by Calculated Risk on 10/31/2005 08:11:00 PM

Monday, October 31, 2005

Data and the Fed

Dr. Duy prepares us for another "measured pace" rate hike tomorrow: Fed Watch: Another Meeting, Another 25 Basis Points

"The above title makes the Fed sound just a little too predictable. But the hawkish rhetoric from Fed officials has been quite clear, and last week’s data adds to the case for additional tightening at what we have come to know as the measured pace.But after the next couple of hikes, Dr. Duy expects the FED to become more data dependent:

...

...incoming data suggests the economy remains on cruise control despite the series of speed bumps the Fed keeps laying down. Does this mean the Fed just keeps laying down more bumps? For the rest of this year, the answer appears to be yes. I think the Fed is comfortable chasing the 10 year bond. Indeed, the bond market has recently cleared the way for additional hikes, with the 10 year yield rising above 4.5%."

"While policymakers might see the need for additional rate hikes, they realize a lot is also in the pipeline as well. With a considerable amount of accommodation removed, the Fed, I suspect, will soon start paying more attention to data that comes in on the weak side.Hey, hey, hey ... I think those housing bears are correct! Read Dr. Duy's entire post - it is excellent as always.

So what will the Fed be looking for in that respect? The Fed will be watching for additional evidence of a slowing housing market. Again, the point is not housing itself, but the expected negative impact of a housing slowdown on consumer spending. I doubt the early data and anecdotal evidence is enough to convince them that the housing ATM is closed, but if the housing bears are correct, we could see evidence in that direction pile up over the next couple of months.

Another red flag for the Fed would be sputtering investment spending. Greenspan’s speeches and the minutes suggest that policymakers expected investment spending to hold strong, and they were a little disappointed by what they were seeing..."

And a couple of comments on the "data". Dr. Kash is concerned about personal income growth and the negative savings rate: Slowing Growth?

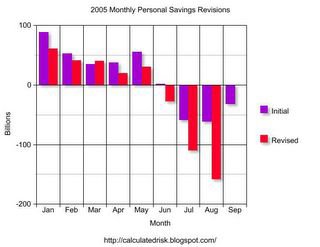

And to add to Kash's concerns, I've noticed that the data on personal savings has been steadily revised downward.

Click on graph for larger image.

Click on graph for larger image.The graph shows the monthly personal savings (Billions $ annual rate) from the BEA's monthly Personal Income and Outlays report.

The purple bar is the initial reported value, the red bar the most recent revision.

With the exception of March (minor upwards revision), all of the revisions have been negative. This might indicate a change in trend. I wonder if this concerns the FED?