by Calculated Risk on 3/14/2005 09:02:00 PM

Monday, March 14, 2005

Mortgage Debt and the Trade Deficit

Money flowing into the housing market works its way back into the economy by increasing consumption or savings (and investment). In recent years, aggregate savings have declined, therefore it appears money has flowed to consumption, both domestic (measured by the increase in GDP) and imports (measured by the increase in the trade deficit).

This is very simplistic but provides a general description of what I believe is happening. I will use the annual increase in mortgage debt as a measure of the money flowing into the economy from housing activities.

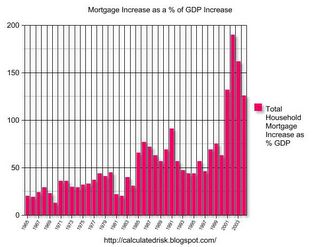

Previously I posted a graph of the annual Increase in Mortgage Debt vs. the Increase in GDP. The graph illustrated that during each of the preceding four years, U.S. households had assumed more mortgage debt than the increase in nominal GDP. I was asked if there were any other periods of similar increases in mortgage debt. The answer is NO, at least not in the last 40 years, as shown by the following graph:

The last four years have been atypical. There has been a surge in mortgage borrowing that far exceeded nominal GDP growth. It is unclear how much of GDP growth was driven by the increase in mortgage debt. However, since I believe most of the mortgage debt has flowed to consumption (not savings or investment); the portion that didn’t contribute to GDP growth must have flowed to imports.

Click on graph for larger image.

From the following chart it appears that the increase in mortgage debt is a factor in the increased trade deficit. The chart shows the annual trade deficit compared to the annual increase in mortgage debt. Data sources: trade deficit, GDP, New Home Sales, Mortgage Debt. There is a strong correlation between increases in mortgage debt and increases in the trade deficit. Although the correlation is high, it is very possible that there is no direct linkage, instead the same economic causes that led to higher trade deficits also led to more household borrowing. However, in recent years, with the dramatic increases in mortgage borrowing (far exceeding the increases in GDP) it is reasonable to expect that some of that money is flowing to imports.

There is a strong correlation between increases in mortgage debt and increases in the trade deficit. Although the correlation is high, it is very possible that there is no direct linkage, instead the same economic causes that led to higher trade deficits also led to more household borrowing. However, in recent years, with the dramatic increases in mortgage borrowing (far exceeding the increases in GDP) it is reasonable to expect that some of that money is flowing to imports.

The implications are important: if the housing market slows down, it will negatively impact both the domestic economy and the economies of our export driven trading partners: China, Japan, S. Korea and others.

The concern is obvious: If we slide into a global recession, we have limited tools available to stimulate the economy. Interest rates are already very low (although the Fed has recently put some arrows back into the quiver), and we are already running general fund budget deficits of close to 6% of GDP. And the concerns are not just economic. Historically, poor economic conditions are the precursors to civil unrest and wars.

One thing is certain, mortgages and housing play a much larger role in today's economy than in the past. In another recent post, I had suggested that the volume of New Home Sales seemed like a reasonable leading indicator of the consumer economy. The following graph shows New Home Sales since 1963.

The gray lines are approximate U.S. economic recessions as determined by NBER. With the exceptions of the 2001 (non-consumer recession) and '69-'70 recessions, New Home Sales were falling for 8 to 12 months prior to the onset of the recession. Since housing is a significantly larger portion of the economy today, a slowdown in housing would have a corresponding larger impact on the overall economy.

That is why I’m so focused on the housing market. I would like to see an orderly rebalancing of the World's economy, but I am not sanguine.