by Calculated Risk on 3/06/2005 08:51:00 PM

Sunday, March 06, 2005

China and the Price of Gas

Last Friday, the USA Today reported that "Gas prices might increase 24 cents". Then at the annual meeting of the National People's Congress, Chinese Foreign Minister Li Zhaoxing told reporters that China 'should not be held responsible for the world's rising oil prices'.

Is China responsible for the increase in oil prices, and consequently, gas prices?

Li was quoted as saying: "Although China's energy import has increased a little bit over the past two years, its import only accounts for approximately six per cent of the world's total traded oil."

From the article:

It's true that China's energy demand has increased to certain extent as the country's economy has been growing rapidly in recent years, but the demand is mainly to be met domestically, he said.

Besides, he said, there is a big potential of saving energy and improving the use of energy efficiency in China's domestic energy supply.

Therefore, the Western media criticism saying that China is a major impact on the world's oil price is "groundless", he said

First, here is a chart of China's oil production and consumption since 1980 (Source: Dept of Energy)

Click on graph for larger image.

Source: Dept of Energy

Starting in 1994 China became a net importer of oil. The graph ends in 2003 with China importing 2.1 million barrels per day (bbl/d). In 2004 China's oil imports increased another 35% to approximately 3 million bbl/d. Still, as Minister Li pointed out, that is a small percentage of the World's traded oil. Also, the United States increased oil imports in 2004 by about 0.7 million bbl/d to 12.25 m bbl/d. Although China's oil imports are growing faster than the US, both in percentage and bbl/d terms, China's oil import quantities are still only about 25% of the United States.

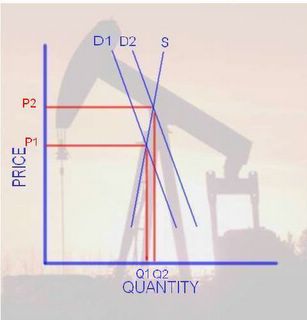

So why has the price of oil increased so dramatically? Here is at least part of the reason: Both the supply and demand curves for oil are very steep. We all know this intuitively. If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

OIL Supply and Demand

UPDATE: fixed typo on drawing. With a small increase in Demand (from D1 to D2), we see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would occur if we had a small decrease in supply such as disruption to production, transport or refining (like hurricane Ivan in the GOM last year).

Of course the opposite is also true. A relatively small decrease in demand (or increase in supply) would cause a significant drop in price. So China's relatively small increase in demand (and the US too!) could have caused a large increase in oil prices.

Is China to blame for higher gas prices? Of course not. They have the same right to oil as any other consumer. But the increased demand in the US and China has most likely caused (without blame) the increase in prices.

The above assumes perfectly competitive markets. And oil differs from most commodities: "it is an exhaustible resource, production is controlled by national governments, and for the major oil exporters oil is the overwhelmingly dominant source of national income." (See: Krugman "The Energy Crisis Revisited") However if the world's spare capacity is exhausted, then the simple approach is probably reasonable.

There could be other factors effecting the price of oil - a terrorism premium and hedge funds speculation are often mentioned as culprits - however, I think the simple explanation is probably the most accurate: fast growth in China coupled with strong growth in the U.S. has utilized most of the world's spare capacity. Since supply is almost inelastic (in the short term), price fluctuates significantly with small changes in demand.

But what happens in the intermediate term? In the longer term the situation becomes more complicated. Since oil is an exhaustible resource, we may be getting close to "peak production" - where the maximum annual oil production is reached and then we will start a long decline in production. There is no way of knowing how close the world is to peak production since many of the key reserves are held by national governments (like Saudi Arabia) and they are not forthcoming with hard data. This lack of transparency has caused concern and might be leading to some of the rumored hedge fund speculation. After oil production starts to decline, the world will need to find a substitute for the loss of oil supply. In that regards, I believe high prices will be the wellspring of innovation.

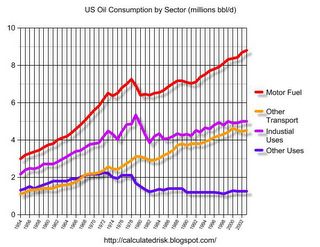

More certain is that if the prices hold, we will see both more production (assuming we are not at Peak Oil), substitution and a moderation in demand. The following chart shows US oil consumption for the last 50 years.

Source: Dept of Energy

The two oil shocks (1973 and 1979) were followed by periods of slackening demand. The industrial sector has never returned to the 1979 consumption levels (due to a combination of efficiencies and substitutes) and "other uses", like electricity generation using oil, has also declined significantly. This leaves motor fuel and "other transportation" as the growth sectors for oil consumption. For demand to decrease, people will probably have to park their Hummers and buy a Prius!

Final comments: There are other reasons than just price to decrease our dependence on oil.

First, burning oil products is a major contributor to global warming. This is a serious problem and, as Professor Tim Barnett of the Scripps Institution of Oceanography said in February: "The debate over whether there is a global warming signal is over now at least for rational people."

And the second is an ethical question: Since oil is an exhaustible resource, do we, the 21st Century cohorts, have a right to burn all of it? Or do we have a responsibility to future generations to use it more discerningly?