by Calculated Risk on 4/28/2006 03:55:00 PM

Friday, April 28, 2006

Q1 GDP, Trade and Residential Investment

Here are a couple of succinct reviews of the Q1 GDP report:

From Professor Polley: Strong 1st quarter growth and tame PCE deflator growth

"Today's figures on durables make up what was lost in the 4th quarter, but taken together the last 6 months have been pretty bad for durables. If that continues through the rest of the year, it will be a drag on GDP."Professor Samwick: The End of Personal Saving?

"I wonder how it can be that with the Baby Boom generation in the high-income and presumably high-saving part of its economic life cycle, we can possibly have negative saving rates for the population as a whole ..."I think the BEA might have underestimated the trade deficit for March. The BEA is estimating a surge in Goods exported in Q1, and this appears likely. However I think the BEA might be underestimating the increase in Goods imported. I'm basing this mostly on the record export / import traffic at West Coast ports in March. If I am correct, the March trade deficit might be close to $70 Billion (a new record) and Q1 GDP would then be revised down to 4.5% or so (still solid).

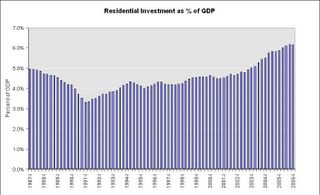

Click on graph for larger image.

Also Real Residential Investment (RI) increased 2.6% from Q4 (SA annualized). So RI grew slower than GDP in Q1 2006 and RI as a % of GDP decreased slightly. I suspect we will start seeing decreases in RI over the next few quarters and that will be a drag on GDP.

Overall this is a solid report.