by Calculated Risk on 2/23/2025 11:04:00 AM

Sunday, February 23, 2025

Housing Starts and Recessions

This morning, Carl Quintanilla posted a graph on Bluesky from BESPOKE suggesting the US is heading towards a recession.

Quintanilla quoted BESPOKE:

Quintanilla quoted BESPOKE:

“On a 12-month average basis, .. Housing Starts have completely rolled over from their peak ..Housing is the basis of one of my favorite models for business cycle forecasting. And policy changes will clearly have a negative impact on homebuilders. Early in February, I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch.

“.. Recessions have always followed a rollover in Housing Starts, and the only question is timing.”

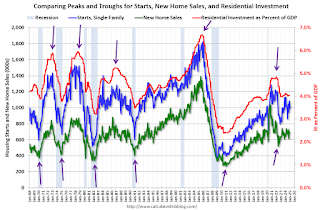

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.New home sales peaked in 2020 as pandemic buying soared. Then new home sales and single-family starts turned down in 2021, but that was partly due to the huge surge in sales during the pandemic. In 2022, both new home sales and single-family starts turned down in response to higher mortgage rates.

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 1% year-over-year!

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 1% year-over-year!

Saturday, February 22, 2025

Real Estate Newsletter Articles this Week: Mortgage Delinquencies Increase, Foreclosures Remain Low

by Calculated Risk on 2/22/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January

• Housing Starts Decreased to 1.366 million Annual Rate in January

• The "Neutral" Rate and Implications for 30-year Mortgage Rates

• California Home Sales Down 1.9% YoY in January; 4th Look at Local Housing Markets

• Lawler: Early Read on Existing Home Sales in January

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 23, 2025

by Calculated Risk on 2/22/2025 08:11:00 AM

The key reports this week are January New Home sales, the second estimate of Q4 GDP, Personal Income and Outlays for January, and Case-Shiller house prices.

For manufacturing, the February Dallas, Kansas City, and Richmond Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

9:00 AM: FHFA House Price Index for December 2024. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the Comp 20 index for December, up from 4.3% in November.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 219 thousand last week.

8:30 AM: Gross Domestic Product, 4th Quarter and Year 2024 (Second Estimate) The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the advance estimate of 2.3%.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.2% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.6% YoY.

9:45 AM: Chicago Purchasing Managers Index for February.

Friday, February 21, 2025

February 21st COVID Update: COVID in Wastewater Declining

by Calculated Risk on 2/21/2025 07:03:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 859 | 953 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has moving down recently.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has moving down recently.Q1 GDP Tracking: Around 2%

by Calculated Risk on 2/21/2025 02:06:00 PM

From BofA:

We initiated our 1Q US GDP tracker with the January retail sales print on February 14. Since then, our 1Q GDP tracker is down two-tenths to 2.3% q/q saar from our official forecast of 2.5% q/q saar. Meanwhile, our 4Q GDP tracking is down two-tenths to 2.2% q/q saar since our last weekly publication. [Feb 21st]From Goldman:

emphasis added

[W]e lowered our Q1 GDP tracking estimate by 0.1pp to +1.9% (quarter-over-quarter annualized) and our Q1 domestic final sales estimate by 0.1pp to +2.1%. We left our Q4 past quarter tracking estimate unchanged at +2.1%. [Feb 19th estimate]And from the Atlanta Fed: GDPNow

[T]he GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is 2.3 percent on February 19, unchanged from February 14 after rounding. [Feb 19th estimate]

Newsletter: Existing-Home Sales Decreased to 4.08 million SAAR in January

by Calculated Risk on 2/21/2025 11:05:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January

Excerpt:

Sales in January (4.08 million SAAR) were down 4.9% from the previous month and were 2.0% above the January 2024 sales rate. This was the fourth consecutive year-over-year increase after declining YoY every month for over 3 years.There is much more in the article.

...

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2024 and 2025.

Sales increased 2.0% year-over-year compared to January 2024.

NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January

by Calculated Risk on 2/21/2025 10:00:00 AM

From the NAR: Existing-Home Sales Decreased 4.9% in January, But Increased Year-Over-Year for Fourth Consecutive Month

Existing-home sales retreated in January, according to the National Association of REALTORS®. Sales slipped in three major U.S. regions and held steady in the Midwest. Year-over-year, sales rose in three regions and were unchanged in the South.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – descended 4.9% from December to a seasonally adjusted annual rate of 4.08 million in January. Year-over-year, sales improved 2.0% (up from 4 million in January 2024).

...

Total housing inventory registered at the end of January was 1.18 million units, up 3.5% from December and 16.8% from one year ago (1.01 million). Unsold inventory sits at a 3.5-month supply at the current sales pace, up from 3.2 months in December and 3.0 months in January 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in January (4.08 million SAAR) were down 4.9% from the previous month and were 2.0% above the January 2024 sales rate. This was the fourth consecutive year-over-year increase after declining YoY every month for over 3 years.

According to the NAR, inventory increased to 1.18 million in January from 1.14 million the previous month.

According to the NAR, inventory increased to 1.18 million in January from 1.14 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 16.8% year-over-year (blue) in January compared to January 2024.

Inventory was up 16.8% year-over-year (blue) in January compared to January 2024. Months of supply (red) increased to 3.5 months in January from 3.2 months the previous month.

The sales rate was below the consensus forecast. I'll have more later.

ICE: Mortgage Delinquency Rate Decreased in January

by Calculated Risk on 2/21/2025 08:07:00 AM

• Delinquencies fell 24 basis points (bps) to 3.47% in January; that’s 10 bps higher than last year, but 33 bps below pre-pandemic levels

• Foreclosure starts jumped by 30% and sales rose by 25% in January – driven by an expiration in the VA foreclosure moratorium – with active inventory rising by 7% in the month

• While the number of borrowers past due as a result of last year’s hurricanes has fallen from 58K to 41K in recent months, the financial impact from the recent Los Angeles wildfires is emerging

• An estimated 680 homeowners in the path of the Los Angeles wildfires missed their January mortgage payment, and ICE’s daily mortgage performance data suggests the number of past-due borrowers could surpass 2,800 by the end of February.

• Prepayment activity (SMM) fell to 0.48% in January, its lowest level in nearly a year, driven by the combination of modestly higher rates and the typical seasonal slowdown in home sale activity

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

Thursday, February 20, 2025

Friday: Existing Home Sales

by Calculated Risk on 2/20/2025 07:01:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.17 million SAAR, down from 4.24 million.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for February).

Realtor.com Reports Active Inventory Up 27.6% YoY

by Calculated Risk on 2/20/2025 03:25:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For January, Realtor.com reported inventory was up 24.6% YoY, but still down 24.8% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Feb. 15, 2025

• Active inventory increased, with for-sale homes 27.6% above year-ago levels

For the 67th consecutive week, the number of homes for sale has increased compared with the same time last year. This week also marked the sixth straight week where the growth rate has increased, fueled by the entrance of many new listings on the market.

• New listings—a measure of sellers putting homes up for sale—increased 5%

Newly listed inventory increased year over year for the sixth week in a row, as sellers go online for the spring buying season. Despite mortgage rates remaining stubbornly high and many prospective sellers feeling the lock-in effect due to their lower previous rates, new homes are hitting the market at a faster pace than in 2024 at this time.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 67th consecutive week.