by Calculated Risk on 7/12/2006 11:08:00 AM

Wednesday, July 12, 2006

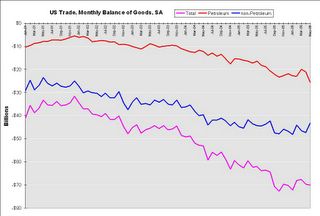

May Trade Deficit: $63.8 Billion

The Census Bureau reports:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that total May exports of $118.7 billion and imports of $182.5 billion resulted in a goods and services deficit of $63.8 billion, $0.5 billion more than the $63.3 billion in April, revised. May exports were $2.7 billion more than April exports of $115.9 billion. May imports were $3.2 billion more than April imports of $179.3 billion.For an excellent analysis See Dr. Setser's: How long can non-oil imports remain flat if the US economy continues to grow?

Click on graph for larger image.

The non-Petroleum goods balance has stabilized since the end of last year. This might suggest that US economic growth is slowing. From a post in March:

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Current account, Feb 4, 2005

I expect the annual increase in mortgage debt to decline in 2006. This is because I expect new and existing home purchases to decline, and homeowners to extract less equity from their homes in 2006.

The drop in mortgage activity is is one of the reasons I expect the trade deficit to stabilize in 2006.