by Calculated Risk on 6/02/2006 03:43:00 PM

Friday, June 02, 2006

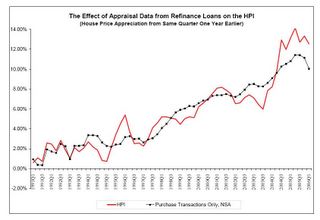

House Price Index: Effect of Appraisal Data

Reader ac suggests in the comments:

"[Could you] post an image of the graph (The Effect of Appraisal Data from Refinance Loans on the HPI) from page 4 of the 2006 Q1 OFHEO HPI data on your site?Here is the graph from the OFHEO HPI:

Seems like there's a lot of misinterpretation and misuse of the HPI data showing up in some media reports... an image of that graph might help with "educating" people.

I think it's clear now that the Q1 HPI numbers were pumped up by appraisals which apparently lag actual sales prices."

Click on graph for larger image.

From OFHEO:

"An important factor that has affected the HPI in some recent quarters is the influence of refinancings on the overall index. The figure below shows percent changes in the HPI for the United States as a whole over the prior four quarters compared with changes in an index constructed using only house prices associated with mortgages used for house purchases. The upward trend is the same, but the purchase-only index has accelerated much more smoothly. Over the past year, while the U.S. HPI has risen 12.54 percent, the purchase-only index has risen 10.04 percent."

And from the OC Register:

The report showed that Orange County home values increased by 2.95 percent in the first quarter of 2006 ... But numbers from other sources place Orange County's appreciation rate at much lower levels...As ac suggests, the HPI appears to be overstating appreciation in the most recent quarters due to the impact of cash-out refis.

Officials compiling the federal index agree their numbers may be overly optimistic. They cited a growing incidence of homeowners extracting cash from loans against their homes' increased value. That's something that may occur more often in homes that have appreciated the most, the agency said.

"Evidence suggests that the growing prevalence of cash-out refinances over the last year has had the effect of increasing measured appreciation rates for the HPI," the [OFHEO] said.

emphasis added.