by Calculated Risk on 11/13/2007 06:43:00 PM

Tuesday, November 13, 2007

Bloomberg's Berry: No Recession

From Bloomberg: Consumer Spending Won't Fall and Cause Recession: John M. Berry. An excerpt on the impact of declining homeowners' equity:

Some analysts argue that falling home prices are wiping out a chunk of owners' equity and limiting their ability to borrow against it. In addition, having less equity will depress owners' willingness to spend on consumption, they say.First, a typo correction in Berry's piece. According to the Fed's Flow of Funds report, the value of household real estate was

Again, there is some truth to both those points, though it's not clear how much.

While homeowners' equity has begun to fall and is likely to continue doing so for some time, there are still huge paper gains in place from previous years.

For example, the Federal Reserve's most recent Flow of Funds report said that at the end of the second quarter owners' equity was $18.85 trillion. That was still almost $40 billion more than at the end of last year and $1.56 trillion more than at the end of 2004.

...

So homeowners can still borrow to supplement their current income even though it may be more difficult and somewhat more expensive.

Berry notes correctly that homeowner equity has started to decline, and will decline further in the future. But then he argues that "there are still huge paper gains in place" that homeowners can continue to borrow against.

Really? Are there huge gains that homeowners can borrow against to supplement their incomes?

Click on graph for larger image.

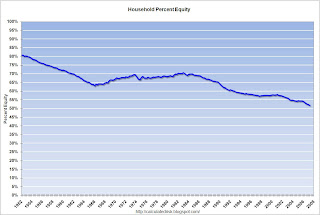

Click on graph for larger image.This graph shows the percent of homeowner equity for the last 50 years. Although the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007, that still sounds pretty good ... at least until you realize that about 1/3 of all owner occupied households have no mortgage debt (their homes are paid off).

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. But it is unreasonable to expect these more risk-averse homeowners will suddenly change their habits and start borrowing against their homes.

So, although there have been gains, there is a real question of much more the already leveraged homeowners can borrow against their equity.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.With falling house prices, the value of household assets will probably fall significantly as a percent of GDP. Yet Berry appears to be arguing that mortgage debt, as a percent of GDP, will continue to increase. And remember that 1/3 of owner occupied households have no mortgage debt.

Although there are several unknowns, if assets fell to 120% of GDP, it is hard to conceive of mortgage debt growing faster than GDP - even staying even with GDP would imply that the mortgaged 2/3 would owe something like 80% of the value of their homes - unlikely.

On this point, I think Berry is wrong. Sure, some homeowners will be able to supplement their incomes by borrowing against their homes, but I think in the aggregate this borrowing will slow significantly over the next few quarters.