Leverage as Speculation Speculation frequently chases appreciation, and the earlier price increases, based at least somewhat on fundamentals and an interest rate shock, probably spurred many buyers to only considered their monthly costs when buying a home (during period 3). Many of these buyers used excessive leverage, speculating that the price would continue to increase into the future.

Speculation frequently chases appreciation, and the earlier price increases, based at least somewhat on fundamentals and an interest rate shock, probably spurred many buyers to only considered their monthly costs when buying a home (during period 3). Many of these buyers used excessive leverage, speculating that the price would continue to increase into the future.

This type of leveraged activity pulls demand from future periods as shown in this diagram. The rampant speculation (with innovative mortgage products) pushed demand from D1 to D2, with associated increases in price and the quantity demanded. However, when the speculation ends, demand will eventually fall back to D3; below the level of demand (D1) when the speculation started.

These models are just a guide, and are intended for efficient markets. But this suggests to me that sales, especially of existing homes, will eventually decline to below the levels of 1998 to 2001.

Flippers and Supply Shifts

Some people may be thinking about the impact of investors (or flippers) on the demand curve. Note: This type of speculation was probably only rampant in the coastal regions. Instead of viewing investor activity as a demand shift, it might be better way to view this type of speculation is as storage - or a supply shift; when the investor buys, they remove the asset from the supply. This means that investor speculation shifted the supply curve (not shown) to the left during the period of speculative activity. When the speculator sells, the supply curve shifts to the right, as the stored units come back on the market. So the news is bad for housing: not only is the demand curve shifting left, but the supply curve is shifting right (especially in some coastal regions).

Credit: template for diagram was from Wikipedia.

PIMCO's Gross: Enough is Enough

by Calculated Risk on 7/24/2007 01:15:00 PM

From Bill Gross at PIMCO: Enough is Enough

Over the past few weeks much ... has changed. The mistrust of rating service ratings, the constipation of the new issue market and the liquidity to hedge the obvious in CDX markets has led to current high yield CDX spreads of 400 basis points or more and bank loan spreads of nearly 300. The market in the U.S. seems to be looking towards this week’s large and significant placing/pricing of the Chrysler Finance and Chrysler auto deals to determine what the new level for debt should be. In the U.K., a similarly large deal for BOOTS promises to be the bell cow for European buyers. But the tide appears to be going out for levered equity financiers and in for the passive owl money managers of the debt market. And because it has been a Nova Scotia tide, rising in increments of ten in a matter of hours, it promises to have severe ramifications for those caught in its wake. No longer will double-digit LBO returns be supported by cheap financing and shameless covenants. No longer therefore will stocks be supported so effortlessly by the double-barreled impact of LBOs and company buybacks. The U.S. economy in turn will not benefit from this tidal shift and increasing cost of financing. The Fed tightens credit by raising short-term rates but rarely, if ever, have they raised yields by 150 basis points in a month and a half’s time as has occurred in the high yield market. Those that assert that this is merely an isolated subprime crisis should observe very closely the price and terms that lenders are willing to accept with Chrysler finance this week. That more than anything else may wake them, shake them, and tell them that their world has suddenly changed.The Chrysler deal will be interesting, and Chrysler finance is probably the best part of the deal (and most easily financed). Back in '89, the failure of the UAL LBO marked the peak of the LBO cycle, however that deal was very different from today since UAL was contingent on obtaining debt financing (if I remember correctly). Now very few deals have contingencies, and we are seeing more and more bridge loans become "pier loans" that end up on the investment banks' balance sheets. See Citi May Be Stuck With Bridge Loans and JPMorgan Marks Down "Hung" Bridge Loan. This probably means the consequences of a failed major deal could be much uglier than in '89.

emphasis added

Record Foreclosures in California

by Calculated Risk on 7/24/2007 11:34:00 AM

From Mathew Padilla at the O.C. Register reporting on DataQuick numbers:

There were 17,408 foreclosures in the Golden State in the second quarter — that’s the highest quarterly total since DataQuick began tracking them in 1988. It surpassed the previous high point of 15,418 foreclosures in the third quarter of 1996.DataQuick reported 46,670 Notice of Defaults (NODs) in Q1.

...

Notices of default, the first stage of foreclosure, totaled 53,943 in the second quarter, the highest since late 1996.

Click on graph for larger image.

Click on graph for larger image.This graph shows the NODs filed in California since 1988. For 2007, the number is estimated at twice the NODs for the first half of 2007. This estimate is probably low, since the housing market appears to be deteriorating rapidly in California.

UPDATE: Here is the DataQuick press release: California Foreclosure Activity Continues to Rise

CFC Reports A Little Prime Problem

by Tanta on 7/24/2007 08:28:00 AM

This ought to calm the markets:

Management anticipates that the second half of 2007 will be increasingly challenging for the industry and Countrywide. Absent a reduction in mortgage interest rates, production volumes are expected to fall and competitive pricing pressures are expected to increase. In addition, volatility in the secondary markets has increased significantly early in the third quarter and liquidity for mortgage securities has been reduced as a result. These conditions are expected to adversely impact secondary market execution and further pressure gain on sale margins. Furthermore, additional deterioration in the housing market may further impact credit costs.Guidance hereby reduced to $2.70 to $3.30/diluted EPS from April's $3.50 to $4.30.

Management has taken, and is continuing to take, a number of actions in response to changing market conditions. These include tightening of credit guidelines, particularly related to subprime and prime home equity loans; further curtailment of subprime product offerings, including the recent elimination of certain adjustable-rate products; risk-based pricing adjustments; use of mortgage insurance for credit enhancement; and expense reduction initiatives. . . .

Credit-related costs in the second quarter included:

-- Impairment on credit-sensitive retained interests. Impairment charges of $417 million were taken during the quarter on the Company's investments in credit-sensitive retained interests. This included $388 million, or approximately $0.40 in earnings per diluted share based on a normalized tax rate, of impairment on residual securities collateralized by prime home equity loans. The impairment charges on these residuals were attributable to accelerated increases in delinquency levels and increases in the estimates of future defaults and loss severities on the underlying loans.

-- Held-for-investment (HFI) portfolio. The provision for losses on HFI loans incurred in the second quarter was $293 million, driven primarily by a loan loss provision of $181 million on prime home equity HFI loans in the Banking segment.

I could be snarky about this, but since it's the first thing I've read today that didn't blame the rating agencies for all the problems, I'm giving extra credit.