by Calculated Risk on 7/05/2005 12:03:00 AM

Tuesday, July 05, 2005

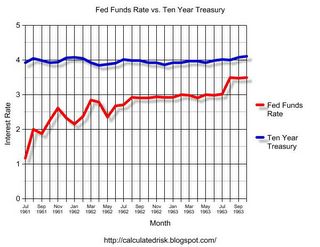

A Unique Conundrum?

The Federal Reserve has been steadily raising rates from a low of 1% to over 3%. And the yield on the Ten Year Treasury stubbornly refuses to budge.

Click on graph for larger image.

That is what happened in the early '60s. The Fed Funds rate moved from 1.1% in July 1961 to 3.5% in late 1963 and the Ten Year yield stayed steady at 4%.

All data from the Federal Reserve.

The yield curve narrowed and then what happened to the economy? It continued to grow and the stock market rallied.

There are many differences from forty years ago and today. But, with the constant drum beat in the financial press about the yield curve, I decided to check if the current situation was unique. It isn't. Nothing profound, I was just curious.

Also, my most recent post is up on Angry Bear: Housing Update.