by Calculated Risk on 6/22/2006 10:24:00 AM

Thursday, June 22, 2006

FED Study: Price of Residential Land

From FED economists Dr. Morris A. Davis and Dr. Michael G. Palumbo: The Price of Residential Land in Large U.S. Cities

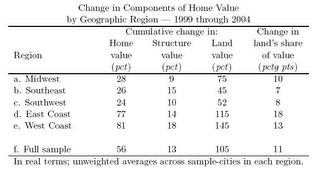

"[A] striking result is just how widespread the strength of land prices has been in the current housing boom — taken to have begun at the end of 1998. We show that in 43 of the 46 large metropolitan areas in our sample, a rapid pace of land price appreciation has pushed up land’s share of home value markedly in just the past six years."

Click on table for larger image.

This table from the Fed study shows that land values have increased significantly more than the value of the structure over the last few years. This has been especially evident along the East and West coasts.

But with land prices, what goes up, can also go down:

"... though residential land has appreciated significantly, on net, over the past past twenty years, for most large metro areas the path has been more of a roller coaster ride than a steady upward march. Indeed, we show that 39 of the 46 cities in our sample have experienced a clear peak in the real residential land price index, and in many of these cities it has taken 10 years or more for land prices to fully recover from their previous troughs."The implication is that home prices may be more volatile in the future:

"... the implication of our data and analysis that, with residential land having appreciated so significantly over the past twenty years around the country, the future course of land prices is expected to play an even more prominent role in governing home prices — in terms of average appreciation rates and volatility — in the next two decades."