by Calculated Risk on 11/20/2007 08:39:00 AM

Tuesday, November 20, 2007

Housing Starts and Completions for October

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell sharply:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,178,000. This is 6.6 percent below the revised September rate of 1,261,000 and is 24.5 percent below the revised October 2006 estimate of 1,560,000.Starts were up:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,229,000. This is 3.0 percent above the revised September estimate of 1,193,000, but is 16.4 percent below the revised October 2006 rate of 1,470,000.And Completions were up:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,436,000. This is 1.9 percent above the revised September estimate of 1,409,000, but is 25.2 percent below the revised October 2006 rate of 1,919,000.

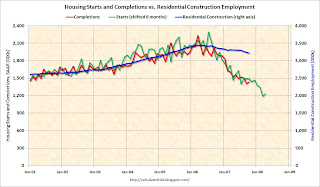

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

The small increase in starts is just noise. With permits falling, starts will continue to fall in coming months. With record inventories, this report shows that the builders are still starting too many homes.

More interesting: Look at what is about to happen to completions:

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.Completions were at a 1.436 million rate in October, but are about to follow starts down to the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

Note: there are many reasons why the BLS reported employment hasn't fallen as far as expected (blue line), but with completions falling further over the next few months - and commercial real estate activity slowing - I'd expect to see significant declines in construction employment soon.