by Calculated Risk on 10/26/2006 11:58:00 AM

Thursday, October 26, 2006

More on September New Home Sales

Please see the previous post: September New Home Sales Click on graph for larger image.

Click on graph for larger image.

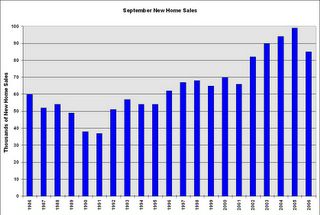

This graph shows September New Home sales for the last 20 years. The recent sharp drop in sales is similar to the decrease at the start of the 1990s housing bust.

September sales have almost fallen back to the 2002 levels.

And this graph shows YTD New Home sales through September. It now appears that 2006 will finish as the 4th best year behind 2003.

Given that sales have fallen back to 2002/2003 levels, it would seem reasonable to expect that BLS reported residential construction employment will fall back to the levels of those same years. The following chart shows BLS data for the last 6 years.

| Residential Construction Employment, Monthly Average, Thousands | |||

| Year | Residential building | Residential specialty trade contractors | Total |

| 2001 | 781 | 1849 | 2630 |

| 2002 | 803 | 1887 | 2690 |

| 2003 | 837 | 1965 | 2802 |

| 2004 | 896 | 2123 | 3019 |

| 2005 | 949 | 2278 | 3227 |

| 2006 | 979 | 2346 | 3325 |

There will probably be 600K jobs lost in reported residential construction employment over the next couple of years - if housing stabilizes at this level. If housing continues to fall, something I think is likely, then even more jobs will be lost.

Over the next few quarters, completions is a better indicator of potential residential construction job losses than sales.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 300K to 400K residential construction employment jobs over the next 6 months.

One of the most reliable economic leading indicators is New Home Sales.

One of the most reliable economic leading indicators is New Home Sales.New Home sales were falling prior to every recession of the last 35 years, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2023 CR4RE LLC |