by Calculated Risk on 7/01/2006 12:54:00 AM

Saturday, July 01, 2006

FED: Residential Investment over the Real Estate Cycle

Fed Economist Dr. Krainer writes: Residential Investment over the Real Estate Cycle (thanks to Professor Thoma for the tip!)

Note: I'm going to jump ahead in the economic letter.

For recession-related downturns, the ratio (shown in Figure 3) starts to rise on average six quarters before the actual downturn, and continues to rise for six quarters into the downturn. For the average non-recession-related downturn, the inventory ratio turns up just one quarter before the downturn and then eases back down after two quarters (which is also the average duration of a non-recession-related downturn).A key point in figure 4 is that the current behavior of inventory looks more like a recession related downturn than a non-recession related housing downturn.

This exercise indicates that prices seem to be considerably less useful predictors of downturns than quantity-type measures. This might seem surprising because, unlike sales volumes and inventories, prices have a forward-looking aspect and thus would seem to be good predictors of the future state of the housing market.

Figure 4 shows the average behavior of real new house prices leading up to and then following a peak in residential investment. The focus here is on new house prices because, presumably, they, rather than existing house prices, are most relevant for real estate developers' decisionmaking. Additionally, new house prices are likely to be more sensitive to market weakness than existing house prices. Developers are always "motivated sellers." If demand is soft, they generally do not have the option of withdrawing the house from the market and simply living in it. For recession-related downturns, the real price of new houses declines about four quarters after the peak, on average. Real new house prices register no detectable declines surrounding the average non-recession-related downturn. This basic stylized fact is even more apparent when using prices of existing homes. Only in the severest downturns do we witness real price declines, and never do these price declines come in advance of a downturn in investment.Note: bold text is added emphasis

One caveat to this analysis is that it is based on the comparison of the average behavior of a housing market series leading up to two different types of downturns in residential investment. Obviously, averaging in the figures masks a fair degree of variation across the different downturns. However, more formal statistical modeling supports the notion that variables such as sales volumes and inventory ratios yield earlier and more reliable signals when the downturn is recession-related. This is natural; recession-related downturns have tended to be more severe than the non-recession-related episodes.

It is also interesting to note that the recent behavior of the month's supply ratio bears more resemblance to the typical behavior before a recession-related downturn than to a non-recession-related downturn. Yet economists, such as those sampled in surveys of professional forecasters, are generally predicting only a moderation in overall economic growth in coming quarters. Given these conflicting observations, it is natural to wonder how much stand-alone information for predicting residential investment is contained in the housing market data. The answer, based on the last 30 years of data is mixed. If we estimate a model of the event that a residential downturn occurs using lagged values of the housing market variables mentioned above, we can generally improve the model prediction error by adding in forecasts of output growth. This suggests that it is best to consider economy-wide factors in addition to specific housing market variables when evaluating the real estate market.

Where are we now with residential investment?

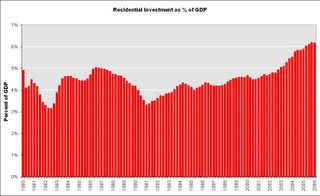

Click on graph for larger image.

This graph shows residential investment as a percent of GDP on a quarterly basis since 1980. It appears residential investment peaked in Q4 2005 and declined slightly (as a % of GDP) in Q1 2006.

Right now this housing slowdown looks more like a recession related slowdown.

On housing, also see Dr. Hamilton's All eyes on housing

"... it raises the possibility that, when the recognition does sink in, the current "gradual cooling" could quickly turn into something more impressive."