by Calculated Risk on 10/06/2006 02:43:00 PM

Friday, October 06, 2006

Housing: Demolitions and Other Losses

UPDATE: This is part of a series, and there were several important caveats in the first post. From the first post, Demographics and Housing Demand

I'm trying to answer one of the key housing questions: How far will New Home sales fall? This is a complicated question and, of course, the quantity demanded depends on the price - and homebuilders are already responding to the sluggish market by lowering their prices and / or offering incentives. So how quickly prices fall is a key determinate on how far New Home Sales decline.This post:

... This is a look at the national market. Note that demographic drivers in local markets will differ considerable from the national trends. As an example the population in Detroit is declining, and since housing is very durable, prices for existing homes are below replacement costs.

In the previous post, based on current demographics, I calculated that the U.S. housing stock would need to increase by 1.2 million units per year - all else being equal. A couple of people noted that the number of new units needed would then be 1.2 million plus the number of units lost each year (through demolition or other losses).

In the comments, mort-fin recommended a paper by Eggers & Moumen: Components of Inventory Change: 2001-2003. From their paper:

Click on figure for larger image.

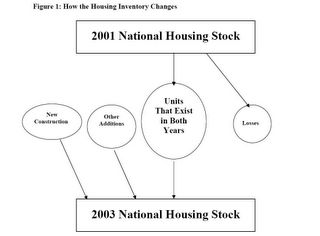

Click on figure for larger image. In the context of Figure 1, the Census Bureau provides estimates for both rectangles (the 2001 and 2003 housing stocks) and one oval (units added through new construction between 2001 and 2003). No one estimates the other three ovals: the number of units that belong to both the 2001 and 2003 housing stock, units lost to the housing stock between 2001 and 2003, and other additions to the housing stock between 2001 and 2003.The paper has a detailed analysis of the housing market from 2001 to 2003. A fairly large number of housing units are taken out of service each year (mobile homes moved, units changed to nonresidential use, etc.) and a similarly large number is added back in each year (changed to residential use, returned to service after temporary loss, etc.).

While losses and other additions are small relative to the overall stock, they encompass important features of how housing markets evolve. ... Losses can be either permanent or temporary. Units destroyed by natural disasters or intentionally demolished are permanent losses. Temporary losses include units that are merged into other units or units that are used for nonresidential purposes. Additions can include units resulting from splitting up larger units, mobile home move-ins, and units that had been used formerly for nonresidential purposes.

Demolitions

The number of units lost to demolitions and disasters, from 2001 to 2003, was 382,000, or about 191,000 per year.

However there is a basic problem applying this analysis to the current market. Many demolitions and temporary losses are voluntary and are dependent on market conditions.

As an example there have been 8 units demolished on my block during the last four years. All of these units have been replaced, or are in the process of being replaced, with new construction. A similar construction boom occurred during the late '80s, but not a single unit was demolished and replaced during the previous housing bust from 1990 to 1996.

During boom times, many more units are removed from stock by demolitions temporarily reducing the overall housing stock. This actually puts some upwards price pressure on homes!

Back to my block: there were an additional four units scheduled for demolition this year. The builders have put off their plans and are now leasing out the existing properties. Note: Yes, it feels like I live in a construction zone. Welcome to a Southern California beach community during a housing boom.

I suspect this is happening everywhere; small builders are delaying projects if they don't already have a shovel in the ground. So the number of demolitions over the next couple of years will probably be substantially below the levels of the last few years (and below the 2001 to 2003 period in the Eggers & Moumen study).

So a demographics analysis would suggest 1.2 million new units are needed per year. During the 2001 to 2003 period, an additional 190 thousand new units were needed per year due to demolitions - but that number will be lower during the bust. Also, the 1.2 million figure is reduced by the number of new mobile homes added each year (147K according to Bill Conerly in the comments to the previous post).

So maybe an estimate of 1.4 million units per year would be generous. This number would then be reduced by the overhang of excessive building of the last few years. More to come ...