by Calculated Risk on 1/20/2007 04:56:00 PM

Saturday, January 20, 2007

What would change my mind?

Update: When I first started this blog, I promised to try to call the next recession - as a fun exercise. I didn't think we would have a recession in '05 or '06. Now I think there is a chance, so I'm going out on a limb.

For those interested in recession predictions, here is an excellent paper on why most forecasters miss recessions: The Arcane Art of Predicting Recessions

Since I've just turned bearish on the general economy (update: this is for '07, not next week or Q1 - sorry if that was confusing), I'd like to note what would change my mind.

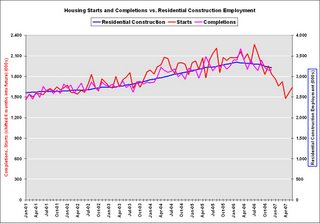

1) Show me several hundred thousand residential construction jobs lost, and little or no impact on the general economy.

There are many stories like this one from the San Diego Union on the local economy: With real estate sector cooling, employment stays on simmer

Construction firms shed 1,800 workers during December and real estate firms cut 500 positions, according to data released yesterday by the California Employment Development Department.

...

During 2006, construction firms in the county lost a total of 5,000 jobs, more than 5 percent of their work force. Statewide, construction firms have axed 15,300 workers, a 1.7 percent loss.

Click on graph for larger image.

Click on graph for larger image.That sounds grim, but in reality very few residential construction jobs have been lost so far. Since residential construction employment peaked in February 2006 at 3,347.4 thousand, only 133.6 thousand jobs have been lost according to the BLS, or about 4%.

Based on the current level of starts, many more jobs will be lost in the coming months (note starts are shifted 6 months into the future on graph, since completions and employment follow starts by about 6 months).

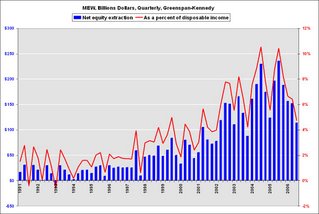

2) Show me mortgage equity withdrawal (MEW) at less than 3% of disposable personal income (DPI), with little or no impact on consumer spending.

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show "Homeowners extracted $113.5 billion ... via mortgage refinancing and other means in the third quarter, the lowest since the fourth quarter of 2003, according to new estimates by a Federal Reserve staffer and former chairman Alan Greenspan3) Show me near record foreclosure activity, with little or no impact on lenders or the general economy. I'll have more on foreclosure activity this week.

That amount ... was down from $151.8 billion in the second quarter, and the high of $235.9 billion recorded in the third quarter of last year. The latest figure equals 4.7% of households' after-tax income, compared to 10.4% in the third quarter of 2005."

I don't ask for much.